Why NASDAQ:GMAB Is a Standout High-Growth Stock in a Consolidation Phase.

By Mill Chart

Last update: Nov 29, 2024

Groth investors are looking for stocks showing high revenue and EPS growth. We will have a look here to see if GENMAB A/S -SP ADR (NASDAQ:GMAB) is suited for growth investing, while it is forming a base and may be ready to breakout. Investors should of course do their own research, but we spotted GENMAB A/S -SP ADR showing up in our growth with base formation screen, so it may be worth spending some more time on it.

What does the Growth looks like for NASDAQ:GMAB

ChartMill assigns a Growth Rating to every stock. This score ranges from 0 to 10 and evaluates the different growth aspects like EPS and Revenue, both in the past as in the future. NASDAQ:GMAB scores a 8 out of 10:

- GMAB shows a strong growth in Earnings Per Share. In the last year, the EPS has been growing by 9.57%, which is quite good.

- Measured over the past years, GMAB shows a very strong growth in Earnings Per Share. The EPS has been growing by 22.70% on average per year.

- The Revenue has grown by 13.57% in the past year. This is quite good.

- GMAB shows a strong growth in Revenue. Measured over the last years, the Revenue has been growing by 40.35% yearly.

- GMAB is expected to show a strong growth in Earnings Per Share. In the coming years, the EPS will grow by 23.65% yearly.

- The Revenue is expected to grow by 17.51% on average over the next years. This is quite good.

Analyzing Health Metrics

ChartMill utilizes a Health Rating to assess stocks, scoring them on a scale of 0 to 10. This rating takes into account a variety of liquidity and solvency ratios, both in absolute terms and in comparison to industry peers. NASDAQ:GMAB has earned a 7 out of 10:

- An Altman-Z score of 9.66 indicates that GMAB is not in any danger for bankruptcy at the moment.

- The Altman-Z score of GMAB (9.66) is better than 84.83% of its industry peers.

- GMAB has a debt to FCF ratio of 0.16. This is a very positive value and a sign of high solvency as it would only need 0.16 years to pay back of all of its debts.

- GMAB has a better Debt to FCF ratio (0.16) than 97.35% of its industry peers.

- A Debt/Equity ratio of 0.03 indicates that GMAB is not too dependend on debt financing.

- GMAB has a Current Ratio of 5.03. This indicates that GMAB is financially healthy and has no problem in meeting its short term obligations.

- GMAB has a Quick Ratio of 5.02. This indicates that GMAB is financially healthy and has no problem in meeting its short term obligations.

Profitability Examination for NASDAQ:GMAB

ChartMill utilizes a Profitability Rating to assess stocks, scoring them on a scale of 0 to 10. This rating takes into account a variety of profitability ratios and margins, both in absolute terms and in comparison to industry peers. NASDAQ:GMAB has earned a 8 out of 10:

- Looking at the Return On Assets, with a value of 14.25%, GMAB belongs to the top of the industry, outperforming 97.88% of the companies in the same industry.

- GMAB has a Return On Equity of 17.77%. This is amongst the best in the industry. GMAB outperforms 97.18% of its industry peers.

- With an excellent Return On Invested Capital value of 13.65%, GMAB belongs to the best of the industry, outperforming 96.65% of the companies in the same industry.

- The 3 year average ROIC (13.32%) for GMAB is below the current ROIC(13.65%), indicating increased profibility in the last year.

- GMAB has a better Profit Margin (29.01%) than 98.41% of its industry peers.

- Looking at the Operating Margin, with a value of 31.65%, GMAB belongs to the top of the industry, outperforming 98.94% of the companies in the same industry.

- The Gross Margin of GMAB (96.83%) is better than 96.83% of its industry peers.

Why is NASDAQ:GMAB a setup?

