Dine Brands (DIN): Buy, Sell, or Hold Post Q3 Earnings?

Provided By StockStory

Last update: Feb 4, 2025

Since August 2024, Dine Brands has been in a holding pattern, posting a small loss of 4.3% while floating around $30.23. The stock also fell short of the S&P 500’s 15.2% gain during that period.

Is there a buying opportunity in Dine Brands, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We don't have much confidence in Dine Brands. Here are three reasons why you should be careful with DIN and a stock we'd rather own.

Why Is Dine Brands Not Exciting?

Operating a franchise model, Dine Brands (NYSE:DIN) is a casual restaurant chain that owns the Applebee’s and IHOP banners.

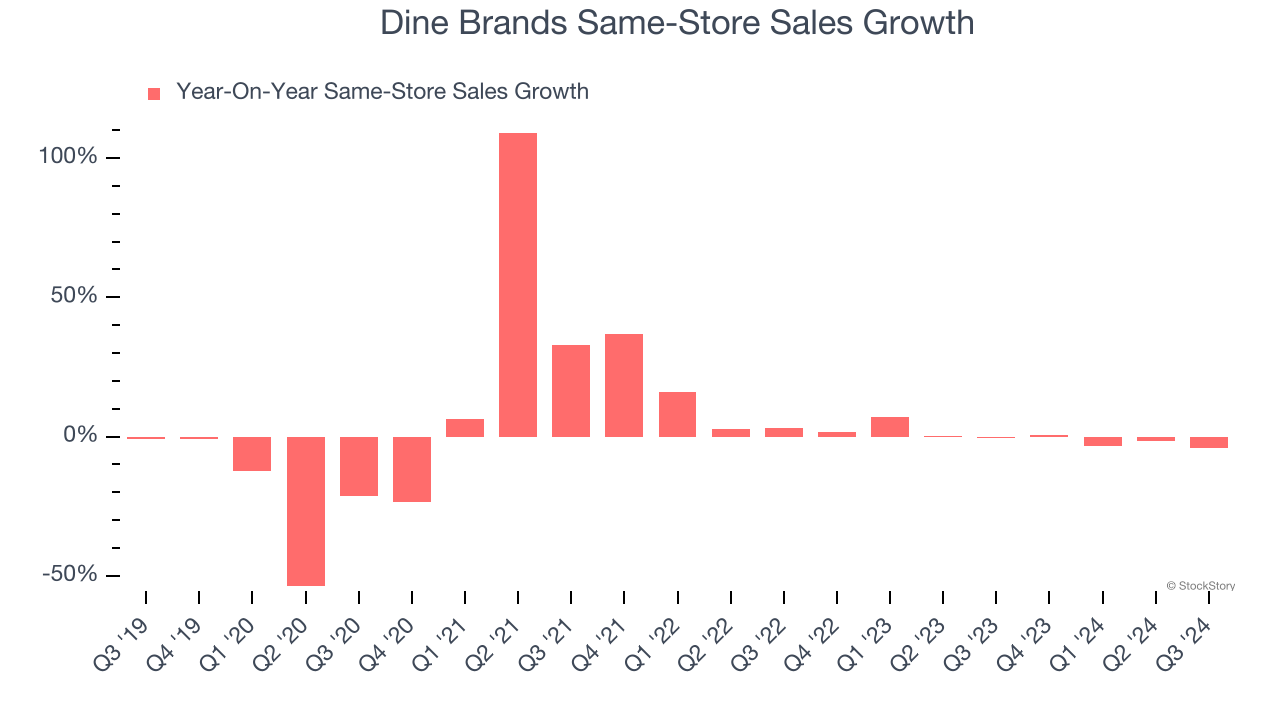

1. Flat Same-Store Sales Indicate Weak Demand

Same-store sales is a key performance indicator used to measure organic growth at restaurants open for at least a year.

Dine Brands’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Dine Brands’s revenue to stall, close to its 1.9% annualized declines for the past five years. This projection is underwhelming and implies its newer menu offerings will not accelerate its top-line performance yet.

