Why NYSE:SITC is a Top Pick for Dividend Investors.

By Mill Chart

Last update: Oct 31, 2024

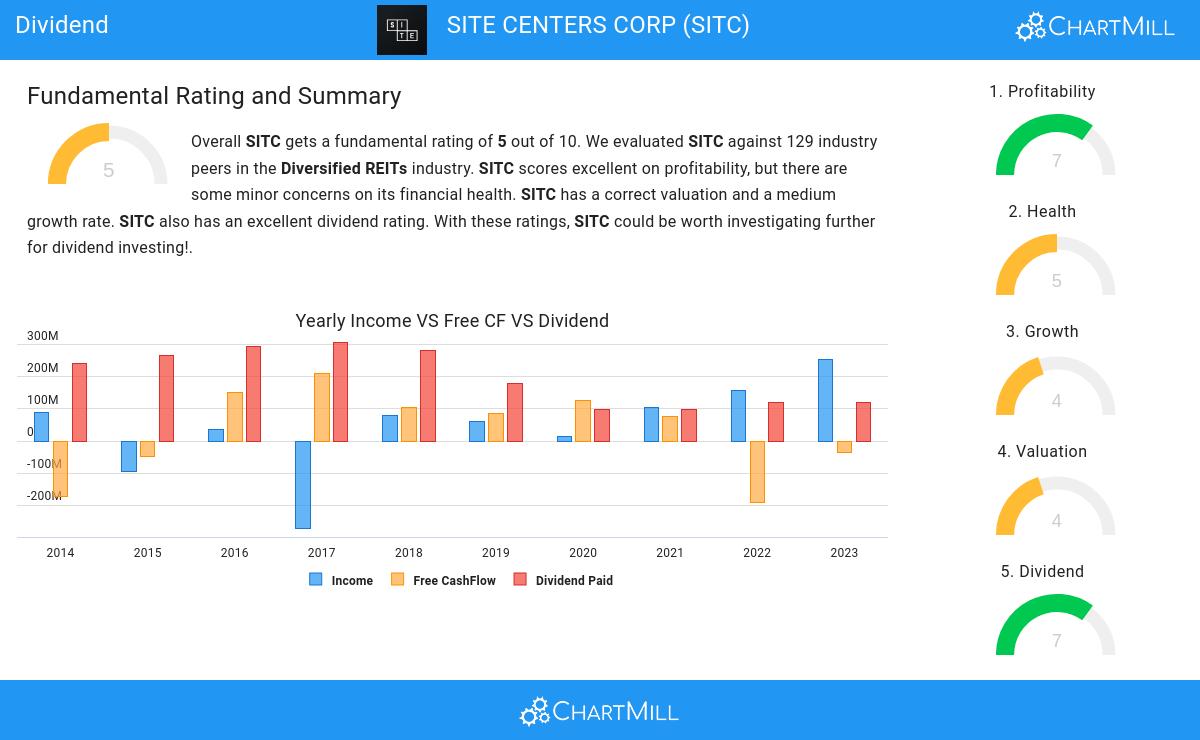

Take a closer look at SITE CENTERS CORP (NYSE:SITC), a stock of interest to dividend investors uncovered by our stock screener. NYSE:SITC excels in fundamentals and provides a decent dividend, all while maintaining a reasonable valuation. Let's break it down further.

Evaluating Dividend: NYSE:SITC

ChartMill assigns a Dividend Rating to each stock, ranging from 0 to 10. This rating is calculated by analyzing various dividend elements, such as yield, historical performance, dividend growth, and sustainability. NYSE:SITC has been awarded a 7 for its dividend quality:

- SITC has a Yearly Dividend Yield of 12.16%, which is a nice return.

- SITC's Dividend Yield is rather good when compared to the industry average which is at 5.81. SITC pays more dividend than 96.03% of the companies in the same industry.

- SITC's Dividend Yield is rather good when compared to the S&P500 average which is at 2.22.

- The dividend of SITC is nicely growing with an annual growth rate of 8.32%!

- SITC has paid a dividend for at least 10 years, which is a reliable track record.

- 34.38% of the earnings are spent on dividend by SITC. This is a low number and sustainable payout ratio.

Exploring NYSE:SITC's Health

To gauge a stock's financial health, ChartMill utilizes a Health Rating on a scale of 0 to 10. This comprehensive evaluation encompasses liquidity and solvency, both in absolute terms and in comparison to industry peers. NYSE:SITC has earned a 5 out of 10:

- Looking at the Debt to Equity ratio, with a value of 0.65, SITC is in the better half of the industry, outperforming 78.57% of the companies in the same industry.

- SITC has a Current Ratio of 6.25. This indicates that SITC is financially healthy and has no problem in meeting its short term obligations.

- With an excellent Current ratio value of 6.25, SITC belongs to the best of the industry, outperforming 94.44% of the companies in the same industry.

- A Quick Ratio of 6.25 indicates that SITC has no problem at all paying its short term obligations.

- SITC has a better Quick ratio (6.25) than 94.44% of its industry peers.

Understanding NYSE:SITC's Profitability

Discover ChartMill's exclusive Profitability Rating, a proprietary metric that assesses stocks on a scale of 0 to 10. It takes into consideration various profitability ratios and margins, both in absolute terms and relative to industry peers. Notably, NYSE:SITC has achieved a 7:

- SITC has a Return On Assets of 11.07%. This is amongst the best in the industry. SITC outperforms 100.00% of its industry peers.

- SITC has a Return On Equity of 19.19%. This is amongst the best in the industry. SITC outperforms 96.03% of its industry peers.

- With an excellent Profit Margin value of 88.32%, SITC belongs to the best of the industry, outperforming 100.00% of the companies in the same industry.

- SITC's Profit Margin has improved in the last couple of years.

- With a decent Gross Margin value of 69.95%, SITC is doing good in the industry, outperforming 60.32% of the companies in the same industry.

Every day, new Best Dividend stocks can be found on ChartMill in our Best Dividend screener.

Check the latest full fundamental report of SITC for a complete fundamental analysis.

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

NYSE:SITC (4/23/2025, 9:41:01 AM)

12.09

+0.2 (+1.68%)

Find more stocks in the Stock Screener