Tutor Perini (NYSE:TPC) Reports Sales Below Analyst Estimates In Q4 Earnings

Provided By StockStory

Last update: Feb 27, 2025

General contracting company Tutor Perini (NYSE:TPC) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 4.5% year on year to $1.07 billion. Its GAAP loss of $1.51 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Tutor Perini? Find out by accessing our full research report, it’s free.

Tutor Perini (TPC) Q4 CY2024 Highlights:

- Revenue: $1.07 billion vs analyst estimates of $1.08 billion (4.5% year-on-year growth, 0.9% miss)

- EPS (GAAP): -$1.51 vs analyst estimates of $0.10 (significant miss)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $1.70 at the midpoint, beating analyst estimates by 5.3%

- Operating Margin: -8.1%, down from -2.2% in the same quarter last year

- Free Cash Flow Margin: 30%, up from 11.8% in the same quarter last year

- Backlog: $18.7 billion at quarter end

- Market Capitalization: $1.21 billion

“With an unprecedented $12.8 billion of new awards during the year, we grew our backlog to a new record of $18.7 billion in 2024 and delivered a third consecutive year of record operating cash flow that shattered our previous record by $200 million,” said Gary Smalley, Chief Executive Officer and President.

Company Overview

Known for constructing the Philadelphia Eagles’ Stadium, Tutor Perini (NYSE:TPC) is a civil and building construction company offering diversified general contracting and design-build services.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

