Why NYSE:DVN qualifies as a good dividend investing stock.

By Mill Chart

Last update: Oct 2, 2024

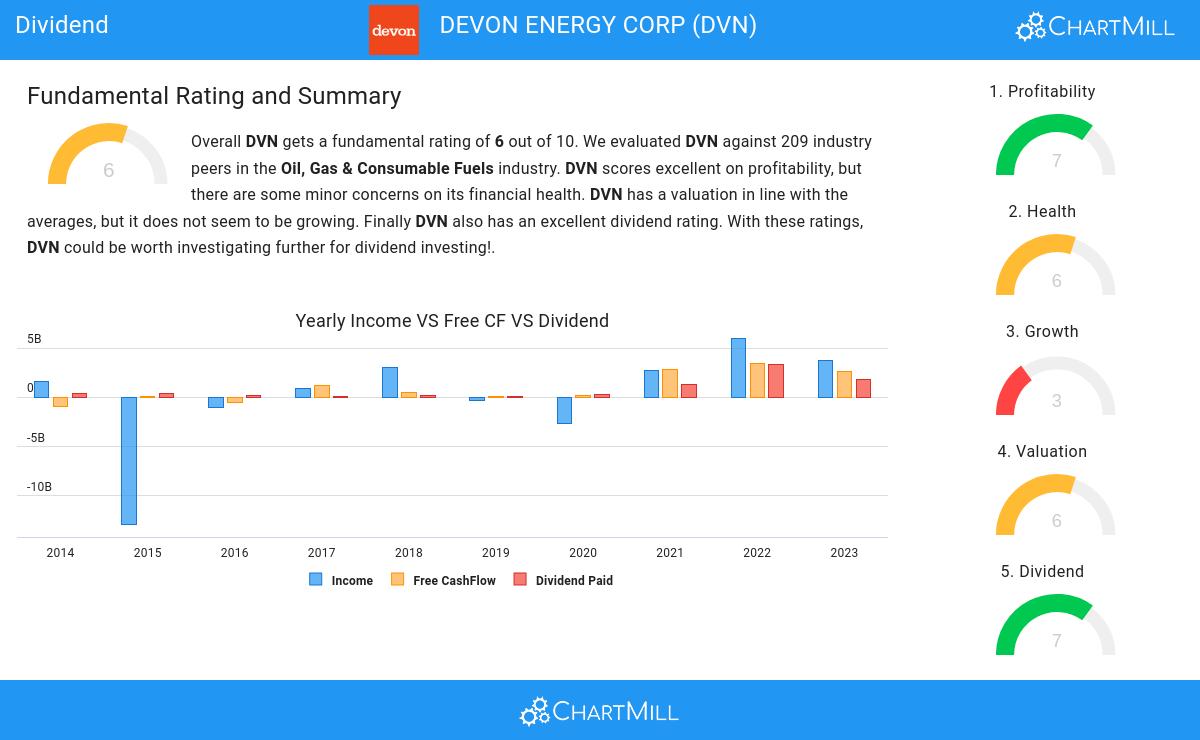

Our stock screener has spotted DEVON ENERGY CORP (NYSE:DVN) as a good dividend stock with solid fundamentals. NYSE:DVN shows decent health and profitability. At the same time it gives a good and sustainable dividend. We'll dive into each aspect below.

Dividend Analysis for NYSE:DVN

To gauge a stock's dividend quality, ChartMill utilizes a Dividend Rating ranging from 0 to 10. This comprehensive assessment considers various dividend aspects, including yield, history, growth, and sustainability. NYSE:DVN has achieved a 7 out of 10:

- With a Yearly Dividend Yield of 4.70%, DVN is a good candidate for dividend investing.

- DVN's Dividend Yield is a higher than the industry average which is at 6.57.

- Compared to an average S&P500 Dividend Yield of 2.20, DVN pays a better dividend.

- On average, the dividend of DVN grows each year by 56.62%, which is quite nice.

- DVN has paid a dividend for at least 10 years, which is a reliable track record.

- DVN pays out 37.75% of its income as dividend. This is a sustainable payout ratio.

Health Analysis for NYSE:DVN

ChartMill employs its own Health Rating for stock assessment. This rating, ranging from 0 to 10, is calculated by examining various liquidity and solvency ratios. In the case of NYSE:DVN, the assigned 6 reflects its health status:

- With a decent Altman-Z score value of 2.83, DVN is doing good in the industry, outperforming 72.25% of the companies in the same industry.

