Is NASDAQ:GCT suited for high growth investing?

By Mill Chart

Last update: Nov 27, 2024

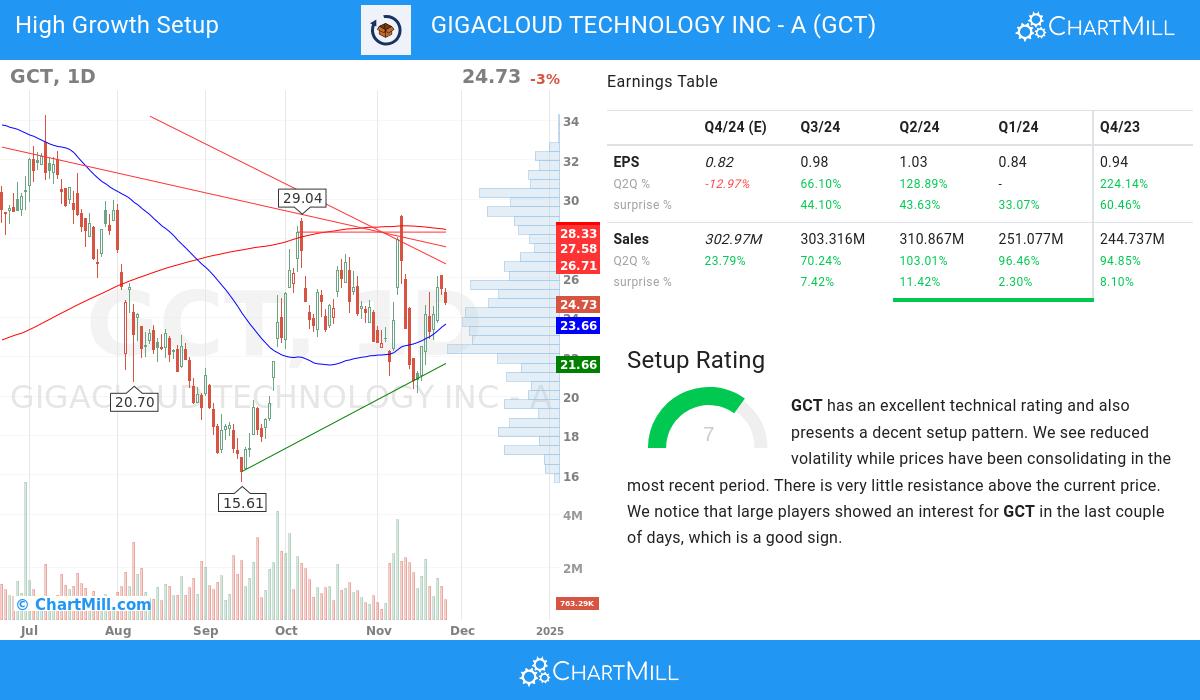

We've identified GIGACLOUD TECHNOLOGY INC - A (NASDAQ:GCT) as a potential breakout candidate based on our stock screener's analysis. This breakout setup pattern suggests that after a strong uptrend, the stock is currently consolidating, potentially signaling a continuation of the trend. Keep an eye on NASDAQ:GCT for further developments.

In-Depth Technical Analysis of NASDAQ:GCT

ChartMill assigns a Technical Rating to every stock. This score ranges from 0 to 10 and is updated daily. The score is determined by evaluating multiple technical indicators and properties.

Overall GCT gets a technical rating of 7 out of 10. Although GCT has been one of the better performers in the overall market, we have a mixed picture in the medium term time frame. But recently some decent action can be observed again.

- The short term trend is positive, while the long term trend is neutral. So this is evolving in the right direction.

- GCT is one of the better performing stocks in the Distributors industry, it outperforms 85% of 15 stocks in the same industry.

- When comparing the yearly performance of all stocks, we notice that GCT is one of the better performing stocks in the market, outperforming 94% of all stocks. However, this overall performance is mostly based on the strong move around 10 months ago.