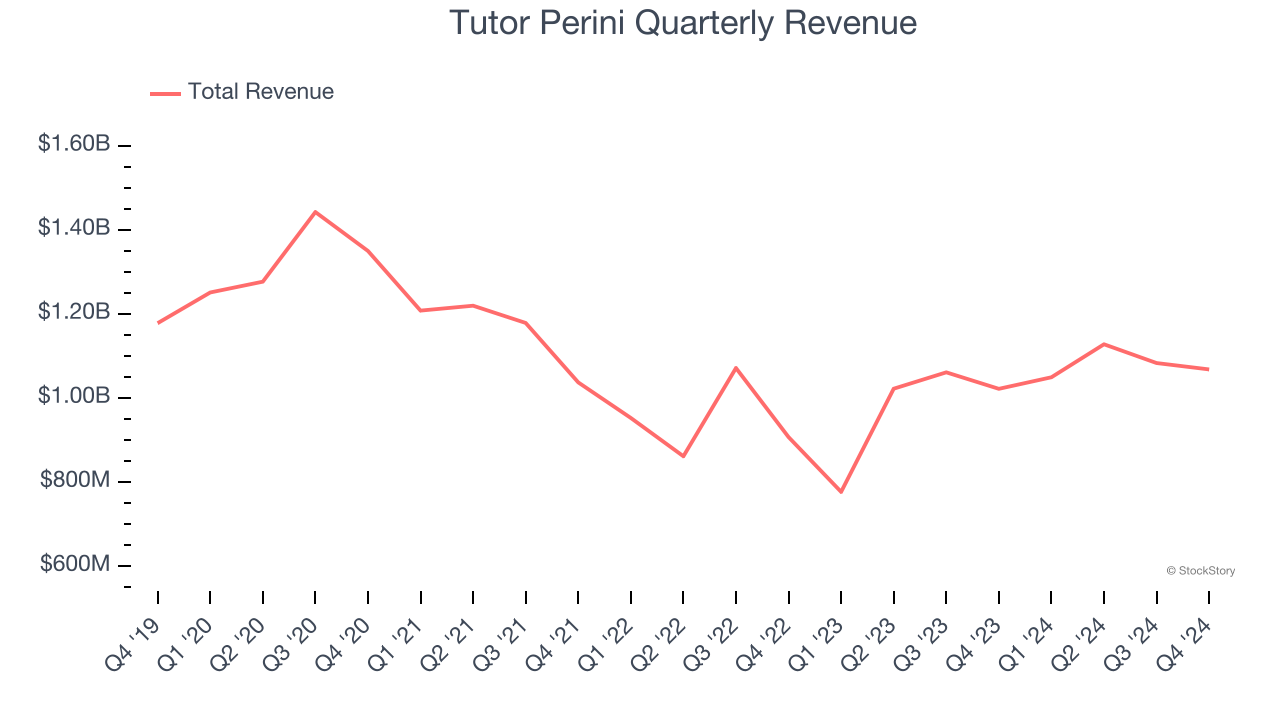

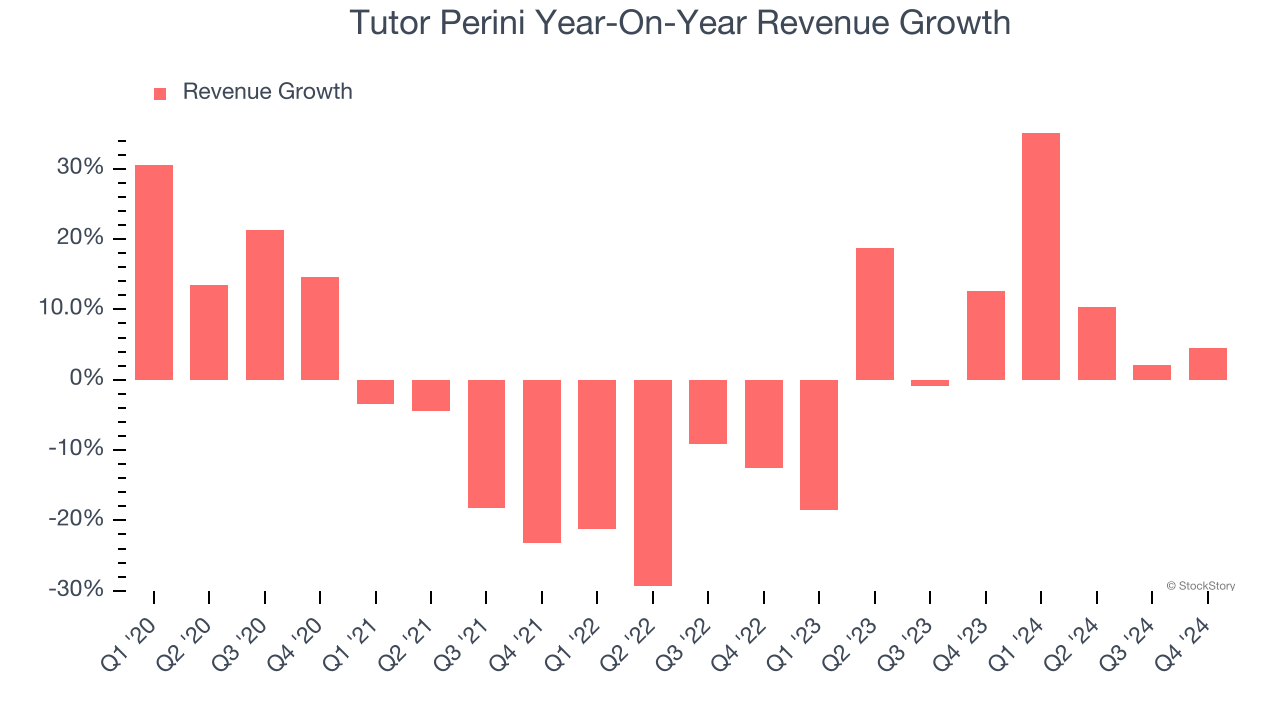

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Tutor Perini struggled to consistently increase demand as its $4.33 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Tutor Perini’s annualized revenue growth of 6.8% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Tutor Perini’s revenue grew by 4.5% year on year to $1.07 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13.3% over the next 12 months, an improvement versus the last two years. This projection is commendable and implies its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

