A technical analysis of ELECTRONIC ARTS INC.

By Mill Chart

Last update: Aug 6, 2024

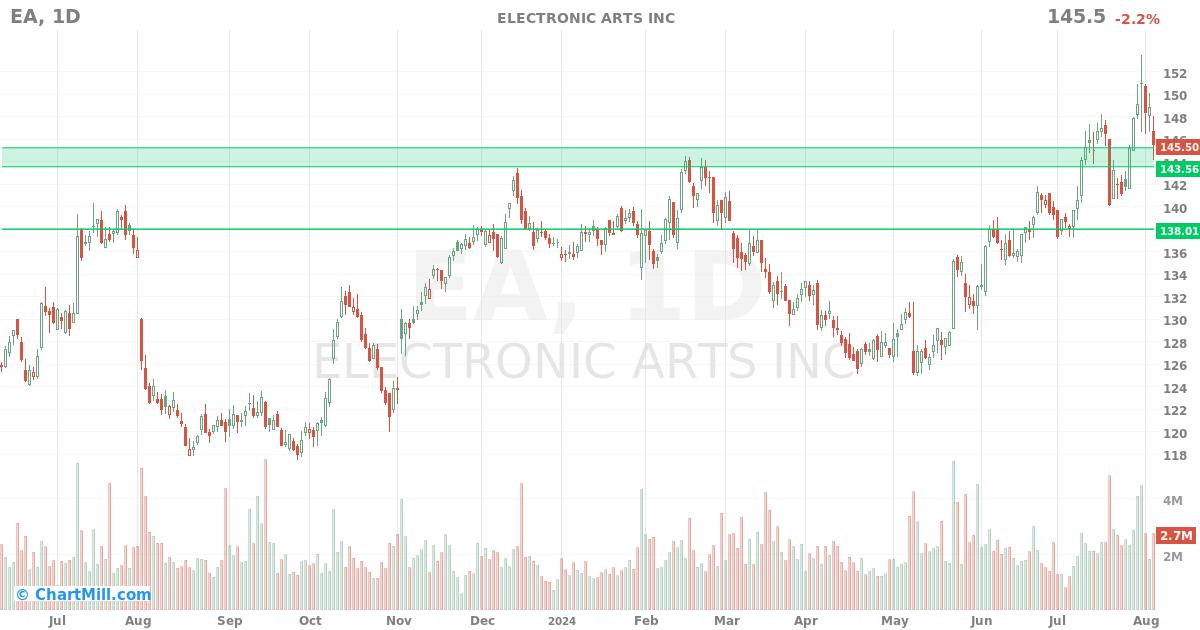

A possible breakout setup was detected on ELECTRONIC ARTS INC (NASDAQ:EA) by our stockscreener. A breakout pattern is formed when a stock consolidates after a strong rise up. We note that this pattern is detected purely based on technical analysis and whether the breakout actually materializes remains to be seen. It could be interesting to keep an eye on NASDAQ:EA.

Insights from Technical Analysis

As part of its analysis, ChartMill provides a comprehensive Technical Rating for each stock. This rating, ranging from 0 to 10, is updated on a daily basis and is based on the evaluation of various technical indicators and properties.

Taking everything into account, EA scores 10 out of 10 in our technical rating. This is due to a consistent performance in both the short and longer term time frames. Also compared to the overall market, EA is showing a nice and steady performance.

- The long and short term trends are both positive. This is looking good!

- Looking at the yearly performance, EA did better than 88% of all other stocks.

- EA is one of the better performing stocks in the Entertainment industry, it outperforms 86% of 73 stocks in the same industry.

- EA is currently trading in the upper part of its 52 week range. The market is still in the middle of its 52 week range, so EA slightly outperforms the market at the moment.

- In the last month EA has a been trading in the 138.82 - 153.50 range, which is quite wide. It is currently trading in the middle of this range where prices have been consolidating recently, this may present a good entry opportunity, but some resistance may be present above.

Check the latest full technical report of EA for a complete technical analysis.

Why is NASDAQ:EA a setup?

Besides the Technical Rating, ChartMill also assign a Setup Rating to every stock. This setup score also ranges from 0 to 10 and determines to which extend the stock is consolidating. This is achieved by evaluating multiple short term technical indicators. NASDAQ:EA currently has a 7 as setup rating:

Besides having an excellent technical rating, EA also presents a decent setup pattern. Prices have been consolidating lately. A pullback is taking place, which may present a nice opportunity for an entry. There is very little resistance above the current price. There is a support zone below the current price at 145.25, a Stop Loss order could be placed below this zone.

How can NASDAQ:EA be traded?

For a potential trade one would typically wait until the stock breaks out of the consolidation zone to enter the stock and it could be sold again for a loss when it would fall back below the zone.

This article should in no way be interpreted as trading advice. You should always make your own analysis and trade or not trade based on your own observations and style. The article is based purely on some technical observations.

More breakout setups can be found in our Breakout screener.

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.