NASDAQ:LULU, a strong growth stock, setting up for a breakout.

By Mill Chart

Last update: Nov 11, 2024

Exploring Growth Potential: LULULEMON ATHLETICA INC (NASDAQ:LULU) and Its Base Formation. Growth investors seek promising revenue and EPS growth, and LULULEMON ATHLETICA INC has come under our scrutiny for potential growth investing. While it's crucial to do your own research, we've detected LULULEMON ATHLETICA INC on our screen for growth with base formation, suggesting it merits a closer look.

Understanding NASDAQ:LULU's Growth

To evaluate a stock's growth potential, ChartMill utilizes a Growth Rating on a scale of 0 to 10. This comprehensive assessment considers various growth aspects, including historical and estimated EPS and revenue growth. NASDAQ:LULU has achieved a 8 out of 10:

- The Earnings Per Share has grown by an nice 18.93% over the past year.

- Measured over the past years, LULU shows a very strong growth in Earnings Per Share. The EPS has been growing by 27.05% on average per year.

- Looking at the last year, LULU shows a quite strong growth in Revenue. The Revenue has grown by 13.02% in the last year.

- Measured over the past years, LULU shows a very strong growth in Revenue. The Revenue has been growing by 23.95% on average per year.

- The Earnings Per Share is expected to grow by 13.50% on average over the next years. This is quite good.

- The Revenue is expected to grow by 11.04% on average over the next years. This is quite good.

Understanding NASDAQ:LULU's Health

A critical element of ChartMill's stock evaluation is the Health Rating, which spans from 0 to 10. This rating considers multiple health factors, including liquidity and solvency, both in absolute terms and relative to industry peers. NASDAQ:LULU has received a 9 out of 10:

- An Altman-Z score of 12.14 indicates that LULU is not in any danger for bankruptcy at the moment.

- With an excellent Altman-Z score value of 12.14, LULU belongs to the best of the industry, outperforming 94.00% of the companies in the same industry.

- There is no outstanding debt for LULU. This means it has a Debt/Equity and Debt/FCF ratio of 0 and it is amongst the best of the sector and industry.

- LULU has a Current Ratio of 2.43. This indicates that LULU is financially healthy and has no problem in meeting its short term obligations.

- LULU's Quick ratio of 1.46 is fine compared to the rest of the industry. LULU outperforms 62.00% of its industry peers.

What does the Profitability looks like for NASDAQ:LULU

ChartMill employs its own Profitability Rating system for stock evaluation. This score, ranging from 0 to 10, is derived from an analysis of diverse profitability metrics and margins. In the case of NASDAQ:LULU, the assigned 9 is noteworthy for profitability:

- LULU's Return On Assets of 24.21% is amongst the best of the industry. LULU outperforms 96.00% of its industry peers.

- LULU's Return On Equity of 40.49% is amongst the best of the industry. LULU outperforms 96.00% of its industry peers.

- LULU has a better Return On Invested Capital (29.51%) than 96.00% of its industry peers.

- LULU had an Average Return On Invested Capital over the past 3 years of 27.36%. This is significantly above the industry average of 11.84%.

- The last Return On Invested Capital (29.51%) for LULU is above the 3 year average (27.36%), which is a sign of increasing profitability.

- LULU's Profit Margin of 16.34% is amongst the best of the industry. LULU outperforms 96.00% of its industry peers.

- LULU's Profit Margin has improved in the last couple of years.

- LULU has a better Operating Margin (23.02%) than 96.00% of its industry peers.

- LULU has a Gross Margin of 58.54%. This is in the better half of the industry: LULU outperforms 76.00% of its industry peers.

How do we evaluate the setup for NASDAQ:LULU?

