Why NYSE:SON provides a good dividend, while having solid fundamentals.

By Mill Chart

Last update: Oct 11, 2024

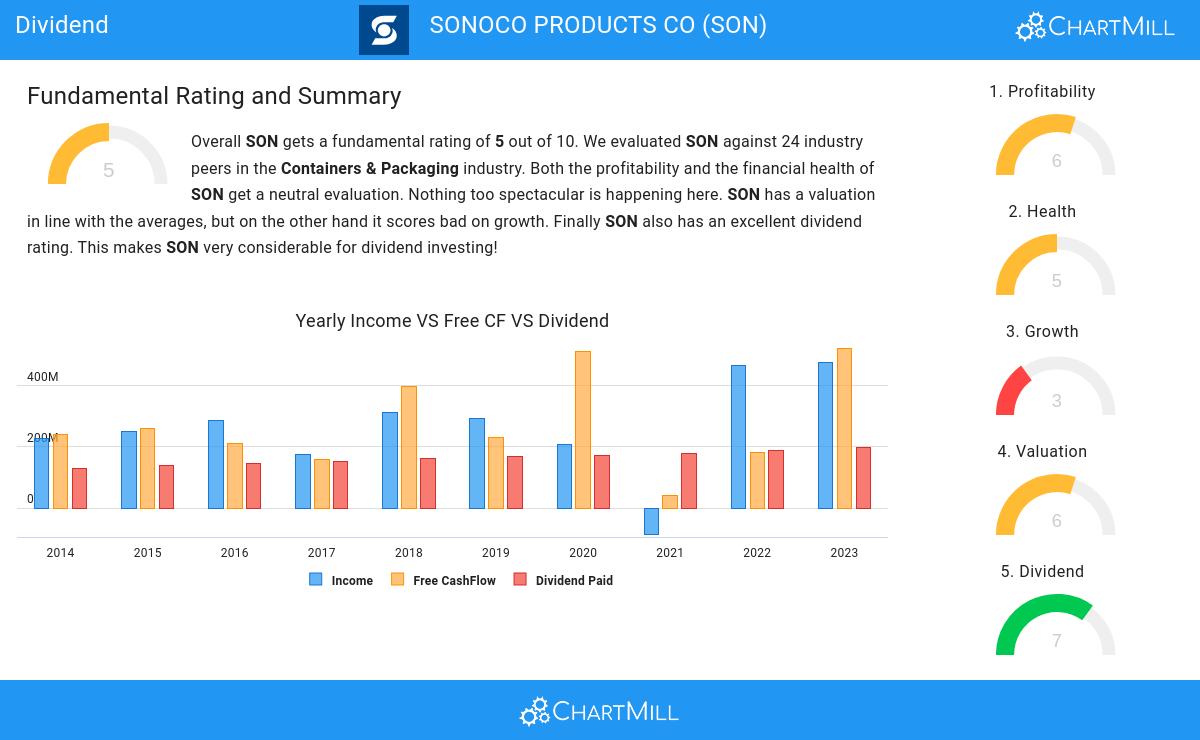

SONOCO PRODUCTS CO (NYSE:SON) is a hidden gem unveiled by our stock screening tool, featuring a promising dividend outlook alongside solid fundamentals. NYSE:SON demonstrates decent financial health and profitability while ensuring a sustainable dividend. Let's break it down further.

How do we evaluate the Dividend for NYSE:SON?

ChartMill employs its own Dividend Rating system for all stocks. This score, on a scale of 0 to 10, is determined by evaluating different dividend factors, such as yield, historical performance, dividend growth, and sustainability. NYSE:SON has been assigned a 7 for dividend:

- Compared to an average industry Dividend Yield of 2.93, SON pays a better dividend. On top of this SON pays more dividend than 86.96% of the companies listed in the same industry.

- SON's Dividend Yield is rather good when compared to the S&P500 average which is at 2.22.

- SON has been paying a dividend for at least 10 years, so it has a reliable track record.

- SON has not decreased its dividend for at least 10 years, so it has a reliable track record of non decreasing dividend.

Analyzing Health Metrics

ChartMill utilizes a Health Rating to assess stocks, scoring them on a scale of 0 to 10. This rating takes into account a variety of liquidity and solvency ratios, both in absolute terms and in comparison to industry peers. NYSE:SON has earned a 5 out of 10:

- SON has a Altman-Z score of 2.50. This is in the better half of the industry: SON outperforms 78.26% of its industry peers.

- With an excellent Debt to FCF ratio value of 7.06, SON belongs to the best of the industry, outperforming 82.61% of the companies in the same industry.

- The Debt to Equity ratio of SON (1.04) is better than 60.87% of its industry peers.

Exploring NYSE:SON's Profitability

Discover ChartMill's exclusive Profitability Rating, a proprietary metric that assesses stocks on a scale of 0 to 10. It takes into consideration various profitability ratios and margins, both in absolute terms and relative to industry peers. Notably, NYSE:SON has achieved a 6:

- With a decent Return On Assets value of 5.14%, SON is doing good in the industry, outperforming 73.91% of the companies in the same industry.

- With a decent Return On Invested Capital value of 9.24%, SON is doing good in the industry, outperforming 69.57% of the companies in the same industry.

- SON's Profit Margin of 5.57% is fine compared to the rest of the industry. SON outperforms 69.57% of its industry peers.

- In the last couple of years the Profit Margin of SON has grown nicely.

- The Operating Margin of SON (9.98%) is better than 60.87% of its industry peers.

- SON's Operating Margin has improved in the last couple of years.

- SON's Gross Margin has improved in the last couple of years.

Our Best Dividend screener lists more Best Dividend stocks and is updated daily.

For an up to date full fundamental analysis you can check the fundamental report of SON

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.