Why NYSE:WSM qualifies as a good dividend investing stock.

By Mill Chart

Last update: Nov 28, 2024

WILLIAMS-SONOMA INC (NYSE:WSM) has caught the attention of dividend investors as a stock worth considering. NYSE:WSM excels in profitability, solvency, and liquidity, all while providing a decent dividend. Let's delve into the details.

ChartMill's Evaluation of Dividend

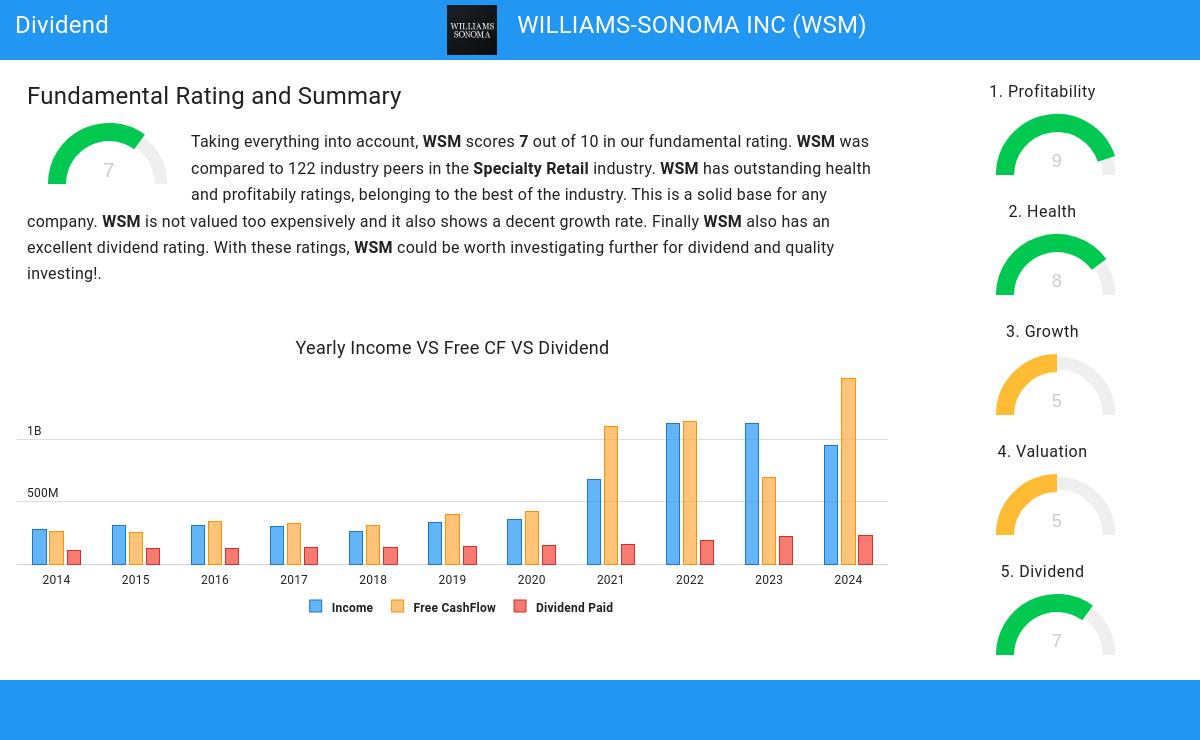

To gauge a stock's dividend quality, ChartMill utilizes a Dividend Rating ranging from 0 to 10. This comprehensive assessment considers various dividend aspects, including yield, history, growth, and sustainability. NYSE:WSM has achieved a 7 out of 10:

- Compared to an average industry Dividend Yield of 3.08, WSM pays a bit more dividend than its industry peers.

- On average, the dividend of WSM grows each year by 6.72%, which is quite nice.

- WSM has been paying a dividend for at least 10 years, so it has a reliable track record.

- WSM has not decreased its dividend for at least 10 years, so it has a reliable track record of non decreasing dividend.

- 24.36% of the earnings are spent on dividend by WSM. This is a low number and sustainable payout ratio.

- WSM's earnings are growing more than its dividend. This makes the dividend growth sustainable.

Assessing Health for NYSE:WSM

ChartMill employs a unique Health Rating system for all stocks. This rating, ranging from 0 to 10, is determined by analyzing various liquidity and solvency ratios. For NYSE:WSM, the assigned 8 for health provides valuable insights:

- WSM has an Altman-Z score of 7.23. This indicates that WSM is financially healthy and has little risk of bankruptcy at the moment.

- WSM's Altman-Z score of 7.23 is amongst the best of the industry. WSM outperforms 95.04% of its industry peers.

- There is no outstanding debt for WSM. This means it has a Debt/Equity and Debt/FCF ratio of 0 and it is amongst the best of the sector and industry.

- WSM does not score too well on the current and quick ratio evaluation. However, as it has excellent solvency and profitability, these ratios do not necessarly indicate liquidity issues and need to be evaluated against the specifics of the business.

