Why NYSE:KT qualifies as a good dividend investing stock.

By Mill Chart

Last update: Oct 22, 2024

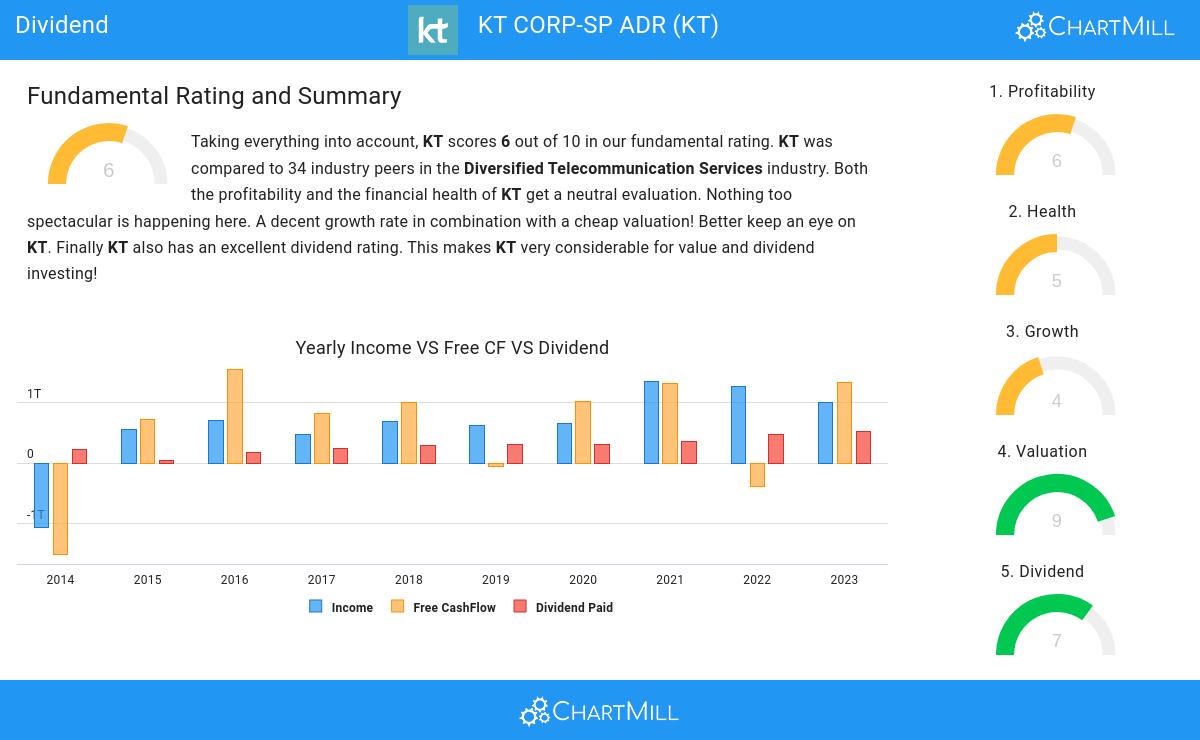

Our stock screener has spotted KT CORP-SP ADR (NYSE:KT) as a good dividend stock with solid fundamentals. NYSE:KT shows decent health and profitability. At the same time it gives a good and sustainable dividend. We'll dive into each aspect below.

A Closer Look at Dividend for NYSE:KT

To gauge a stock's dividend quality, ChartMill utilizes a Dividend Rating ranging from 0 to 10. This comprehensive assessment considers various dividend aspects, including yield, history, growth, and sustainability. NYSE:KT has achieved a 7 out of 10:

- KT has a Yearly Dividend Yield of 8.08%, which is a nice return.

- KT's Dividend Yield is rather good when compared to the industry average which is at 4.76. KT pays more dividend than 94.12% of the companies in the same industry.

- Compared to an average S&P500 Dividend Yield of 2.18, KT pays a better dividend.

- The dividend of KT is nicely growing with an annual growth rate of 11.46%!

- KT has been paying a dividend for at least 10 years, so it has a reliable track record.

Health Insights: NYSE:KT

ChartMill employs a unique Health Rating system for all stocks. This rating, ranging from 0 to 10, is determined by analyzing various liquidity and solvency ratios. For NYSE:KT, the assigned 5 for health provides valuable insights:

- KT has a Altman-Z score of 1.48. This is amongst the best in the industry. KT outperforms 82.35% of its industry peers.

- The Debt to FCF ratio of KT (4.52) is better than 85.29% of its industry peers.

- KT has a Debt/Equity ratio of 0.46. This is a healthy value indicating a solid balance between debt and equity.

- KT has a better Debt to Equity ratio (0.46) than 76.47% of its industry peers.

Analyzing Profitability Metrics

ChartMill assigns a Profitability Rating to every stock. This score ranges from 0 to 10 and evaluates the different profitability ratios and margins, both absolutely, but also relative to the industry peers. NYSE:KT scores a 6 out of 10:

- KT has a better Return On Assets (2.52%) than 64.71% of its industry peers.

- In the last couple of years the Profit Margin of KT has grown nicely.

- In the last couple of years the Operating Margin of KT has grown nicely.

- KT's Gross Margin of 64.59% is fine compared to the rest of the industry. KT outperforms 76.47% of its industry peers.

- In the last couple of years the Gross Margin of KT has grown nicely.

More Best Dividend stocks can be found in our Best Dividend screener.

Check the latest full fundamental report of KT for a complete fundamental analysis.

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.