3 Reasons to Sell MTD and 1 Stock to Buy Instead

Provided By StockStory

Last update: Feb 21, 2025

Over the past six months, Mettler-Toledo’s shares (currently trading at $1,304) have posted a disappointing 8.9% loss, well below the S&P 500’s 8.9% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Mettler-Toledo, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the more favorable entry price, we're swiping left on Mettler-Toledo for now. Here are three reasons why we avoid MTD and a stock we'd rather own.

Why Is Mettler-Toledo Not Exciting?

Founded in 1945, Mettler-Toledo (NYSE:MTD) designs and manufactures precision instruments and services for use across healthcare research, quality control, production, and retail.

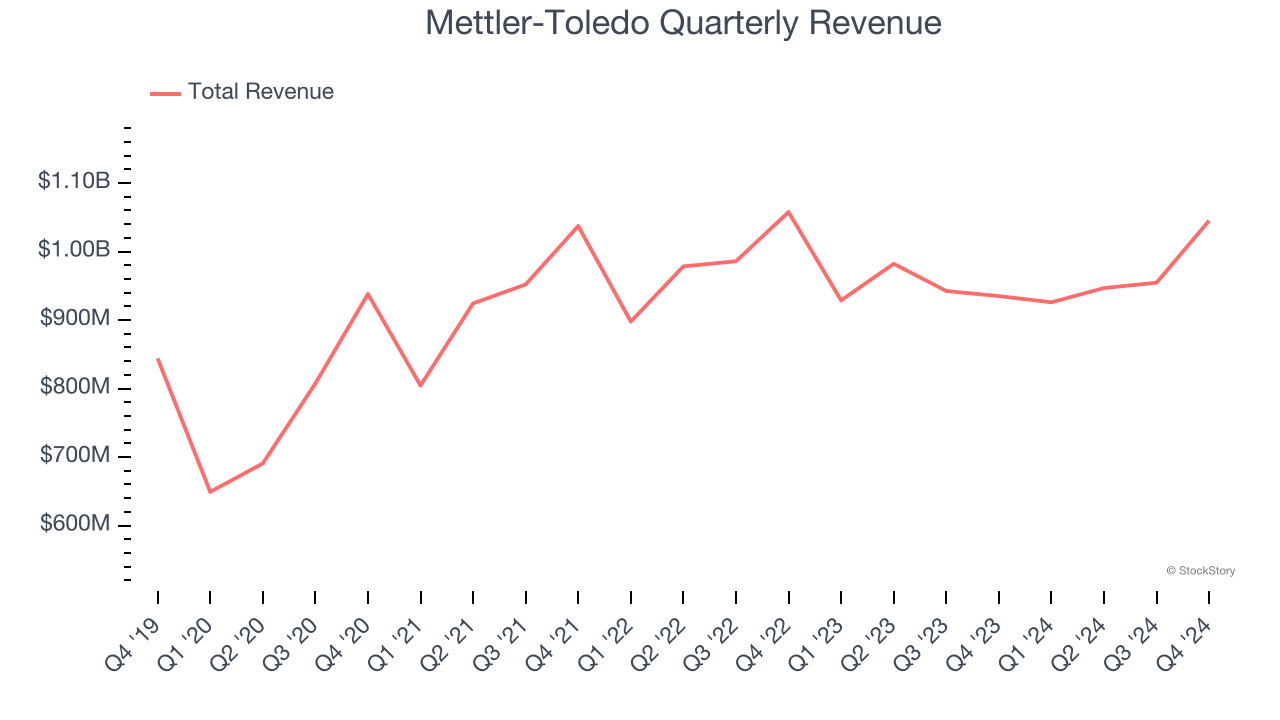

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Mettler-Toledo grew its sales at a mediocre 5.2% compounded annual growth rate. This was below our standard for the healthcare sector.

