Swing Trading Recap: Two Recent Trades

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Dec 20, 2024

Swing trading is not just about identifying the right entry and exit points; it’s also about disciplined risk and position management.

Here’s a detailed recap of 2 recently completed swing trades (managed through a demo spreadsheet on my personal X account), showcasing the importance of these principles.

Important: the demo-spreadsheet shared on 'X' in no way constitutes a recommendation to buy or sell shares. It is purely a paper trading follow-up designed to showcase and test a number of setups arising from the ChartMill screens and trading ideas that I explore on a daily base. I have no open positions in the stocks covered in this demo-spreadsheet unless otherwise reported on X.

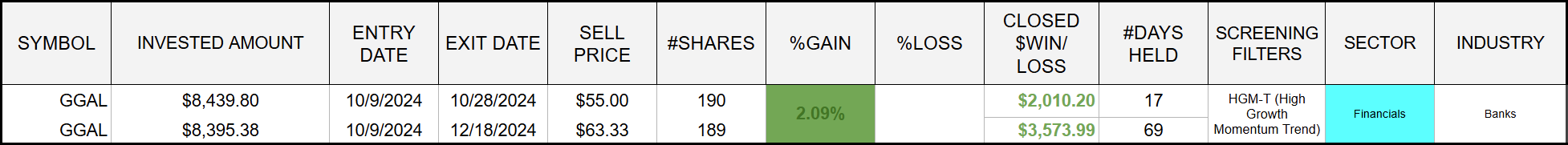

Trade 1 - GRUPO FINANCIERO GALICIA (GGAL)

I detected this setup by using the ChartMill 'High Growht Momentum Trend' Trading Idea.

The screens filters for stocks which meet the Minervini Trend Template and have a ChartMill High Growth Momentum score of at least 6. The trend template makes sure the results are stocks which are in an uptrend, not too far of their highs and well above their yearly lows.

The ChartMill HGM rating assures the results show high EPS and Sales growth and acceleration.

The Trade Details:

-

Ticker: GGAL (Grupo Financiero Galicia)

-

Entry Date: 2024/10/09

-

Entry Price: $44.42

-

Initial Stop Loss: $40.92

-

Initial Total Risk on Portfolio: 0.50%

Exit Strategy and Results:

First Target Reached:

-

Date: 2024/10/28

-

Price: $55.00

-

Profit from First Half: 0.75% of the portfolio

Stop Loss Adjustments

- Throughout the trade, the stop loss was adjusted upwards, effectively locking in profits and minimizing risks.

Second Portion Sold:

-

Date: 2024/12/18

-

Price: $63.33 (stop loss hit)

-

Profit from Second Half: 1.34% of the portfolio

-

Total Profit on Trade: 2.09% of the portfolio

Remarks:

- Although my second target was set at $73 (the stock’s all-time high), the market didn’t provide the opportunity to reach it.

Key Takeaways:

Risk Management:

-

By limiting the initial risk to just 0.50% of the portfolio, the trade maintained a favorable risk-reward ratio.

-

Gradually raising the stop loss allowed for protecting gains without prematurely exiting the trade.

Patience and Discipline:

-

The first exit at $55 ensured a partial realization of profits.

-

The decision to hold the remaining position until the adjusted stop loss was hit maximized the trade’s potential (Risk/reward > 4/1), highlighting the importance of flexible expectations.

Chart & Trade Results

Trade 2 - SENSUS HEALTHCARE INC (SRTS)

This stock not only popped up in the High Growth Momentum screen but in addition ChartMil recognized a bullish flag pattern (Also take a look at the High Tight Flag Pattern screen) on date of 04/12/2024, causing the stock to end up in my watchlist.

The Trade Details:

-

Ticker: SRTS (Sensus Healthcare Inc.)

-

Entry Date: 2024/12/05

-

Exit Date: 2024/12/13

-

Result: The stop loss was triggered, resulting in a minimal loss of 0.50% of the total portfolio equity.

Key Takeaways:

Loss Control:

- The strict adherence to the stop-loss level kept the loss small, preventing it from negatively impacting overall portfolio performance.

Consistency:

- This trade underscores the importance of following a predefined plan, regardless of the outcome.

Chart & Trade Results

The ChartMill Flag Recognition

Long Entry and Initial Stop Loss

Stop Loss Hit

Current Situation

Final Thoughts:

- Both trades demonstrate that swing trading success relies heavily on disciplined risk management and sticking to a well-thought-out strategy.

- Losses are part of the game, but minimizing them and maximizing winning trades will ensure consistent growth over time.