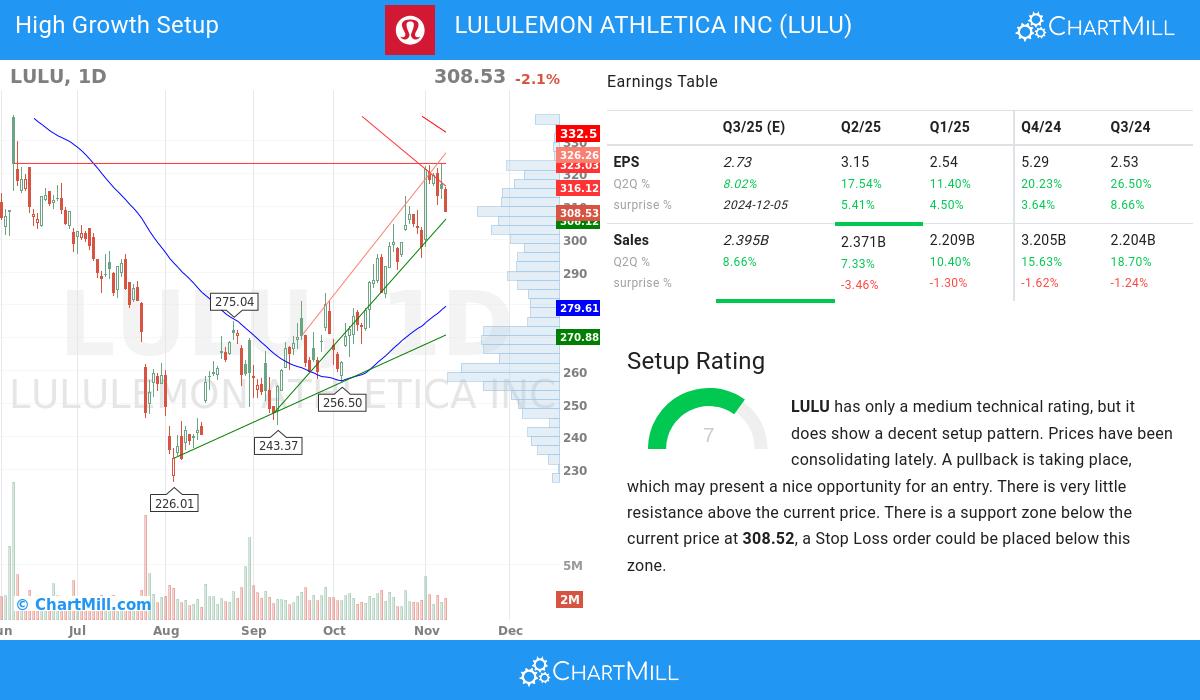

Besides the Technical Rating, ChartMill assigns a Setup Rating to every stock to determine the degree of consolidation. This rating, ranging from 0 to 10, is updated daily and evaluates various short-term technical indicators. NASDAQ:LULU currently holds a 7 as its setup rating, suggesting a particular level of consolidation in the stock.

Although the technical rating is only medium, LULU does present a nice setup opportunity. Prices have been consolidating lately. A pullback is taking place, which may present a nice opportunity for an entry. There is very little resistance above the current price. There is a support zone below the current price at 308.52, a Stop Loss order could be placed below this zone.

Our Strong Growth screener lists more Strong Growth stocks and is updated daily.

Our latest full fundamental report of LULU contains the most current fundamental analsysis.

Our latest full technical report of LULU contains the most current technical analsysis.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

267.9

-2.74 (-1.01%)

Find more stocks in the Stock Screener

LULU Latest News and Analysis

5 days ago - ChartmillShould Quality-Oriented Investors Explore LULULEMON ATHLETICA INC (NASDAQ:LULU)?

5 days ago - ChartmillShould Quality-Oriented Investors Explore LULULEMON ATHLETICA INC (NASDAQ:LULU)?A fundamental analysis of (NASDAQ:LULU): Should Quality Investors Include NASDAQ:LULU in Their Portfolio?

13 days ago - ChartmillWould Peter Lynch consider LULULEMON ATHLETICA INC (NASDAQ:LULU) a winning stock?

13 days ago - ChartmillWould Peter Lynch consider LULULEMON ATHLETICA INC (NASDAQ:LULU) a winning stock?Known for his philosophy of investing in what you know, Peter Lynch looked for companies with consistent earnings growth, low debt, and a competitive edge. Does LULULEMON ATHLETICA INC (NASDAQ:LULU) meet these key criteria? Let’s find out.

20 days ago - ChartmillTuesday's session: top gainers and losers in the S&P500 index

20 days ago - ChartmillTuesday's session: top gainers and losers in the S&P500 indexCurious about the top performers within the S&P500 index one hour before the close of the markets on Tuesday? Dive into the list of today's session's top gainers and losers for a comprehensive overview.

20 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.

20 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.Curious about the top performers within the S&P500 index in the middle of the day on Tuesday? Dive into the list of today's session's top gainers and losers for a comprehensive overview.