Herbalife (NYSE:HLF) Posts Better-Than-Expected Sales In Q4, Stock Jumps 13.7%

Provided By StockStory

Last update: Feb 19, 2025

Health and wellness products company Herbalife (NYSE:HLF) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales were flat year on year at $1.21 billion. On the other hand, next quarter’s revenue guidance of $1.22 billion was less impressive, coming in 4.2% below analysts’ estimates. Its non-GAAP profit of $0.36 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Herbalife? Find out by accessing our full research report, it’s free.

Herbalife (HLF) Q4 CY2024 Highlights:

- Revenue: $1.21 billion vs analyst estimates of $1.20 billion (flat year on year, 0.6% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.14 (significant beat)

- Adjusted EBITDA: $150 million vs analyst estimates of $123.6 million (12.4% margin, 21.4% beat)

- Revenue Guidance for Q1 CY2025 is $1.22 billion at the midpoint, below analyst estimates of $1.27 billion

- EBITDA guidance for the upcoming financial year 2025 is $620 million at the midpoint, below analyst estimates of $631.3 million

- Operating Margin: 8.8%, up from 4.6% in the same quarter last year

- Free Cash Flow Margin: 3.6%, down from 5% in the same quarter last year

- Organic Revenue rose 2.7% year on year, in line with the same quarter last year

- Sales Volumes were flat year on year (-2% in the same quarter last year)

- Market Capitalization: $515 million

Company Overview

With the first products sold out of the trunk of the founder’s car, Herbalife (NYSE:HLF) today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.99 billion in revenue over the past 12 months, Herbalife carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

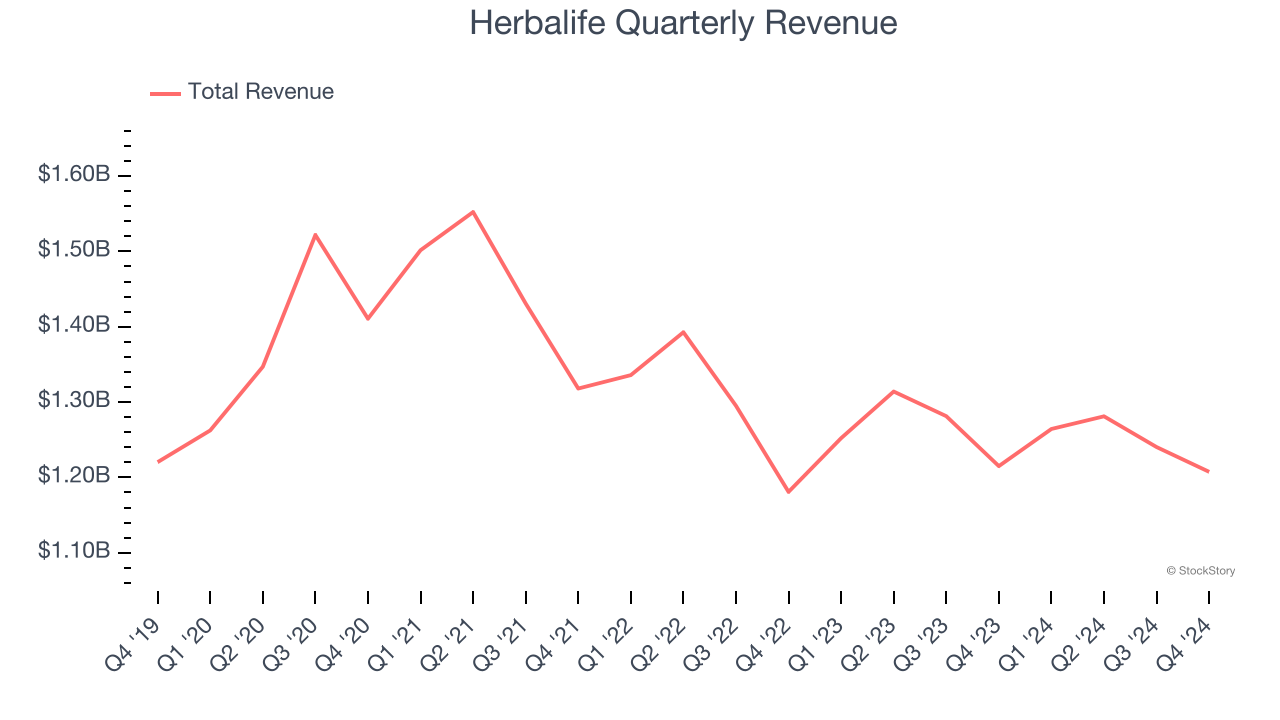

As you can see below, Herbalife’s demand was weak over the last three years. Its sales fell by 4.9% annually as consumers bought less of its products.

