US Market Update

Last update: May 9, 2022

Bipolar financial markets

"A Bipolar disorder is a disorder that involves episodes of mood swings, ranging from depressive lows to manic highs". For those who have trouble imagining this, we recommend taking a look back at the financial markets last Wednesday and Thursday.

Wednesday, May 4 was the manic high, when the Federal Reserve decided to raise interest rates by 50 basis points. This was the largest increase in 22 years, but because an even higher increase of 75 points was expected in advance - and did not materialize - the market promptly reacted with a real good news rally and daily gains of more than 3% for the indices.

However, the depressed low came the very next day. An unprecedented wave of selling engulfed the markets and brought all indices even lower than the bottom on Wednesday. The biggest loss was recorded by the Nasdaq which lost more than 5%. It seemed as if the markets suddenly realized that the euphoria of the previous day was totally misplaced....

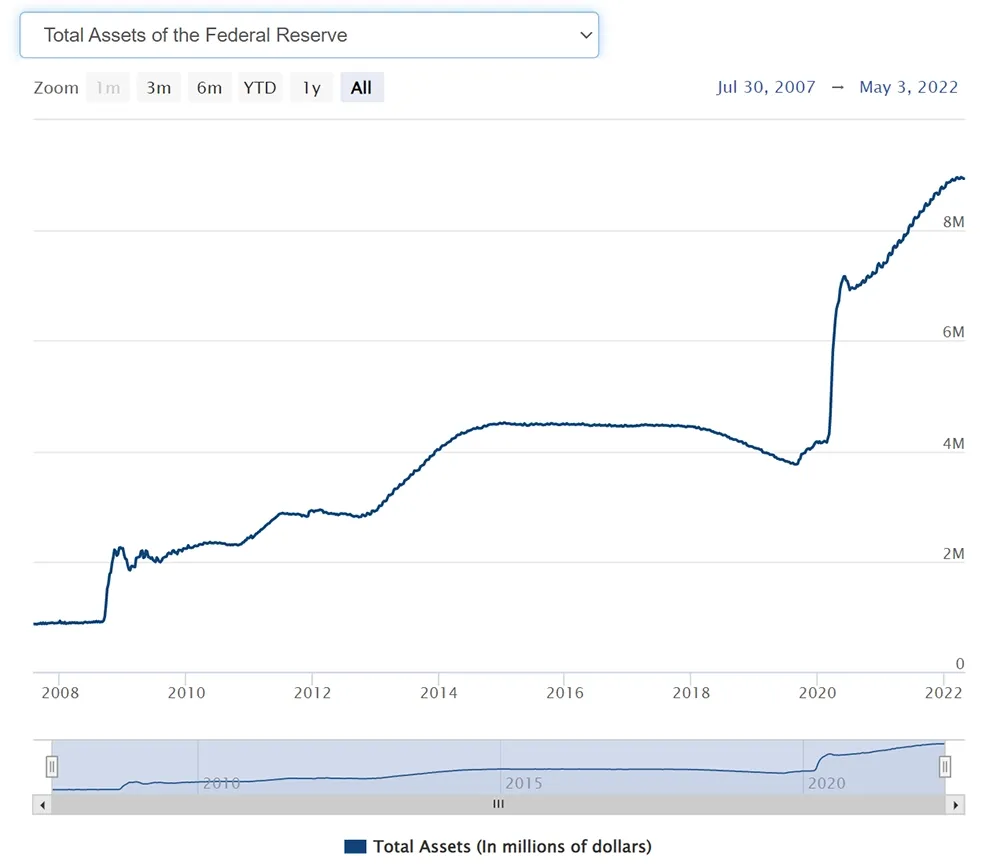

The reason for this rollercoaster is a mix of elements that form a dangerous cocktail. With inflation skyrocketing, it's all hands on deck for Jerome Powell. Yet it is feared that a rate hike of "only" 50 basis points will not be powerful enough to stop the inflation tsunami. Although it was decided to start reducing the huge bond portfolio in June, this will initially be done at a pace of $47.5 billion per month. Initially, this was planned at twice the rate (95 billion). To put these amounts into perspective, the buying up of bonds on the capital market has caused the central bank's balance sheet to increase from around 4000 to almost 9000 billion dollars since 2020.

