Why the high growth investor may take a look at NYSE:GOLD.

By Mill Chart

Last update: Sep 26, 2024

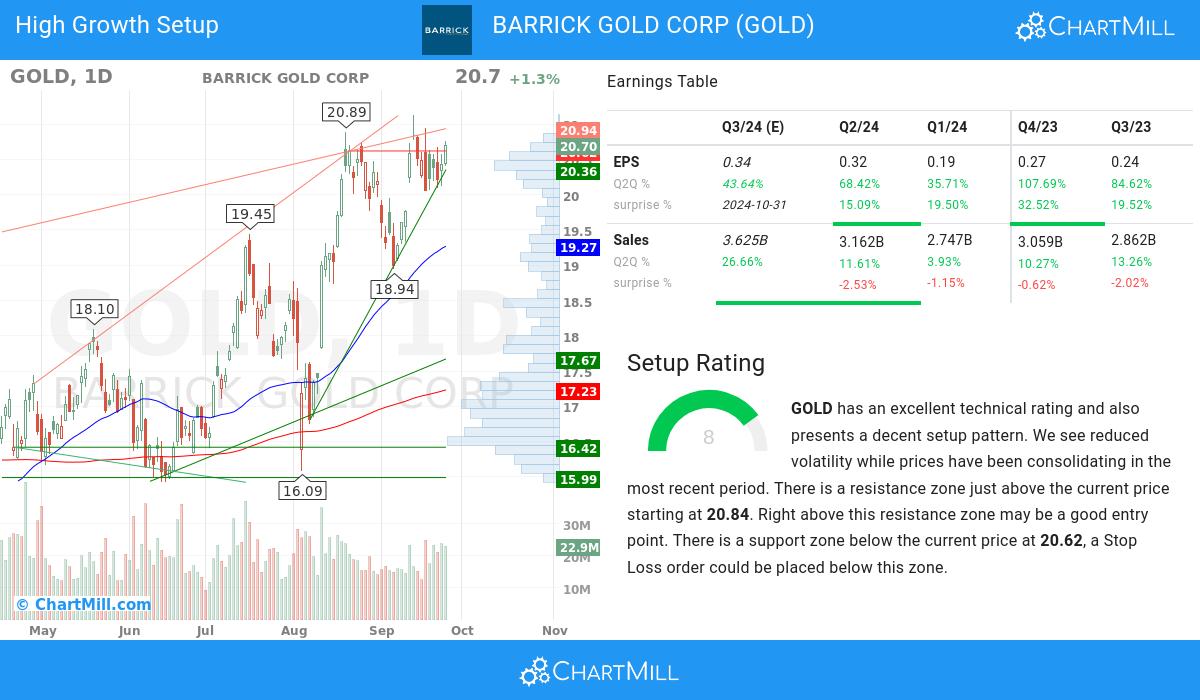

Our stock screener has spotted BARRICK GOLD CORP (NYSE:GOLD) as a possible breakout candidate. A technical breakout setup pattern occurs when the stock is consolidating after a nice uptrend. Whether the actual breakout occurs remains to be seen of course, but it may be interesting to keep an eye on NYSE:GOLD.

Zooming in on the technicals.

ChartMill assigns a Technical Rating to every stock. This score, ranging from 0 to 10, is updated daily and is determined by evaluating multiple technical indicators and properties.

Taking everything into account, GOLD scores 10 out of 10 in our technical rating. Both in the recent history as in the last year, GOLD has proven to be a steady performer, scoring decent points in every aspect analyzed.

- Both the short term and long term trends are positive. This is a very positive sign.

- Looking at the yearly performance, GOLD did better than 88% of all other stocks. We also observe that the gains produced by GOLD over the past year are nicely spread over this period.

- GOLD is one of the better performing stocks in the Metals & Mining industry, it outperforms 72% of 156 stocks in the same industry.

- GOLD is currently trading near its 52 week high, which is a good sign. The S&P500 Index however is also trading near new highs, which makes the performance in line with the market.

- In the last month GOLD has a been trading in the 18.94 - 21.13 range, which is quite wide. It is currently trading near the high of this range.

Our latest full technical report of GOLD contains the most current technical analsysis.

Why is NYSE:GOLD a setup?

Besides the Technical Rating, ChartMill also assign a Setup Rating to every stock. This setup score also ranges from 0 to 10 and determines to which extend the stock is consolidating. This is achieved by evaluating multiple short term technical indicators. NYSE:GOLD currently has a 8 as setup rating:

GOLD has an excellent technical rating and also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is a resistance zone just above the current price starting at 20.84. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 20.62, a Stop Loss order could be placed below this zone.

What matters for high growth investors.

- The earnings per share (EPS) of BARRICK GOLD CORP have shown positive growth on a quarter-to-quarter (Q2Q) basis, with a 68.42% increase. This reflects the company's ability to improve its profitability over time.

- The average next Quarter EPS Estimate for BARRICK GOLD CORP has experienced a 20.29% change in the last 3 months, reflecting evolving expectations by analysts regarding the company's EPS performance.

- In the most recent financial report, BARRICK GOLD CORP reported a 68.42% increase in quarterly earnings compared to the previous quarter. This notable growth indicates positive momentum in the company's financials, suggesting an upward trend

- The earnings per share (EPS) growth of BARRICK GOLD CORP are accelerating: the current Q2Q growth of 68.42% is above the previous year Q2Q growth of -20.83%. Earnings momentum and acceleration are key for high growth systems.

- BARRICK GOLD CORP has shown positive growth in its operating margin over the past year, indicating improved operational efficiency. This growth highlights the company's ability to effectively manage costs and maximize profitability.

- BARRICK GOLD CORP maintains a healthy Debt-to-Equity ratio of 0.2. This indicates the company's conservative capital structure and signifies its ability to effectively manage debt obligations while maintaining a strong equity position.

- With institutional shareholders at 55.21%, BARRICK GOLD CORP demonstrates a healthy ownership distribution. This reflects a mix of institutional and individual investors, creating a market environment that may foster increased trading activity and price discovery.

- With a track record of beating EPS estimates in the last 4 quarters, BARRICK GOLD CORP showcases its consistent ability to deliver earnings surprises. This reflects the company's strong execution and its competitive position in the market.

- BARRICK GOLD CORP has maintained a healthy Relative Strength (RS) over the analyzed period, with a current 88.45 rating. This demonstrates the stock's ability to outperform its peers and indicates its competitive positioning. BARRICK GOLD CORP is well-positioned for potential price growth opportunities.

More ideas for high growth momentum breakouts can be found on ChartMill in our High Growth Momentum Breakout screen.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.