This quarter, Herbalife’s $1.21 billion of revenue was flat year on year but beat Wall Street’s estimates by 0.6%. Company management is currently guiding for a 3.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months. Although this projection indicates its newer products will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Volume Growth

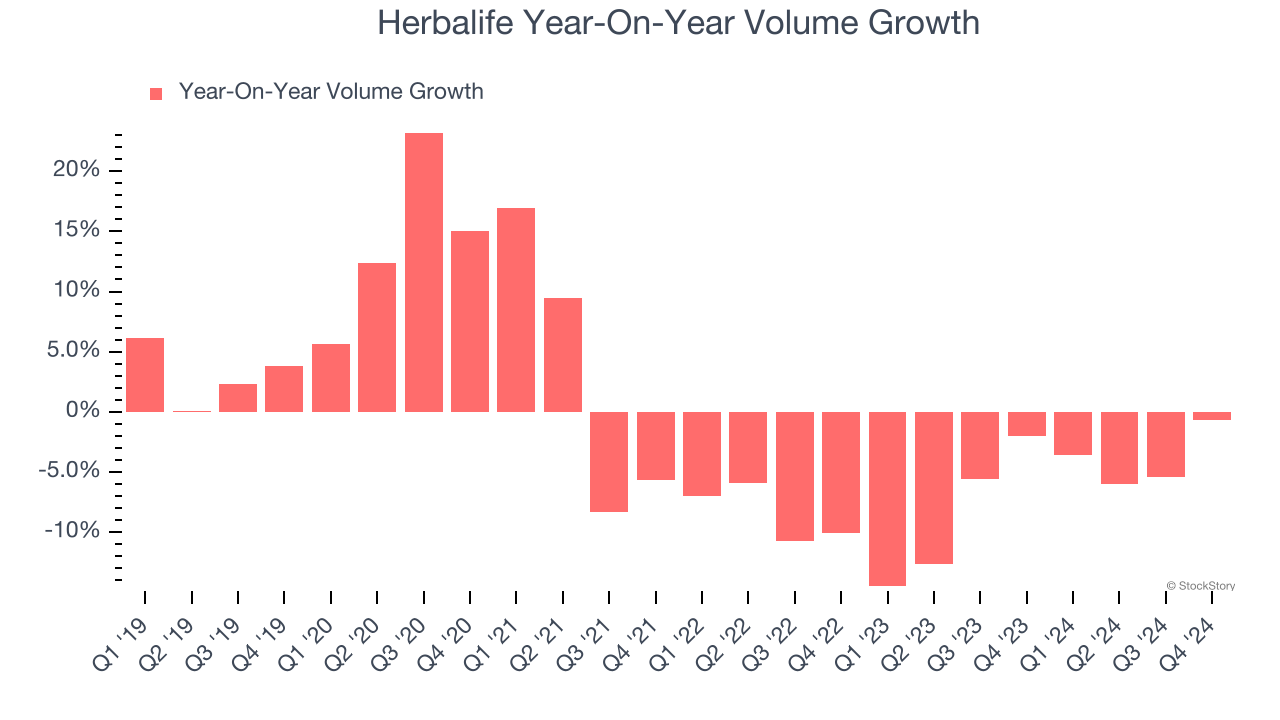

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Herbalife generated its growth (or lack thereof) from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Herbalife’s average quarterly sales volumes have shrunk by 6.3%. This isn’t ideal for a consumer staples company, where demand is typically stable.

In Herbalife’s Q4 2024, year on year sales volumes were flat. This result was a well-appreciated turnaround from its historical levels, showing the company is heading in the right direction.

Key Takeaways from Herbalife’s Q4 Results

We were impressed by how significantly Herbalife blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue guidance for next quarter missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter was mixed but it seems the market is overlooking the weaker guidance. The stock traded up 13.7% to $6.39 immediately after reporting.

Indeed, Herbalife had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

8.31

+0.29 (+3.62%)

Find more stocks in the Stock Screener

HLF Latest News and Analysis

a day ago - ChartmillMarket Monitor February 20th

a day ago - ChartmillMarket Monitor February 20thUS Markets Decline as Weak Earnings and Economic Concerns Weigh on Stocks

2 days ago - ChartmillWhat's going on in today's session

2 days ago - ChartmillWhat's going on in today's sessionIntrigued by the market activity one hour before the close of the markets on Thursday? Uncover the key winners and losers of today's session in our insightful analysis.

2 days ago - ChartmillTop movers in Thursday's session

2 days ago - ChartmillTop movers in Thursday's sessionLooking for insights into the US markets in the middle of the day on Thursday? Delve into the top gainers and losers of today's session and gain valuable market intelligence.

2 days ago - ChartmillLet's uncover which stocks are experiencing notable gaps during today's session.

2 days ago - ChartmillLet's uncover which stocks are experiencing notable gaps during today's session.Investors and traders are closely monitoring the gap up and gap down stocks in today's session on Thursday. Let's explore the market movements and identify the stocks with significant gaps.

2 days ago - ChartmillStay updated with the stocks that are on the move in today's pre-market session.

2 days ago - ChartmillStay updated with the stocks that are on the move in today's pre-market session.As the US market prepares to open on Thursday, let's get an early glimpse into the pre-market session and identify the stocks leading the pack in terms of gains and losses.

3 days ago - ChartmillWhich stocks are moving after the closing bell on Wednesday?

3 days ago - ChartmillWhich stocks are moving after the closing bell on Wednesday?As the regular session of the US market concludes on Wednesday, let's get an insight into the after-hours session and identify the stocks leading the pack in terms of gains and losses.