How do we evaluate the Profitability for NYSE:WSM?

ChartMill assigns a Profitability Rating to every stock. This score ranges from 0 to 10 and evaluates the different profitability ratios and margins, both absolutely, but also relative to the industry peers. NYSE:WSM scores a 9 out of 10:

- WSM's Return On Assets of 22.04% is amongst the best of the industry. WSM outperforms 99.17% of its industry peers.

- Looking at the Return On Equity, with a value of 57.42%, WSM belongs to the top of the industry, outperforming 95.04% of the companies in the same industry.

- With an excellent Return On Invested Capital value of 33.38%, WSM belongs to the best of the industry, outperforming 97.52% of the companies in the same industry.

- The Average Return On Invested Capital over the past 3 years for WSM is significantly above the industry average of 12.31%.

- WSM's Profit Margin of 14.54% is amongst the best of the industry. WSM outperforms 98.35% of its industry peers.

- WSM's Profit Margin has improved in the last couple of years.

- Looking at the Operating Margin, with a value of 18.50%, WSM belongs to the top of the industry, outperforming 95.87% of the companies in the same industry.

- WSM's Operating Margin has improved in the last couple of years.

- WSM has a Gross Margin of 46.75%. This is in the better half of the industry: WSM outperforms 75.21% of its industry peers.

- In the last couple of years the Gross Margin of WSM has grown nicely.

More Best Dividend stocks can be found in our Best Dividend screener.

Our latest full fundamental report of WSM contains the most current fundamental analsysis.

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

139.21

+1.59 (+1.16%)

Find more stocks in the Stock Screener

WSM Latest News and Analysis

5 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.

5 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.Let's have a look at the top S&P500 gainers and losers one hour before the close of the markets of today's session.

8 days ago - ChartmillWILLIAMS-SONOMA INC (NYSE:WSM) can be considered a quality stock. Here's why.

8 days ago - ChartmillWILLIAMS-SONOMA INC (NYSE:WSM) can be considered a quality stock. Here's why.A fundamental analysis of (NYSE:WSM): Why WILLIAMS-SONOMA INC (NYSE:WSM) qualifies as a quality stock.

15 days ago - ChartmillWould Peter Lynch consider WILLIAMS-SONOMA INC (NYSE:WSM) a winning stock?

15 days ago - ChartmillWould Peter Lynch consider WILLIAMS-SONOMA INC (NYSE:WSM) a winning stock?With a strategy that emphasized steady earnings growth and a strong market position, Peter Lynch sought out long-term winners. We put WILLIAMS-SONOMA INC (NYSE:WSM) to the test against his stock-picking rules.

15 days ago - ChartmillDiscover which S&P500 stocks are making waves on Friday.

15 days ago - ChartmillDiscover which S&P500 stocks are making waves on Friday.Stay informed about the performance of the S&P500 index one hour before the close of the markets on Friday. Uncover the top gainers and losers in today's session for valuable insights.

15 days ago - ChartmillWhat's going on in today's session: S&P500 movers

15 days ago - ChartmillWhat's going on in today's session: S&P500 moversWondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Friday.

16 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

16 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Stay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Thursday.

16 days ago - ChartmillThursday's session: top gainers and losers in the S&P500 index

16 days ago - ChartmillThursday's session: top gainers and losers in the S&P500 indexStay informed about the performance of the S&P500 index in the middle of the day on Thursday. Uncover the top gainers and losers in today's session for valuable insights.

16 days ago - ChartmillGapping S&P500 stocks in Thursday's session

16 days ago - ChartmillGapping S&P500 stocks in Thursday's sessionWondering which stocks are making significant price gaps? Explore the S&P500 index on Thursday to find the gap up and gap down stocks in today's session.

16 days ago - ChartmillTop S&P500 movers in Thursday's pre-market session

16 days ago - ChartmillTop S&P500 movers in Thursday's pre-market sessionThe US market is yet to commence its session on Thursday, but let's get a preview of the pre-market session and explore the top S&P500 gainers and losers driving the early market movements.

17 days ago - ChartmillWhich S&P500 stocks are moving after the closing bell on Wednesday?

17 days ago - ChartmillWhich S&P500 stocks are moving after the closing bell on Wednesday?After the conclusion of the US market's regular session on Wednesday, let's examine the after-hours session and unveil the notable S&P500 performers among the top gainers and losers.

17 days ago - ChartmillStay informed with the top movers within the S&P500 index on Wednesday.

17 days ago - ChartmillStay informed with the top movers within the S&P500 index on Wednesday.Get insights into the S&P500 index performance on Wednesday. Explore the top gainers and losers within the S&P500 index in today's session.

17 days ago - ChartmillWednesday's session: top gainers and losers in the S&P500 index

17 days ago - ChartmillWednesday's session: top gainers and losers in the S&P500 indexStay updated with the movements of the S&P500 index in the middle of the day on Wednesday. Discover which stocks are leading as top gainers and losers in today's session.