PINTEREST INC- CLASS A (NYSE:PINS) showing some interesting technicals. Here's why.

By Mill Chart

Last update: Sep 4, 2023

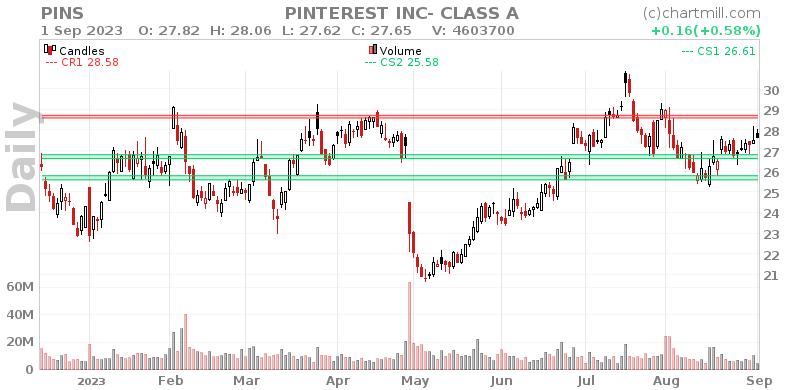

Our stock screener has detected a potential breakout setup on PINTEREST INC- CLASS A (NYSE:PINS). This breakout pattern is observed when a stock consolidates following a strong upward movement. It's important to note that this pattern is based on technical analysis, and the actual breakout outcome is uncertain. However, it might be worth keeping an eye on NYSE:PINS.

Technical Analysis Observations

ChartMill assigns a Technical Rating to every stock. This score, ranging from 0 to 10, is updated daily and is determined by evaluating multiple technical indicators and properties.

Overall PINS gets a technical rating of 7 out of 10. PINS has been one of the better performers in the overall market. Some doubts were observed in the medium time frame, but recent action was again very positive.

- The long and short term trends are both positive. This is looking good!

- Looking at the yearly performance, PINS did better than 88% of all other stocks.

- PINS is part of the Interactive Media & Services industry. There are 73 other stocks in this industry. PINS outperforms 86% of them.

- PINS is currently trading in the upper part of its 52 week range. The S&P500 Index however is currently trading near a new high, so PINS is lagging the market slightly.

- In the last month PINS has a been trading in the 25.22 - 28.17 range, which is quite wide. It is currently trading near the high of this range.

Check the latest full technical report of PINS for a complete technical analysis.

Why is NYSE:PINS a setup?

ChartMill incorporates a Setup Rating in its analysis, which measures the extent of consolidation in a stock over recent days and weeks. This rating, ranging from 0 to 10, is updated daily and takes into account multiple short-term technical indicators. The current setup rating for NYSE:PINS is 9:

PINS has an excellent technical rating and also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is a resistance zone just above the current price starting at 28.58. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 26.80, a Stop Loss order could be placed below this zone. Very recently a Pocket Pivot signal was observed. This is another positive sign.

Trading setups like NYSE:PINS

One strategy to consider is waiting for the actual breakout to occur, where the stock breaks out above the current consolidation zone. Traders can then enter a buy position, anticipating further upward momentum. As a risk management measure, it is advisable to set a stop loss order below the consolidation zone.

Please note that this article should not be construed as trading advice. The information provided is solely based on automated technical analysis and serves to highlight technical observations. It is important to conduct your own analysis and make trading decisions based on your own judgment and responsibility.

Our Breakout screener lists more breakout setups and is updated daily.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

38.69

-0.63 (-1.6%)

Find more stocks in the Stock Screener

PINS Latest News and Analysis

7 days ago - ChartmillFor those who appreciate growth without the sticker shock, NYSE:PINS is worth considering.

7 days ago - ChartmillFor those who appreciate growth without the sticker shock, NYSE:PINS is worth considering.Based on Fundamental Analysis it can be said that NYSE:PINS is a growth stock which is not overvalued.

12 days ago - ChartmillLet's uncover which stocks are experiencing notable gaps during today's session.

12 days ago - ChartmillLet's uncover which stocks are experiencing notable gaps during today's session.Let's have a look at what is happening on the US markets on Friday. Below you can find the gap up and gap down stocks in today's session.

13 days ago - ChartmillWhat's going on in today's pre-market session

13 days ago - ChartmillWhat's going on in today's pre-market sessionDiscover the top movers in Friday's pre-market session and stay informed about market dynamics.

13 days ago - ChartmillThese stocks are moving in today's after hours session

13 days ago - ChartmillThese stocks are moving in today's after hours sessionLet's have a look at what is happening on the US markets after the closing bell on Thursday. Below you can find the top gainers and losers in today's after hours session.

15 days ago - ChartmillTechnical Setup: PINTEREST INC- CLASS A Appears Poised for a Breakout.

15 days ago - ChartmillTechnical Setup: PINTEREST INC- CLASS A Appears Poised for a Breakout.Exploring PINTEREST INC- CLASS A's Technical Signals and Breakout Potential: Based on good technical signals, PINTEREST INC- CLASS A is potentially setting up for a breakout.