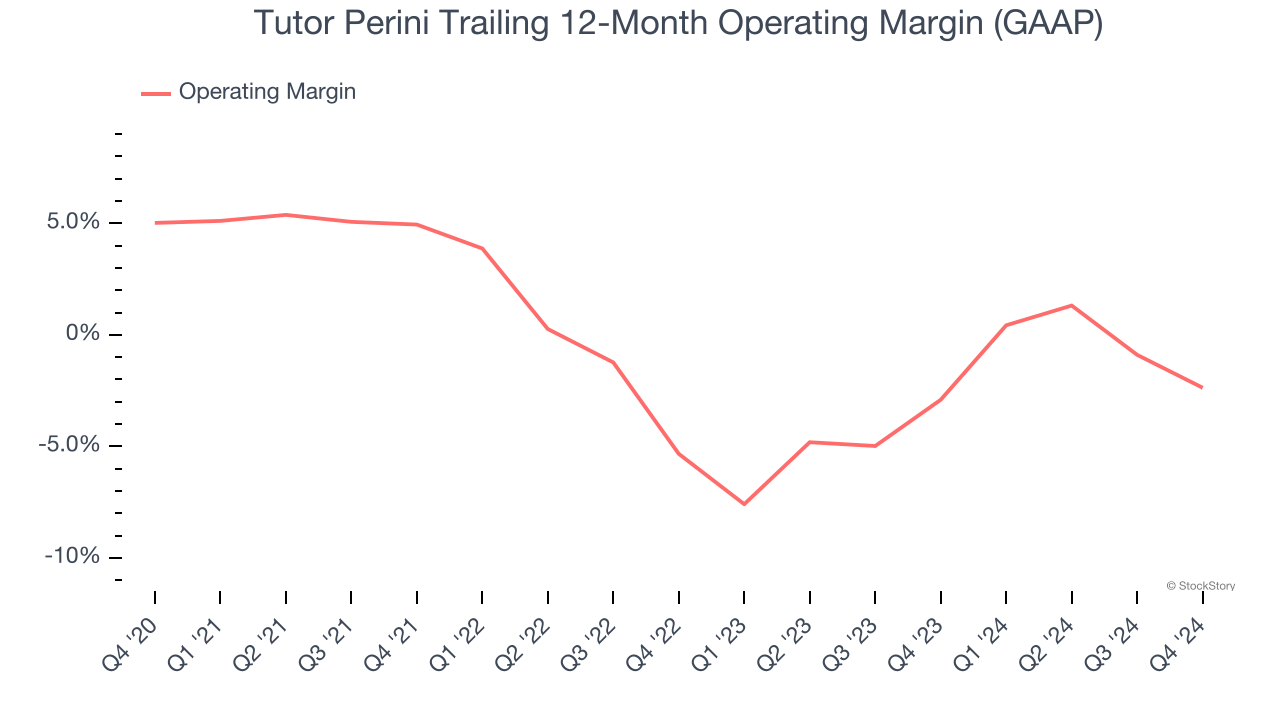

Operating Margin

Tutor Perini was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Tutor Perini’s operating margin decreased by 7.4 percentage points over the last five years. Tutor Perini’s performance was poor no matter how you look at it - it shows costs were rising and that it couldn’t pass them onto its customers.

In Q4, Tutor Perini generated an operating profit margin of negative 8.1%, down 5.9 percentage points year on year. Since Tutor Perini’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

