3 Reasons ULTA Has Explosive Upside Potential

Provided By StockStory

Last update: Feb 7, 2025

Over the past six months, Ulta has been a great trade, beating the S&P 500 by 7.2%. Its stock price has climbed to $398.50, representing a healthy 24% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy ULTA? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Are We Positive On ULTA?

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Ulta has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.1%.

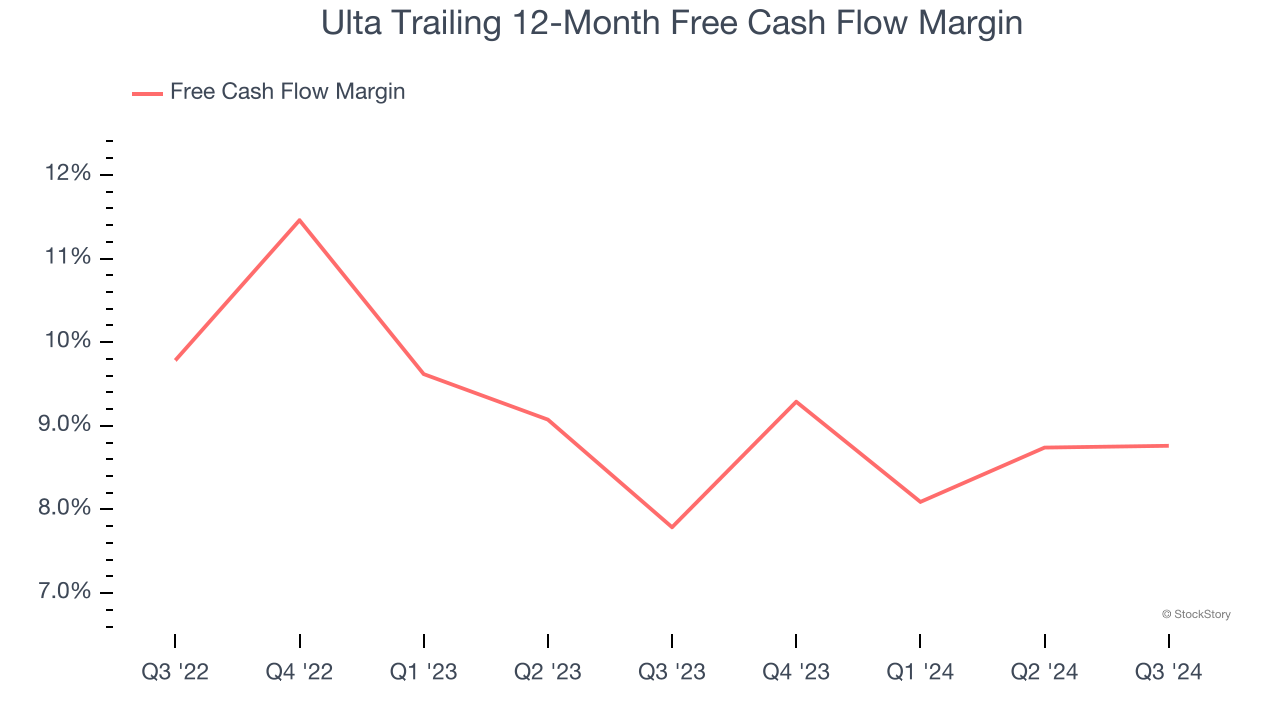

2. Free Cash Flow Margin Stuck in Neutral

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Ulta’s margin was unchanged over the last year, showing it couldn’t improve. Its free cash flow margin for the trailing 12 months was 8.8%.

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Ulta’s five-year average ROIC was 28.5%, placing it among the best consumer retail companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why Ulta ranks highly on our list, and with its shares outperforming the market lately, the stock trades at 17.8× forward price-to-earnings (or $398.50 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Ulta

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

348.855

-17.5 (-4.78%)

Find more stocks in the Stock Screener

ULTA Latest News and Analysis

12 days ago - ChartmillWhich S&P500 stocks are moving on Wednesday?

12 days ago - ChartmillWhich S&P500 stocks are moving on Wednesday?Let's have a look at what is happening on the US markets one hour before the close of the markets on Wednesday. Below you can find the top S&P500 gainers and losers in today's session.

18 days ago - ChartmillWhat's going on in today's session: S&P500 movers

18 days ago - ChartmillWhat's going on in today's session: S&P500 moversCurious about the top performers within the S&P500 index one hour before the close of the markets on Thursday? Dive into the list of today's session's top gainers and losers for a comprehensive overview.