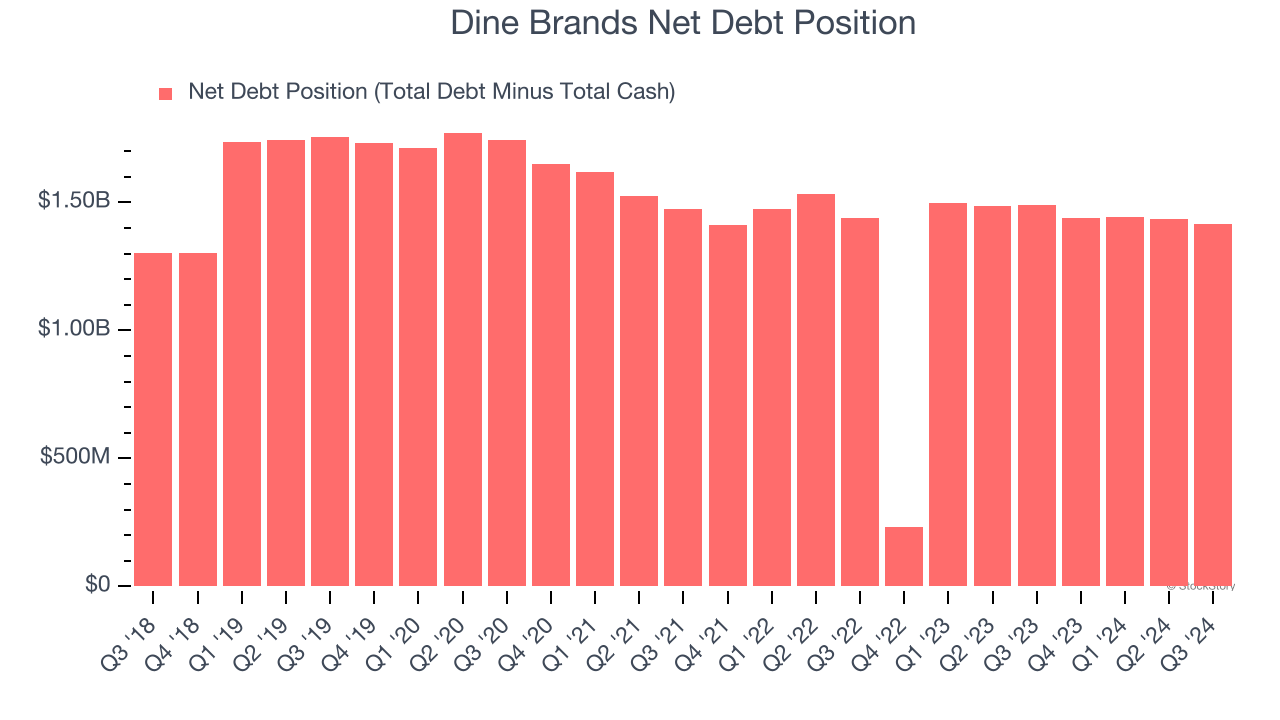

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Dine Brands’s $1.59 billion of debt exceeds the $169.6 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $251.8 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Dine Brands could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Dine Brands can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Dine Brands’s business quality ultimately falls short of our standards. With its shares lagging the market recently, the stock trades at 5.1× forward price-to-earnings (or $30.23 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d recommend looking at one of our top digital advertising picks.

Stocks We Like More Than Dine Brands

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

72.06

-3.67 (-4.85%)

25.76

-0.79 (-2.98%)

Find more stocks in the Stock Screener

TTD Latest News and Analysis

10 days ago - ChartmillKeep an eye on the top gainers and losers in Thursday's session.

10 days ago - ChartmillKeep an eye on the top gainers and losers in Thursday's session.Keep an eye on the top gainers and losers in Thursday's session, as they reflect the most notable price movements.

10 days ago - ChartmillWhich stocks are moving on Thursday?

10 days ago - ChartmillWhich stocks are moving on Thursday?Stay up-to-date with the latest market trends in the middle of the day on Thursday. Explore the top gainers and losers during today's session in our detailed report.

10 days ago - ChartmillThursday's session: gap up and gap down stocks

10 days ago - ChartmillThursday's session: gap up and gap down stocksIn today's session, there are notable price gaps in the US markets on Thursday. Take a closer look at the stocks that are gap up and gap down.

11 days ago - ChartmillThursday's pre-market session: top gainers and losers

11 days ago - ChartmillThursday's pre-market session: top gainers and losersWondering what's happening in Thursday's pre-market session? Find an overview in this article.

11 days ago - ChartmillWhy NASDAQ:TTD Is a Promising High-Growth Stock in the Midst of Consolidation.

11 days ago - ChartmillWhy NASDAQ:TTD Is a Promising High-Growth Stock in the Midst of Consolidation.Based on a technical and fundamental analysis of NASDAQ:TTD we are exploring the Growth Potential of TRADE DESK INC/THE -CLASS A (NASDAQ:TTD) as It Nears a Breakout.

11 days ago - ChartmillWondering what's happening in today's after-hours session?

11 days ago - ChartmillWondering what's happening in today's after-hours session?After the conclusion of the US market's regular session on Wednesday, let's examine the after-hours session and unveil the notable performers among the top gainers and losers.