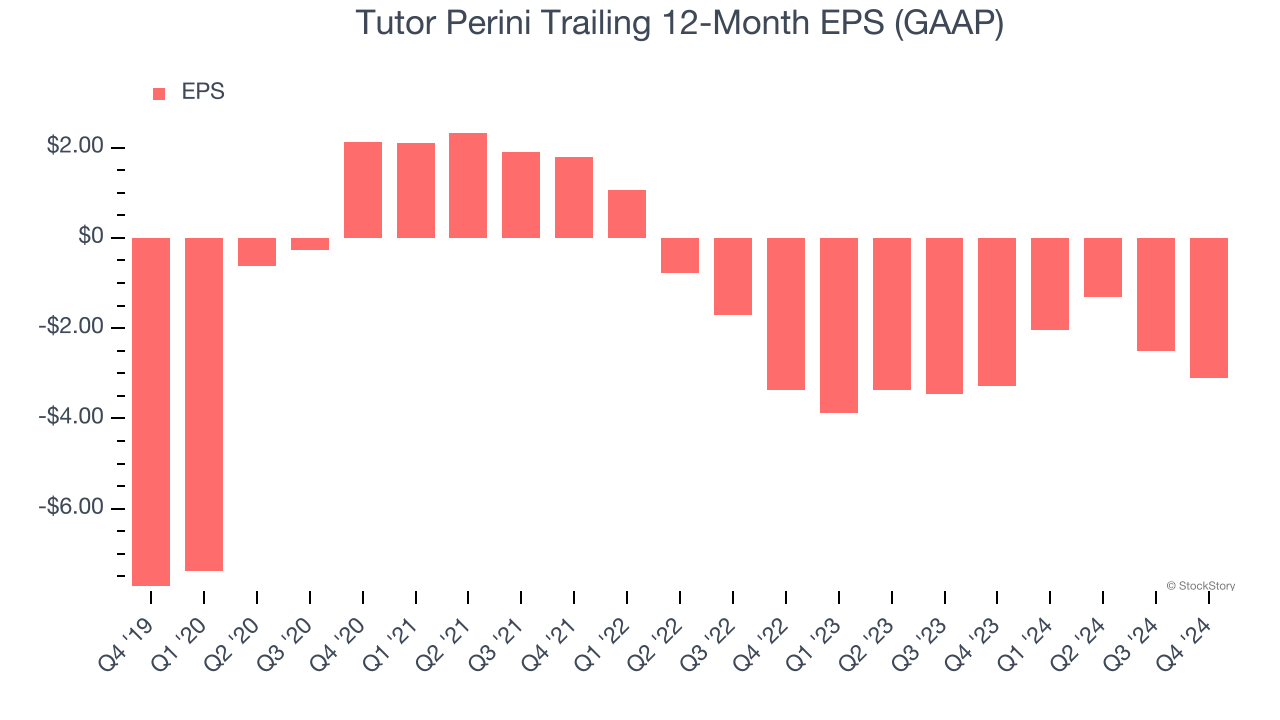

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Tutor Perini’s full-year earnings are still negative, it reduced its losses and improved its EPS by 16.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Tutor Perini, its two-year annual EPS growth of 3.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Tutor Perini reported EPS at negative $1.51, down from negative $0.91 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Tutor Perini’s full-year EPS of negative $3.11 will flip to positive $1.59.

Key Takeaways from Tutor Perini’s Q4 Results

We were impressed by Tutor Perini’s optimistic full-year EPS guidance, which blew past analysts’ expectations. On the other hand, its revenue and EPS in the quarter missed. Overall, this quarter was mixed. The market seemed to be focusing on the positives, and the stock traded up 4.8% to $22.94 immediately following the results.

Is Tutor Perini an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

NYSE:TPC (3/3/2025, 2:58:09 PM)

28.34

-1.05 (-3.57%)

Find more stocks in the Stock Screener

TPC Latest News and Analysis

3 days ago - ChartmillKeep an eye on the top gainers and losers in Friday's session.

3 days ago - ChartmillKeep an eye on the top gainers and losers in Friday's session.Intrigued by the market activity one hour before the close of the markets on Friday? Uncover the key winners and losers of today's session in our insightful analysis.

3 days ago - ChartmillFriday's session: top gainers and losers

3 days ago - ChartmillFriday's session: top gainers and losersStay up-to-date with the latest market trends in the middle of the day on Friday. Explore the top gainers and losers during today's session in our detailed report.

3 days ago - ChartmillThese stocks are gapping in today's session

3 days ago - ChartmillThese stocks are gapping in today's sessionInvestors and traders are closely monitoring the gap up and gap down stocks in today's session on Friday. Let's explore the market movements and identify the stocks with significant gaps.