Why the high growth investor may take a look at NYSE:PSN.

By Mill Chart

Last update: Nov 6, 2024

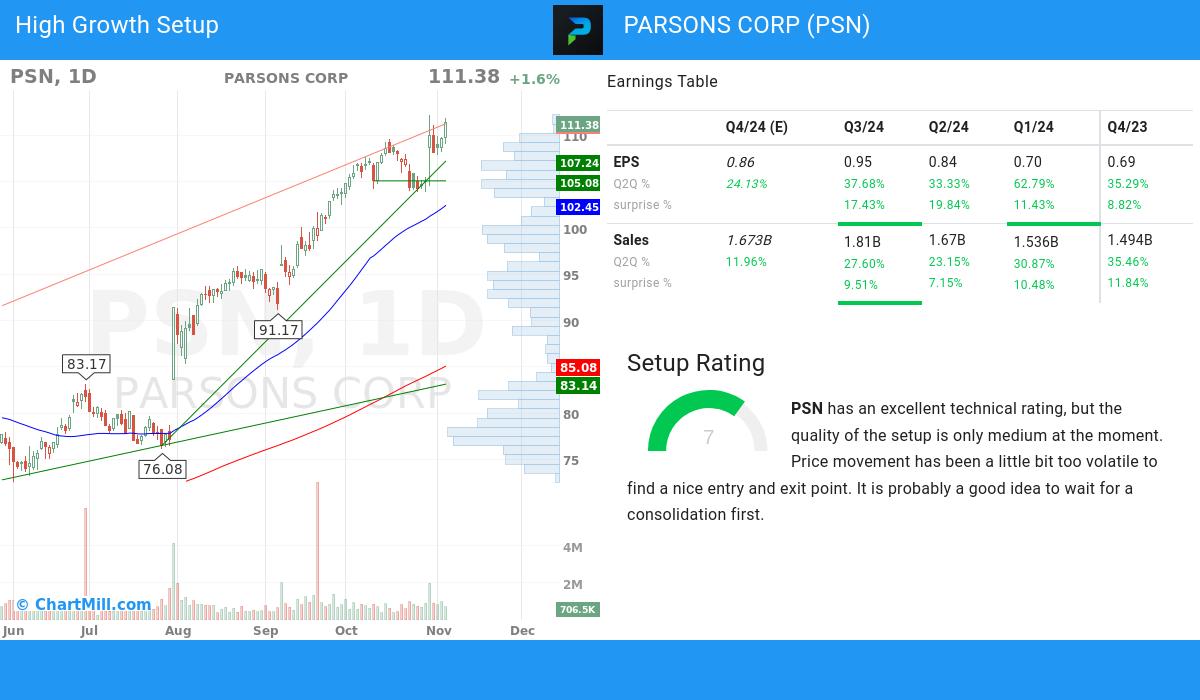

PARSONS CORP (NYSE:PSN) was identified as a Technical Breakout Setup Pattern by our stockscreener. Such a pattern occurs when we see a pause in a strong uptrend: after a strong rise the stock is consolidating a bit and at some point the trend may be continued. Whether this actually happens can not be predicted of course, but it may be a good idea to keep and eye on NYSE:PSN.

Technical analysis of NYSE:PSN

Every day ChartMill assigns a Technical Rating to every stock. The score ranges from 0 to 10 and is determined by evaluating multiple technical indicators and properties.

Overall PSN gets a technical rating of 10 out of 10. Both in the recent history as in the last year, PSN has proven to be a steady performer, scoring decent points in every aspect analyzed.

- Both the short term and long term trends are positive. This is a very positive sign.

- Looking at the yearly performance, PSN did better than 91% of all other stocks. We also observe that the gains produced by PSN over the past year are nicely spread over this period.

- PSN is one of the better performing stocks in the Professional Services industry, it outperforms 88% of 82 stocks in the same industry.

- PSN is currently trading near its 52 week high, which is a good sign. The S&P500 Index however is also trading near new highs, which makes the performance in line with the market.

- In the last month PSN has a been trading in the 103.89 - 112.19 range, which is quite wide. It is currently trading near the high of this range.

- Prices have been rising strongly lately, it may be a good idea to wait for a consolidation or pullback before considering an entry.

Our latest full technical report of PSN contains the most current technical analsysis.

Why is NYSE:PSN a setup?

ChartMill takes into account not only the Technical Rating but also assigns a Setup Rating to each stock. This rating, on a scale of 0 to 10, reflects the degree of consolidation observed based on short-term technical indicators. Currently, NYSE:PSN exhibits a 7 setup rating, indicating its consolidation status in recent days and weeks.

PSN has an excellent technical rating, but the quality of the setup is only medium at the moment. Price movement has been a little bit too volatile to find a nice entry and exit point. It is probably a good idea to wait for a consolidation first.

Why NYSE:PSN may be interesting for high growth investors.

- PARSONS CORP has demonstrated consistent growth in its earnings per share (EPS) from one quarter to another (Q2Q), with a 37.68% increase. This indicates improving financial performance and the company's effective management of its operations.

- PARSONS CORP has demonstrated strong quarter-to-quarter (Q2Q) revenue growth of 27.6%, reflecting its ability to generate consistent increases in sales. This growth highlights the company's effective market positioning and its potential for continued success.

- Over the past 3 years, PARSONS CORP has demonstrated 36.0% growth in EPS, signifying its positive financial trajectory and potential for future profitability.

- PARSONS CORP has demonstrated strong 1-year revenue growth of 28.88%, reflecting revenue momentum and its ability to generate consistent top-line expansion. This growth underscores the company's strong market position and its potential for future success.

- The recent financial report of PARSONS CORP demonstrates a 37.68% increase in quarterly earnings compared to the previous quarter. This growth indicates positive momentum in the company's financials and suggests a promising upward trend

- PARSONS CORP has experienced notable growth in its operating margin over the past year, reflecting improved operational performance. This growth suggests the company's ability to generate higher profits from its core business activities.

- The free cash flow (FCF) of PARSONS CORP has seen steady growth over the past year, indicating enhanced cash flow generation and financial health. This trend underscores the company's effective capital management and its ability to generate sustainable cash flows.

- PARSONS CORP maintains a healthy Debt-to-Equity ratio of 0.54. This indicates the company's conservative capital structure and signifies its ability to effectively manage debt obligations while maintaining a strong equity position.

- PARSONS CORP exhibits a favorable ownership structure, with an institutional shareholder ownership of 10.12%. This signifies a diverse investor base, which can contribute to a more stable and efficient market for the stock.

- PARSONS CORP has consistently surpassed EPS estimates in the last 4 quarters, reflecting its strong financial performance and effective management. This trend suggests the company's ability to generate positive earnings surprises and drive shareholder value.

- The Relative Strength (RS) of PARSONS CORP has consistently been strong, with a current 91.29 rating. This indicates the stock's ability to exhibit relative price outperformance and reflects its competitive strength. PARSONS CORP demonstrates promising potential for sustained price momentum.

More ideas for high growth momentum breakouts can be found on ChartMill in our High Growth Momentum Breakout screen.

Keep in mind

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.