Does FLUOR CORP (NYSE:FLR) match Peter Lynch’s “Invest in What You Know” philosophy?

By Mill Chart

Last update: Mar 26, 2025

Peter Lynch, one of the most successful investors of all time, focused on growth stocks with strong fundamentals and a business model that’s easy to understand. Let’s analyze whether FLUOR CORP (NYSE:FLR) fits his legendary investment approach.

Evaluating FLUOR CORP (NYSE:FLR) using Peter Lynch’s legendary strategy

- In terms of Return on Equity(ROE), FLR is performing well, achieving a 54.32% ratio. This highlights the company's effective allocation of shareholder investments and signifies its commitment to maximizing returns.

- With a Debt/Equity ratio of 0.28, FLR maintains a solid financial position with controlled leverage.

- The EPS of FLR has shown consistent growth over a 5-year period, indicating the company's ability to generate increasing earnings over time.

- With a PEG ratio of 0.61, FLR is valued very reasonably for the growth it experiences.

- A Current Ratio of 1.69 indicates that FLR has a comfortable liquidity buffer.

What is the full fundamental picture of FLR telling us.

ChartMill employs a sophisticated system to assign a Fundamental Rating to every stock in its analysis. This rating, which ranges from 0 to 10, is determined by carefully assessing multiple fundamental indicators and properties.

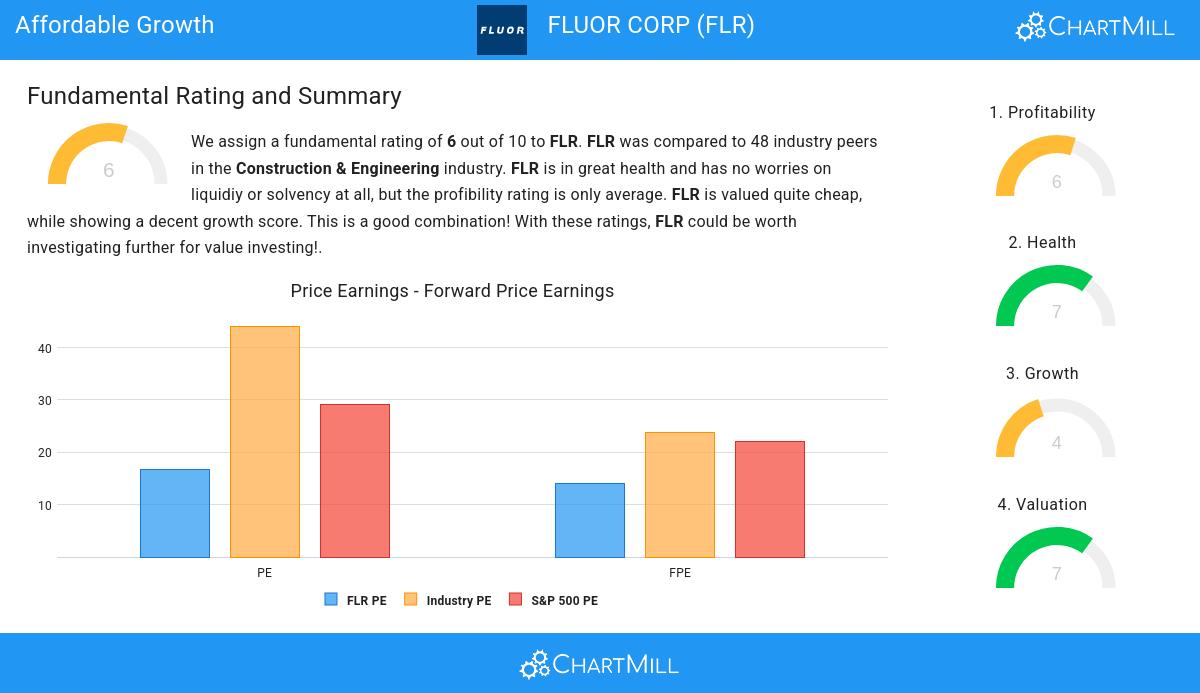

We assign a fundamental rating of 6 out of 10 to FLR. FLR was compared to 48 industry peers in the Construction & Engineering industry. While FLR has a great health rating, its profitability is only average at the moment. FLR scores decently on growth, while it is valued quite cheap. This could make an interesting combination. These ratings would make FLR suitable for value investing!

For an up to date full fundamental analysis you can check the fundamental report of FLR

More Affordable Growth stocks can be found in our Peter Lynch screener.

Disclaimer

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.