- GCT is currently trading in the middle of its 52 week range. The S&P500 Index however is currently trading near new highs, so GCT is lagging the market.

- In the last month GCT has a been trading in the 20.16 - 29.20 range, which is quite wide. It is currently trading in the middle of this range, so some resistance may be found above.

Check the latest full technical report of GCT for a complete technical analysis.

Looking at the Setup

Next to the Technical Rating, the Setup Rating of a stock determines to which extend the stock is consolidating. This score also ranges from 0 to 10 and is updated daily. The setup score evaluates various short term technical indicators. For NASDAQ:GCT this score is currently 7:

Besides having an excellent technical rating, GCT also presents a decent setup pattern. We see reduced volatility while prices have been consolidating in the most recent period. There is very little resistance above the current price. We notice that large players showed an interest for GCT in the last couple of days, which is a good sign.

Some of the high growth metrics of NASDAQ:GCT highlighted

- The quarterly earnings of GIGACLOUD TECHNOLOGY INC - A have shown a 66.1% increase compared to the previous quarter, as revealed in the recent financial report. This growth signifies positive momentum in the company's financials, pointing towards a promising upward trend

- GIGACLOUD TECHNOLOGY INC - A has achieved significant quarter-to-quarter (Q2Q) revenue growth of 70.24%, signaling its ability to capture market opportunities and drive top-line expansion. This growth underscores the company's effective execution and its potential for continued success.

- GIGACLOUD TECHNOLOGY INC - A has experienced 92.98% growth in EPS over a 3-year period, demonstrating its ability to generate sustained and positive earnings momentum.

- GIGACLOUD TECHNOLOGY INC - A has achieved significant 1-year revenue growth of 89.85%, signaling its ability to capture market opportunities and drive top-line expansion. This growth indicates the company's effective execution and its potential for continued success.

- The quarterly earnings of GIGACLOUD TECHNOLOGY INC - A have shown a 66.1% increase compared to the previous quarter, as revealed in the recent financial report. This growth signifies positive momentum in the company's financials, pointing towards a promising upward trend

- The free cash flow (FCF) of GIGACLOUD TECHNOLOGY INC - A has seen steady growth over the past year, indicating enhanced cash flow generation and financial health. This trend underscores the company's effective capital management and its ability to generate sustainable cash flows.

- GIGACLOUD TECHNOLOGY INC - A has a healthy Return on Equity(ROE) of 32.57%. This demonstrates the company's efficient utilization of capital and indicates its commitment to driving profitability.

- GIGACLOUD TECHNOLOGY INC - A maintains a healthy Debt-to-Equity ratio of 0.0. This indicates the company's conservative capital structure and signifies its ability to effectively manage debt obligations while maintaining a strong equity position.

- GIGACLOUD TECHNOLOGY INC - A has consistently exceeded EPS estimates in the last 4 quarters, demonstrating its ability to outperform market expectations. This trend highlights the company's strong financial performance and its potential for future growth.

- GIGACLOUD TECHNOLOGY INC - A has exhibited strong Relative Strength(RS) in recent periods, with a current 94.87 rating. This indicates the stock's ability to outperform the broader market and reflects its competitive position. GIGACLOUD TECHNOLOGY INC - A shows promising potential for continued price momentum.

More high growth momentum breakout stocks can be found in our High Growth Momentum Breakout screen.

Disclaimer

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

13.42

+0.4 (+3.07%)

Find more stocks in the Stock Screener

GCT Latest News and Analysis

20 days ago - ChartmillWhy GIGACLOUD TECHNOLOGY INC - A (NASDAQ:GCT) should be investigated by quality investors.

20 days ago - ChartmillWhy GIGACLOUD TECHNOLOGY INC - A (NASDAQ:GCT) should be investigated by quality investors.A fundamental analysis of (NASDAQ:GCT): Is GIGACLOUD TECHNOLOGY INC - A (NASDAQ:GCT) a Strong Candidate for Quality Investing?