Why the dividend investor may take a look at NYSE:HRL.

By Mill Chart

Last update: Oct 8, 2024

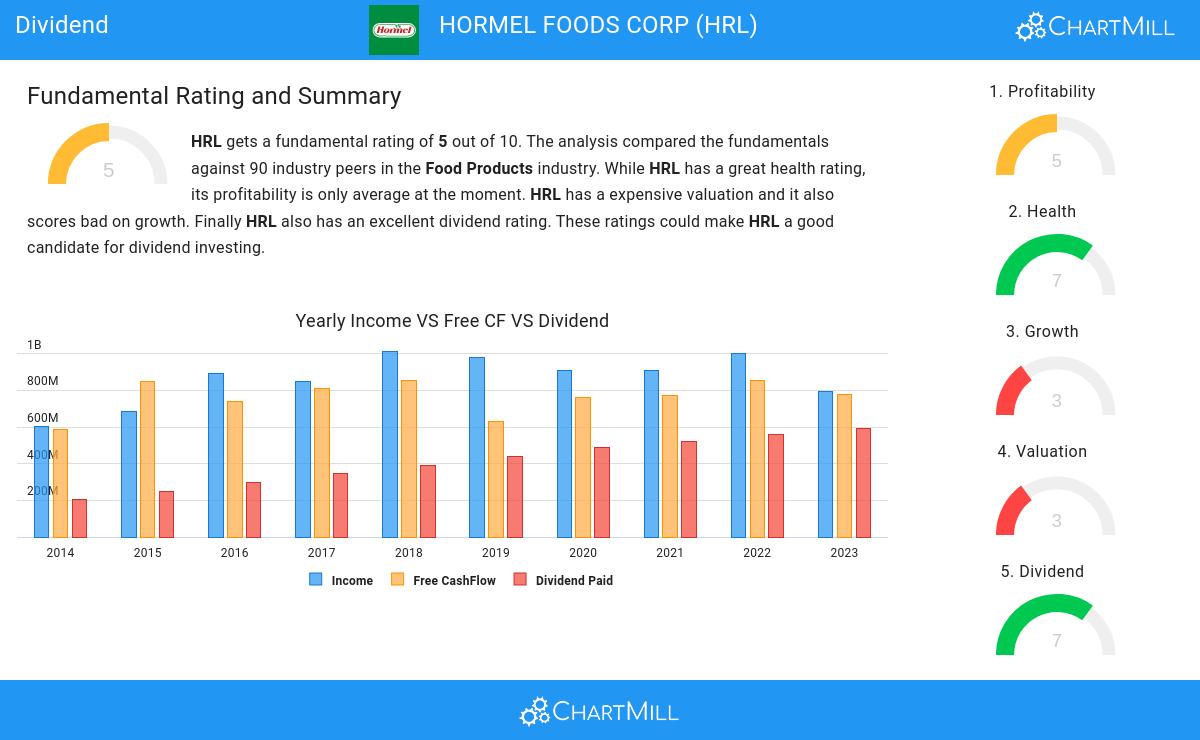

Our stock screening tool has identified HORMEL FOODS CORP (NYSE:HRL) as a strong dividend contender with robust fundamentals. NYSE:HRL exhibits commendable financial health and profitability, all while offering a sustainable dividend. Let's delve into each aspect below.

Dividend Insights: NYSE:HRL

ChartMill assigns a Dividend Rating to each stock, ranging from 0 to 10. This rating is calculated by analyzing various dividend elements, such as yield, historical performance, dividend growth, and sustainability. NYSE:HRL has been awarded a 7 for its dividend quality:

- Compared to an average industry Dividend Yield of 3.57, HRL pays a better dividend. On top of this HRL pays more dividend than 84.44% of the companies listed in the same industry.

- HRL's Dividend Yield is rather good when compared to the S&P500 average which is at 2.22.

- On average, the dividend of HRL grows each year by 8.23%, which is quite nice.

- HRL has paid a dividend for at least 10 years, which is a reliable track record.

- HRL has not decreased its dividend for at least 10 years, so it has a reliable track record of non decreasing dividend.

Assessing Health Metrics for NYSE:HRL

To gauge a stock's financial health, ChartMill utilizes a Health Rating on a scale of 0 to 10. This comprehensive evaluation encompasses liquidity and solvency, both in absolute terms and in comparison to industry peers. NYSE:HRL has earned a 7 out of 10:

- An Altman-Z score of 4.10 indicates that HRL is not in any danger for bankruptcy at the moment.

- HRL has a Altman-Z score of 4.10. This is amongst the best in the industry. HRL outperforms 81.11% of its industry peers.

- The Debt to FCF ratio of HRL is 3.17, which is a good value as it means it would take HRL, 3.17 years of fcf income to pay off all of its debts.

- HRL has a better Debt to FCF ratio (3.17) than 75.56% of its industry peers.

- A Debt/Equity ratio of 0.36 indicates that HRL is not too dependend on debt financing.

- HRL has a Current Ratio of 2.29. This indicates that HRL is financially healthy and has no problem in meeting its short term obligations.

- HRL has a better Current ratio (2.29) than 73.33% of its industry peers.

- HRL has a better Quick ratio (1.03) than 63.33% of its industry peers.

Evaluating Profitability: NYSE:HRL

ChartMill assigns a Profitability Rating to every stock. This score ranges from 0 to 10 and evaluates the different profitability ratios and margins, both absolutely, but also relative to the industry peers. NYSE:HRL scores a 5 out of 10:

- HRL has a better Return On Assets (5.95%) than 67.78% of its industry peers.

- HRL has a Return On Equity of 9.92%. This is in the better half of the industry: HRL outperforms 64.44% of its industry peers.

- With a decent Return On Invested Capital value of 6.84%, HRL is doing good in the industry, outperforming 68.89% of the companies in the same industry.

- HRL has a Profit Margin of 6.52%. This is in the better half of the industry: HRL outperforms 73.33% of its industry peers.

- HRL has a Operating Margin of 8.61%. This is in the better half of the industry: HRL outperforms 73.33% of its industry peers.

More Best Dividend stocks can be found in our Best Dividend screener.

Our latest full fundamental report of HRL contains the most current fundamental analsysis.

Disclaimer

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

NYSE:HRL (12/19/2025, 10:19:09 AM)

23.915

-0.09 (-0.35%)

Find more stocks in the Stock Screener

HRL Latest News and Analysis