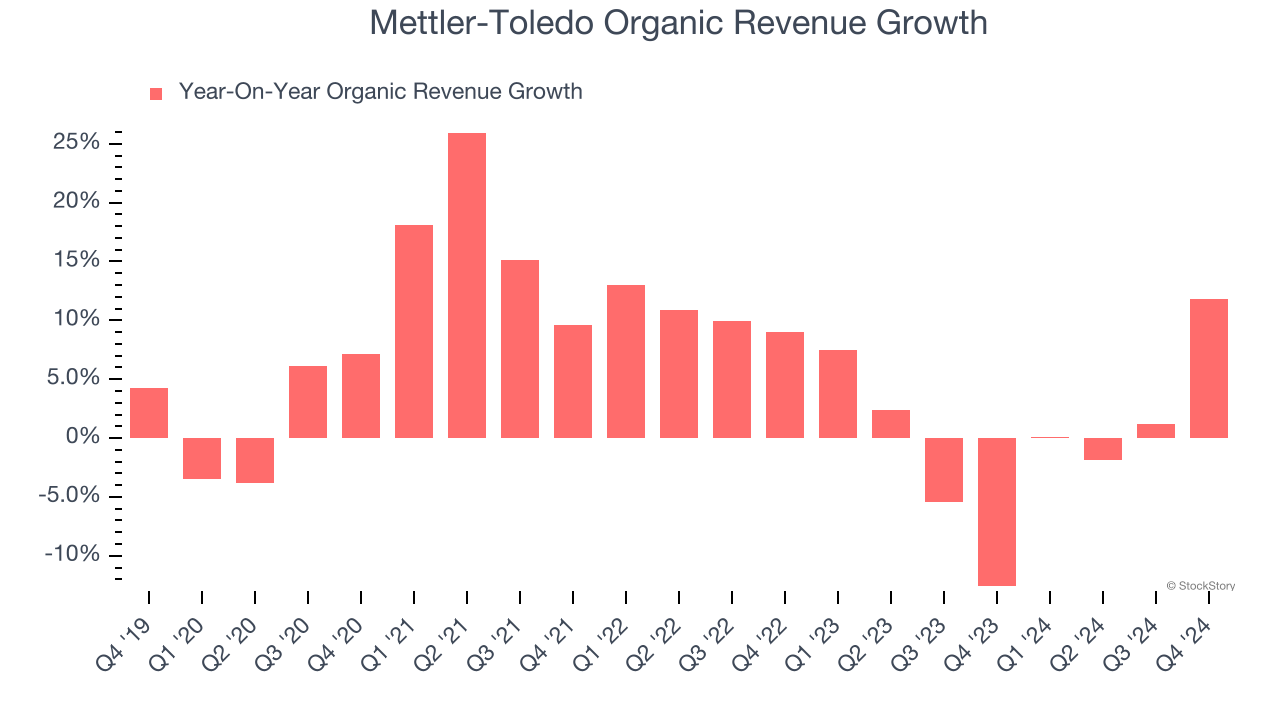

2. Core Business Falling Behind as Demand Plateaus

Investors interested in Research Tools & Consumables companies should track organic revenue in addition to reported revenue. This metric gives visibility into Mettler-Toledo’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Mettler-Toledo failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Mettler-Toledo might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

3. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Mettler-Toledo’s revenue to stall. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Final Judgment

Mettler-Toledo’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 31× forward price-to-earnings (or $1,304 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Mettler-Toledo

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

1286.54

-16.59 (-1.27%)

754.3

-23.33 (-3%)

Find more stocks in the Stock Screener

MTD Latest News and Analysis

12 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

12 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Monday.

12 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

12 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Curious about the S&P500 stocks that are in motion on Monday? Join us as we explore the top movers within the S&P500 index during today's session.

15 days ago - ChartmillThese S&P500 stocks are moving in today's session

15 days ago - ChartmillThese S&P500 stocks are moving in today's sessionGet insights into the S&P500 index performance on Friday. Explore the top gainers and losers within the S&P500 index in today's session.

15 days ago - ChartmillTop S&P500 movers in Friday's session

15 days ago - ChartmillTop S&P500 movers in Friday's sessionUncover the latest developments among S&P500 stocks in today's session. Stay tuned to the S&P500 index's top gainers and losers on Friday.

15 days ago - ChartmillGet insights into the top movers in the S&P500 index of Friday's pre-market session.

15 days ago - ChartmillGet insights into the top movers in the S&P500 index of Friday's pre-market session.Stay updated with the S&P500 stocks that are on the move in today's pre-market session.