In this article we will dive into SPROUTS FARMERS MARKET INC (NASDAQ:SFM) as a possible candidate for quality investing. Investors should always do their own research, but we noticed SPROUTS FARMERS MARKET INC showing up in our Caviar Cruise quality screen, which makes it worth to investigate a bit more.

What matters for quality investors.

- The 5-year revenue growth of SPROUTS FARMERS MARKET INC has been remarkable, with 5.6% increase. This showcases the company's strong performance in driving revenue growth and indicates its competitiveness within the market.

- The ROIC excluding cash and goodwill of SPROUTS FARMERS MARKET INC stands at 17.47%, reflecting the company's strong financial management and profitability. This metric underscores its ability to generate favorable returns on the capital invested in its core operations.

- The Debt/Free Cash Flow Ratio of SPROUTS FARMERS MARKET INC stands at 0.03, reflecting the company's prudent capital structure and cash flow dynamics. This ratio highlights the company's ability to generate robust free cash flow relative to its debt obligations.

- The Profit Quality (5-year) of SPROUTS FARMERS MARKET INC stands at 108.0%, highlighting its ability to consistently generate reliable profits. This metric underscores the company's strong business fundamentals and reinforces its position as a financially stable entity.

- The 5-year EBIT growth of SPROUTS FARMERS MARKET INC has been remarkable, with 10.63% increase. This demonstrates the company's ability to improve its operational efficiency and indicates its competitiveness within the market.

- SPROUTS FARMERS MARKET INC has achieved impressive EBIT 5-year growth, surpassing its Revenue 5-year growth. This indicates the company's ability to improve its profitability and operational efficiency, highlighting its strong financial performance.

How does the complete fundamental picture look for NASDAQ:SFM?

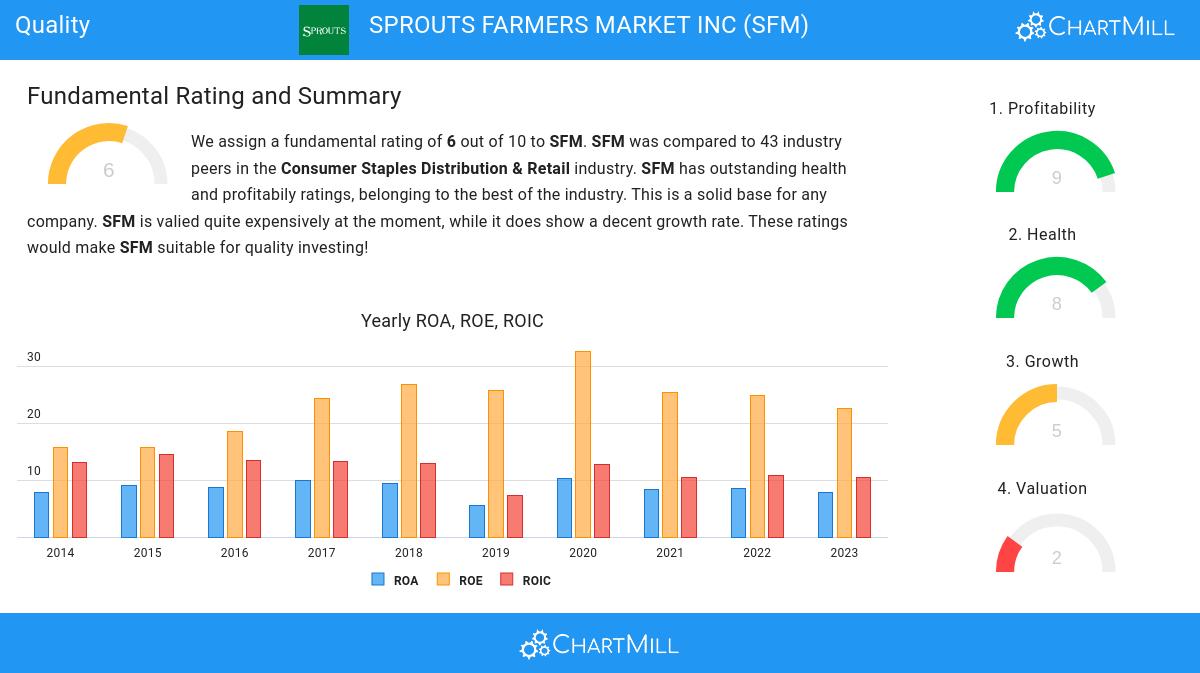

ChartMill employs a sophisticated system to assign a Fundamental Rating to every stock in its analysis. This rating, which ranges from 0 to 10, is determined by carefully assessing multiple fundamental indicators and properties.

Taking everything into account, SFM scores 6 out of 10 in our fundamental rating. SFM was compared to 43 industry peers in the Consumer Staples Distribution & Retail industry. Both the health and profitability get an excellent rating, making SFM a very profitable company, without any liquidiy or solvency issues. SFM is quite expensive at the moment. It does show a decent growth rate. These ratings would make SFM suitable for quality investing!

Check the latest full fundamental report of SFM for a complete fundamental analysis.

More quality stocks can be found in our Caviar Cruise screen.

Keep in mind

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.