- The Debt to FCF ratio of DVN is 2.18, which is a good value as it means it would take DVN, 2.18 years of fcf income to pay off all of its debts.

- The Debt to FCF ratio of DVN (2.18) is better than 76.08% of its industry peers.

- DVN has a Debt/Equity ratio of 0.47. This is a healthy value indicating a solid balance between debt and equity.

Evaluating Profitability: NYSE:DVN

ChartMill employs its own Profitability Rating system for stock evaluation. This score, ranging from 0 to 10, is derived from an analysis of diverse profitability metrics and margins. In the case of NYSE:DVN, the assigned 7 is noteworthy for profitability:

- With an excellent Return On Assets value of 13.92%, DVN belongs to the best of the industry, outperforming 84.21% of the companies in the same industry.

- DVN has a Return On Equity of 27.90%. This is amongst the best in the industry. DVN outperforms 84.21% of its industry peers.

- DVN has a Return On Invested Capital of 16.91%. This is amongst the best in the industry. DVN outperforms 86.12% of its industry peers.

- The last Return On Invested Capital (16.91%) for DVN is well below the 3 year average (21.19%), which needs to be investigated, but indicates that DVN had better years and this may not be a problem.

- With a decent Profit Margin value of 22.60%, DVN is doing good in the industry, outperforming 70.33% of the companies in the same industry.

- DVN has a Operating Margin of 30.31%. This is in the better half of the industry: DVN outperforms 61.72% of its industry peers.

- In the last couple of years the Operating Margin of DVN has grown nicely.

Our Best Dividend screener lists more Best Dividend stocks and is updated daily.

Check the latest full fundamental report of DVN for a complete fundamental analysis.

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

31.47

+0.39 (+1.25%)

Find more stocks in the Stock Screener

DVN Latest News and Analysis

3 days ago - ChartmillExploring the top movers within the S&P500 index during today's session.

3 days ago - ChartmillExploring the top movers within the S&P500 index during today's session.Stay updated with the movements of the S&P500 index in the middle of the day on Tuesday. Discover which stocks are leading as top gainers and losers in today's session.

3 days ago - ChartmillWhich S&P500 stocks are gapping on Tuesday?

3 days ago - ChartmillWhich S&P500 stocks are gapping on Tuesday?Curious about the market action on Tuesday? Dive into the US markets to explore the gap up and gap down stocks in the S&P500 index during today's session.

3 days ago - ChartmillTop S&P500 movers in Tuesday's pre-market session

3 days ago - ChartmillTop S&P500 movers in Tuesday's pre-market sessionCurious about the S&P500 stocks that are showing activity before the opening bell on Tuesday?

7 days ago - ChartmillStay informed with the top movers within the S&P500 index on Thursday.

7 days ago - ChartmillStay informed with the top movers within the S&P500 index on Thursday.Stay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Thursday.

8 days ago - ChartmillWhat's going on in today's session: S&P500 movers

8 days ago - ChartmillWhat's going on in today's session: S&P500 moversStay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Thursday.

8 days ago - ChartmillStay informed with the top movers within the S&P500 index on Wednesday.

8 days ago - ChartmillStay informed with the top movers within the S&P500 index on Wednesday.Let's delve into the developments on the US markets one hour before the close of the markets on Wednesday. Below, you'll find the top gainers and losers within the S&P500 index during today's session.

9 days ago - ChartmillDiscover which S&P500 stocks are making waves on Wednesday.

9 days ago - ChartmillDiscover which S&P500 stocks are making waves on Wednesday.Let's delve into the developments on the US markets in the middle of the day on Wednesday. Below, you'll find the top gainers and losers within the S&P500 index during today's session.

14 days ago - ChartmillTop S&P500 movers in Thursday's session

14 days ago - ChartmillTop S&P500 movers in Thursday's sessionLet's have a look at what is happening on the US markets one hour before the close of the markets on Thursday. Below you can find the top S&P500 gainers and losers in today's session.

15 days ago - ChartmillGapping S&P500 stocks in Thursday's session

15 days ago - ChartmillGapping S&P500 stocks in Thursday's sessionLet's take a look at the S&P500 stocks that are experiencing notable price gaps in today's session on Thursday. Discover the gap up and gap down stocks in the S&P500 index.