RingCentral’s (NYSE:RNG) Q4 Earnings Results: Revenue In Line With Expectations But Quarterly Revenue Guidance Significantly Misses Expectations

Provided By StockStory

Last update: Feb 20, 2025

Office and call centre communications software provider RingCentral (NYSE:RNG) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 7.6% year on year to $614.5 million. On the other hand, next quarter’s revenue guidance of $609.5 million was less impressive, coming in 2.7% below analysts’ estimates. Its non-GAAP profit of $0.98 per share was 1.3% above analysts’ consensus estimates.

Is now the time to buy RingCentral? Find out by accessing our full research report, it’s free.

RingCentral (RNG) Q4 CY2024 Highlights:

- Revenue: $614.5 million vs analyst estimates of $612.4 million (7.6% year-on-year growth, in line)

- Adjusted EPS: $0.98 vs analyst estimates of $0.97 (1.3% beat)

- Adjusted Operating Income: $131.2 million vs analyst estimates of $129.8 million (21.3% margin, 1% beat)

- Revenue Guidance for Q1 CY2025 is $609.5 million at the midpoint, below analyst estimates of $626.5 million

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.20 at the midpoint, in line with analyst estimates

- Operating Margin: 0%, up from -7.9% in the same quarter last year

- Free Cash Flow Margin: 18.2%, similar to the previous quarter

- Market Capitalization: $2.86 billion

"We had a good fourth quarter, capping a strong year,” said Vlad Shmunis, RingCentral's founder and CEO.

Company Overview

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Sales Growth

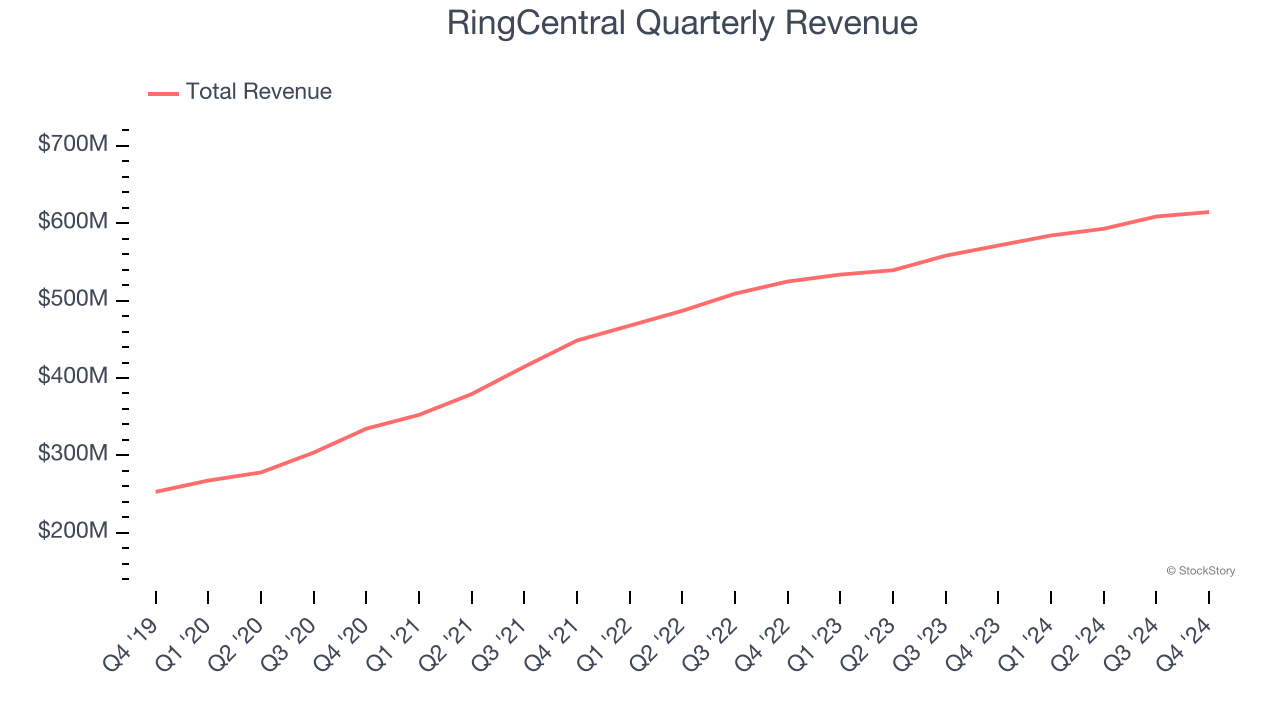

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, RingCentral grew its sales at a 14.6% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the software sector, which enjoys a number of secular tailwinds.

This quarter, RingCentral grew its revenue by 7.6% year on year, and its $614.5 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 4.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for RingCentral to acquire new customers as its CAC payback period checked in at 123.8 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from RingCentral’s Q4 Results

We struggled to find many positives in these results. Its revenue guidance for next quarter missed significantly and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.5% to $30 immediately following the results.

RingCentral’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.