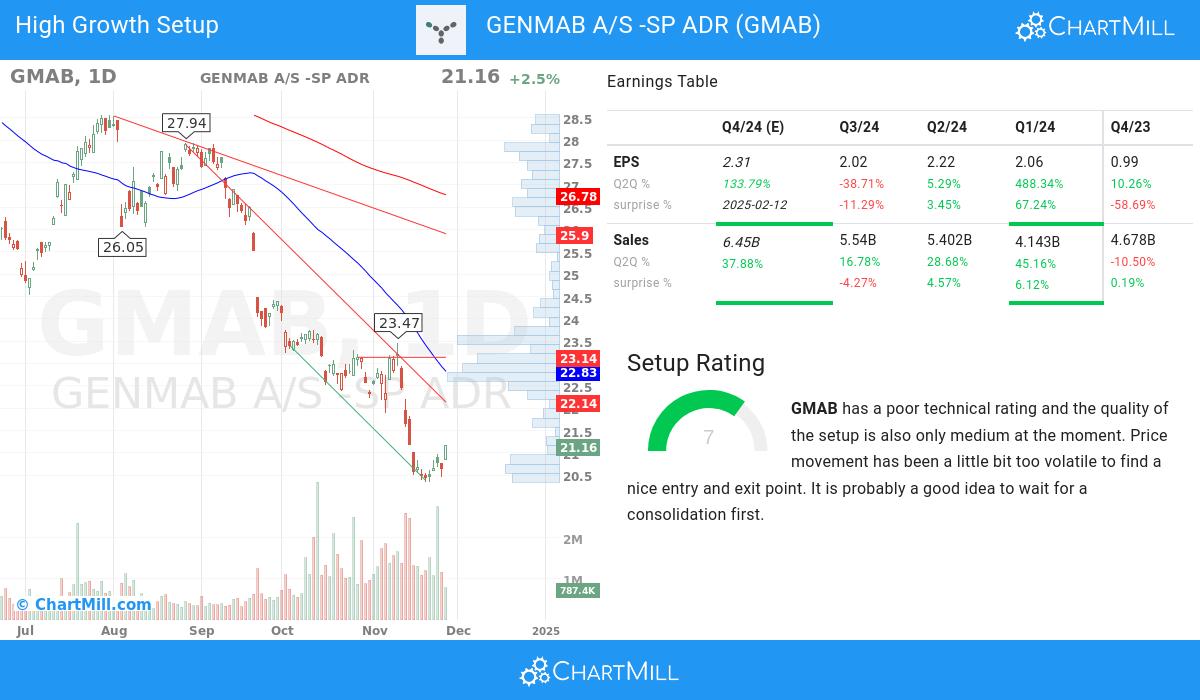

In addition to the Technical Rating, ChartMill provides a Setup Rating for each stock. This rating, ranging from 0 to 10, assesses the extent of consolidation in the stock based on multiple short-term technical indicators. Currently, NASDAQ:GMAB has a 7 as its setup rating:

GMAB has a poor technical rating and the quality of the setup is also only medium at the moment. Price movement has been a little bit too volatile to find a nice entry and exit point. It is probably a good idea to wait for a consolidation first.

Our Strong Growth screener lists more Strong Growth stocks and is updated daily.

For an up to date full fundamental analysis you can check the fundamental report of GMAB

Check the latest full technical report of GMAB for a complete technical analysis.

Disclaimer

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

20.79

+0.16 (+0.78%)

Find more stocks in the Stock Screener

GMAB Latest News and Analysis

18 hours ago - ChartmillGENMAB A/S -SP ADR (NASDAQ:GMAB): a strong growth stock preparing for the next leg up?.

18 hours ago - ChartmillGENMAB A/S -SP ADR (NASDAQ:GMAB): a strong growth stock preparing for the next leg up?.Based on a technical and fundamental analysis of NASDAQ:GMAB we can say: GENMAB A/S -SP ADR (NASDAQ:GMAB), a strong growth stock, setting up for a breakout.

7 days ago - ChartmillWhy Peter Lynch may take an interest in GENMAB A/S -SP ADR (NASDAQ:GMAB)

7 days ago - ChartmillWhy Peter Lynch may take an interest in GENMAB A/S -SP ADR (NASDAQ:GMAB)Peter Lynch, one of the most successful investors of all time, focused on growth stocks with strong fundamentals and a business model that’s easy to understand. Let’s analyze whether GENMAB A/S -SP ADR (NASDAQ:GMAB) fits his legendary investment approach.

11 days ago - ChartmillDespite its growth, GENMAB A/S -SP ADR (NASDAQ:GMAB) remains within the realm of affordability.

11 days ago - ChartmillDespite its growth, GENMAB A/S -SP ADR (NASDAQ:GMAB) remains within the realm of affordability.GENMAB A/S -SP ADR was identified as a growth stock that isn't overvalued. NASDAQ:GMAB is excelling in various growth indicators while maintaining a solid financial footing.