This cautiousness on the part of the central bank to suddenly push the interest rate pedal too hard has everything to do with the particular market environment we are in today. Inflation moderation in an economic environment that is struggling with the aftermath of Corona (and also the current situation in China) and the war in Ukraine is anything but easy. The prices of energy and many basic materials have already risen extremely, pushing up costs for businesses significantly. They will have to recover these higher costs, at least in part, by raising prices for consumers. The same consumer who, now more than ever, is becoming more cautious in his spending habits because everything is effectively becoming more expensive (highest inflation increase in March 2022 since 1981).

The Fed is caught between hammer and anvil these days. How do you temper the economy sufficiently so that inflation falls significantly without putting too much of a brake on the growth of companies and their willingness to invest? An extremely difficult balancing act and last Friday's job report does not make things any easier... In April, 428,000 jobs were added while only 380,000 were expected. While that sounds positive, it is primarily a sign that there are currently too few workers to meet that demand. The U.S. unemployment rate clocked in at 3.6%, remaining unchanged from the previous month. The previous record low was in March 2020 (3.5%). There are still around 1.2 million fewer jobs than before the pandemic. This causes wages to rise as demand for workers exceeds supply. Those who ask for a wage increase and don't get it have plenty of alternatives from companies that are willing to pay more. The average hourly wage rose by 0.3 percent in April and on an annual basis by 5.5 percent. If the number of vacancies doesn't get filled soon enough, wages risk rising even more and so does inflation....

The long-term charts (SPY, QQQ, DIA and IWM on a weekly timeframe)

The SPY is quoting at the bottom of its current sideways trading channel with selling volumes rising. The $400 level will be crucial this week. If that lower boundary is broken, there is effectively a new lower low and the current long-term downtrend is strongly reaffirmed.

- ChartMill Trend Indicator: RED (down)

- Stage Analysis phase: 3 (topping out)

The QQQ is battered hard. Since the beginning of 2022, this index has lost almost 25%. It is not surprising that typical growth companies are particularly hard hit in times of rising interest rates. After all, rising interest rates imply a decreased valuation of future profits. And future profits are what it's all about for growth companies...

The long-term downtrend is therefore most evident on the chart of the QQQ with a second lower bottom in the making. Next support lies around $300.

- ChartMill Trend Indicator: RED (down)

- Stage Analysis phase: 4 (declining)

The DIA etf is holding up well, yet this index is once again trading at the bottom of its current range. In case of a downward continuation below the lower horizontal line, the next target point is the $300 level to look out for, which would probably result in another oversold signal for the RSI.

- ChartMill Trend Indicator: RED (down)

- Stage Analysis Phase: 3 (topping out)

For the IWM, the trend is also unmistakably downward and similar to the decline in the QQQ. The iShares Russell 2000 ETF seeks to track the investment results of an index composed of small-capitalization U.S. equities. This includes growth stocks with low profitability and high valuations. Unlike large companies, these smaller ones are much less able to simply pass on their increased costs to the end consumer. In addition, these smaller companies finance themselves more often with short-term loans and will therefore feel the effect of the interest rate increases more quickly. A clear pattern of lower bottoms and tops is present here as well. Next support = +/- $173.

- ChartMill Trend Indicator: RED (down)

- Stage Analysis Phase: 4 (declining)

Summary

Expect further downward price pressure and markets that remain highly volatile. QQQ and IWM are approaching crucial support levels, combined with an RSI currently close to the oversold area, this may provide some new buyer appeal. Nevertheless, for the time being, these remain typical market conditions for short-term speculative traders and momentum strategies. As an investor or postion trader with a long-term vision, the main thing in this uncertain market environment is to be patient and keep a close eye on the typical value companies. Even though these companies will not escape the current turmoil in the stock markets, their low(er) valuations can now offer opportunities. Proceed with caution, however: stepping in just because something has fallen sharply is not a good indicator.

The ChartMill Team