Is WESTERN DIGITAL CORP Ready to Break Out of Its Range?

By Mill Chart

Last update: Nov 11, 2024

A possible breakout setup was detected on WESTERN DIGITAL CORP (NASDAQ:WDC) by our stockscreener. A breakout pattern is formed when a stock consolidates after a strong rise up. We note that this pattern is detected purely based on technical analysis and whether the breakout actually materializes remains to be seen. It could be interesting to keep an eye on NASDAQ:WDC.

Zooming in on the technicals.

At ChartMill, a crucial aspect of their analysis is the assignment of a Technical Rating to each stock. This rating, ranging from 0 to 10, is calculated daily by considering numerous technical indicators and properties.

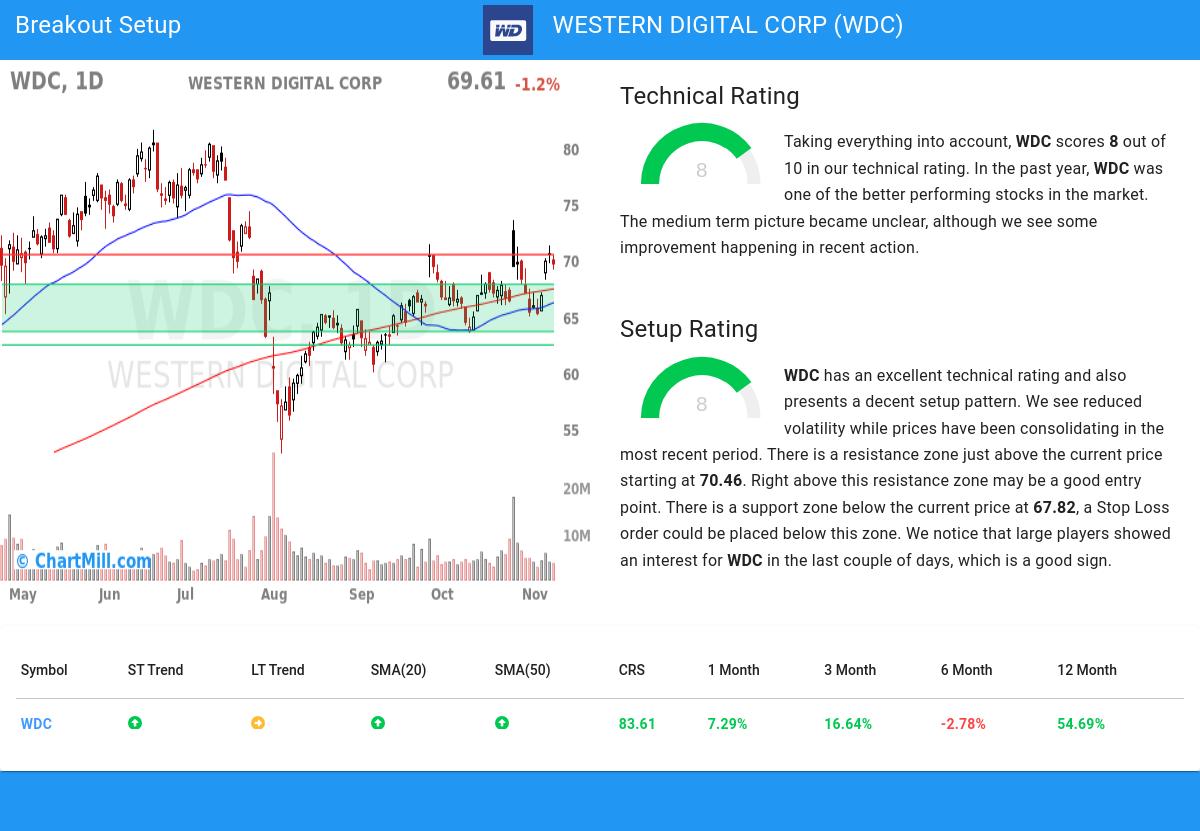

We assign a technical rating of 8 out of 10 to WDC. Although WDC has been one of the better performers in the overall market, we have a mixed picture in the medium term time frame. But recently some decent action can be observed again.

- The long term trend is still neutral, but the short term trend is positive, so the stock is getting more and more appreciated by traders and investors.

- Looking at the yearly performance, WDC did better than 83% of all other stocks.

- WDC is part of the Technology Hardware, Storage & Peripherals industry. There are 32 other stocks in this industry. WDC outperforms 77% of them.

- WDC is currently trading in the middle of its 52 week range. The S&P500 Index however is currently trading near new highs, so WDC is lagging the market.

- In the last month WDC has a been trading in the 65.00 - 73.50 range, which is quite wide. It is currently trading in the middle of this range, so some resistance may be found above.

For an up to date full technical analysis you can check the technical report of WDC

How does the Setup look for NASDAQ:WDC

ChartMill takes into account not only the Technical Rating but also assigns a Setup Rating to each stock. This rating, on a scale of 0 to 10, reflects the degree of consolidation observed based on short-term technical indicators. Currently, NASDAQ:WDC exhibits a 8 setup rating, indicating its consolidation status in recent days and weeks.

WDC has an excellent technical rating and also presents a decent setup pattern. We see reduced volatility while prices have been consolidating in the most recent period. There is a resistance zone just above the current price starting at 70.46. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 67.82, a Stop Loss order could be placed below this zone. We notice that large players showed an interest for WDC in the last couple of days, which is a good sign.

Trading setups like NASDAQ:WDC

To potentially initiate a trade, it is common practice to wait for the stock to break out of the consolidation zone. This breakout signifies a potential upward movement, and traders may enter the stock at that point. Conversely, if the stock falls back below the consolidation zone, it may be sold at a loss.

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents technical observations generated by automated analysis but does not guarantee any trading outcomes. Always trade responsibly and make independent judgments.

Every day, new breakout setups can be found on ChartMill in our Breakout screener.

Disclaimer

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.