Why NYSE:HWM qualifies as a high growth stock.

By Mill Chart

Last update: Nov 6, 2024

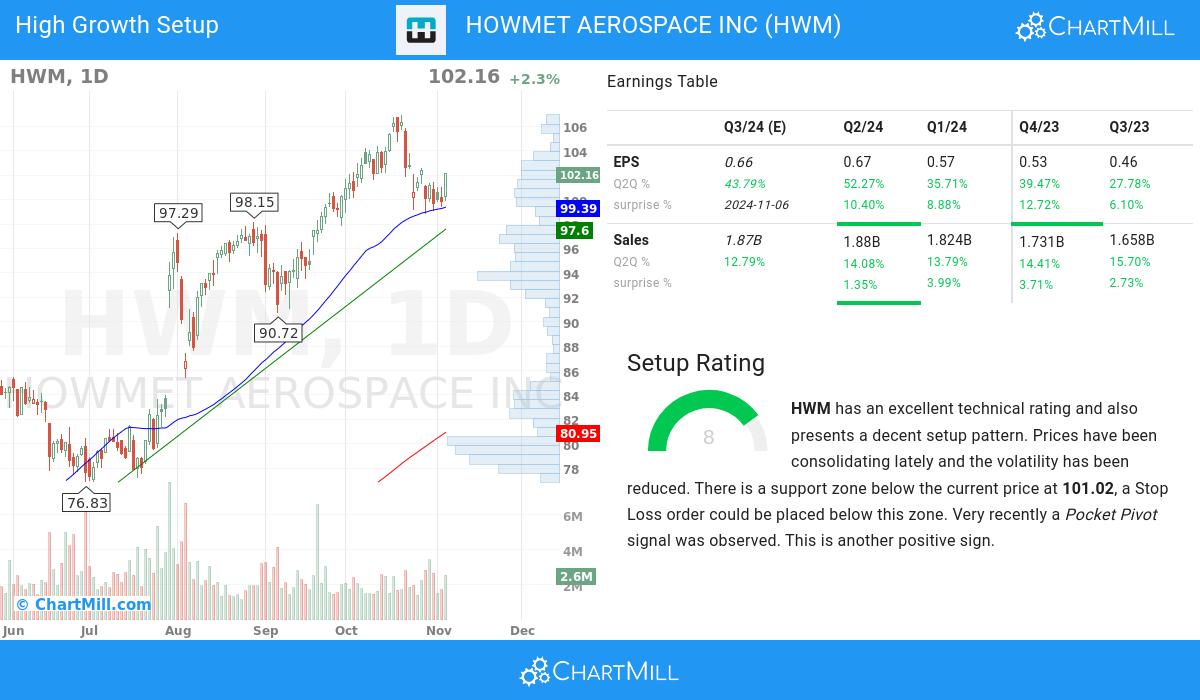

We've identified HOWMET AEROSPACE INC (NYSE:HWM) as a potential breakout candidate based on our stock screener's analysis. This breakout setup pattern suggests that after a strong uptrend, the stock is currently consolidating, potentially signaling a continuation of the trend. Keep an eye on NYSE:HWM for further developments.

In-Depth Technical Analysis of NYSE:HWM

ChartMill employs a sophisticated system to assign a Technical Rating to every stock in its analysis. This rating, which ranges from 0 to 10, is determined by carefully assessing multiple technical indicators and properties.

Overall HWM gets a technical rating of 8 out of 10. This is due to a consistent overall performance, although we see some doubts in the very recent evolution. In the medium time frame things are still looking good.

- The long term trend is positive and the short term trend is neutral. The long term trend gets the benefit of the doubt for now.

- Looking at the yearly performance, HWM did better than 93% of all other stocks. We also observe that the gains produced by HWM over the past year are nicely spread over this period.

- HWM is part of the Aerospace & Defense industry. There are 66 other stocks in this industry. HWM outperforms 84% of them.

- HWM is currently trading in the upper part of its 52 week range. The S&P500 Index however is currently trading near a new high, so HWM is lagging the market slightly.

For an up to date full technical analysis you can check the technical report of HWM

How do we evaluate the setup for NYSE:HWM?

Besides the Technical Rating, ChartMill assigns a Setup Rating to every stock to determine the degree of consolidation. This rating, ranging from 0 to 10, is updated daily and evaluates various short-term technical indicators. NYSE:HWM currently holds a 8 as its setup rating, suggesting a particular level of consolidation in the stock.

HWM has an excellent technical rating and also presents a decent setup pattern. We see reduced volatility while prices have been consolidating in the most recent period. There is a support zone below the current price at 101.02, a Stop Loss order could be placed below this zone. Another positive sign is the recent Pocket Pivot signal.

Why NYSE:HWM may be interesting for high growth investors.

- With a favorable trend in its quarter-to-quarter (Q2Q) earnings per share (EPS), HOWMET AEROSPACE INC highlights its ability to generate increasing profitability, showcasing a 52.27% growth.

- The recent financial report of HOWMET AEROSPACE INC demonstrates a 52.27% increase in quarterly earnings compared to the previous quarter. This growth indicates positive momentum in the company's financials and suggests a promising upward trend

- HOWMET AEROSPACE INC shows accelerating EPS growth: when comparing the current Q2Q growth of 52.27% to the previous year Q2Q growth of 25.71%, we see the growth rate improving.

- HOWMET AEROSPACE INC has experienced notable growth in its operating margin over the past year, reflecting improved operational performance. This growth suggests the company's ability to generate higher profits from its core business activities.

- With a favorable trend in its free cash flow (FCF) over the past year, HOWMET AEROSPACE INC demonstrates its ability to generate robust cash flows and maintain financial stability. This growth reflects the company's focus on efficient capital allocation and cash management.

- HOWMET AEROSPACE INC has achieved an impressive Return on Equity (ROE) of 21.77%, showcasing its ability to generate favorable returns for shareholders.

- Maintaining a Debt-to-Equity ratio of 0.67, HOWMET AEROSPACE INC demonstrates a conservative financial approach. This signifies the company's focus on minimizing debt burdens while preserving a solid equity position.

- The ownership composition of HOWMET AEROSPACE INC reflects a balanced investor ecosystem, with institutional shareholders owning 12.49%. This indicates a broader market participation and potential for increased trading liquidity.

- HOWMET AEROSPACE INC has a strong history of beating EPS estimates in the last 4 quarters, signaling its ability to consistently exceed market expectations. This indicates the company's strong financial performance and its potential for creating shareholder value.

- The Relative Strength (RS) of HOWMET AEROSPACE INC has been consistently solid, with a current 93.13 rating. This highlights the stock's ability to exhibit sustained price strength and signifies its competitive advantage. HOWMET AEROSPACE INC exhibits strong prospects for further price appreciation.

More high growth momentum breakout stocks can be found in our High Growth Momentum Breakout screen.

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

123.23

-0.7 (-0.56%)

Find more stocks in the Stock Screener

HWM Latest News and Analysis

6 days ago - ChartmillWondering what's happening in today's S&P500 pre-market session?

6 days ago - ChartmillWondering what's happening in today's S&P500 pre-market session?Let's have a look at what is happening on the US markets before the opening bell on Tuesday. Below you can find the top S&P500 gainers and losers in today's pre-market session.