Camping World (CWH): Buy, Sell, or Hold Post Q3 Earnings?

Provided By StockStory

Last update: Jan 22, 2025

Camping World trades at $22.59 per share and has stayed right on track with the overall market, gaining 7.6% over the last six months. At the same time, the S&P 500 has returned 9.1%.

Is there a buying opportunity in Camping World, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We're swiping left on Camping World for now. Here are three reasons why we avoid CWH and a stock we'd rather own.

Why Is Camping World Not Exciting?

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

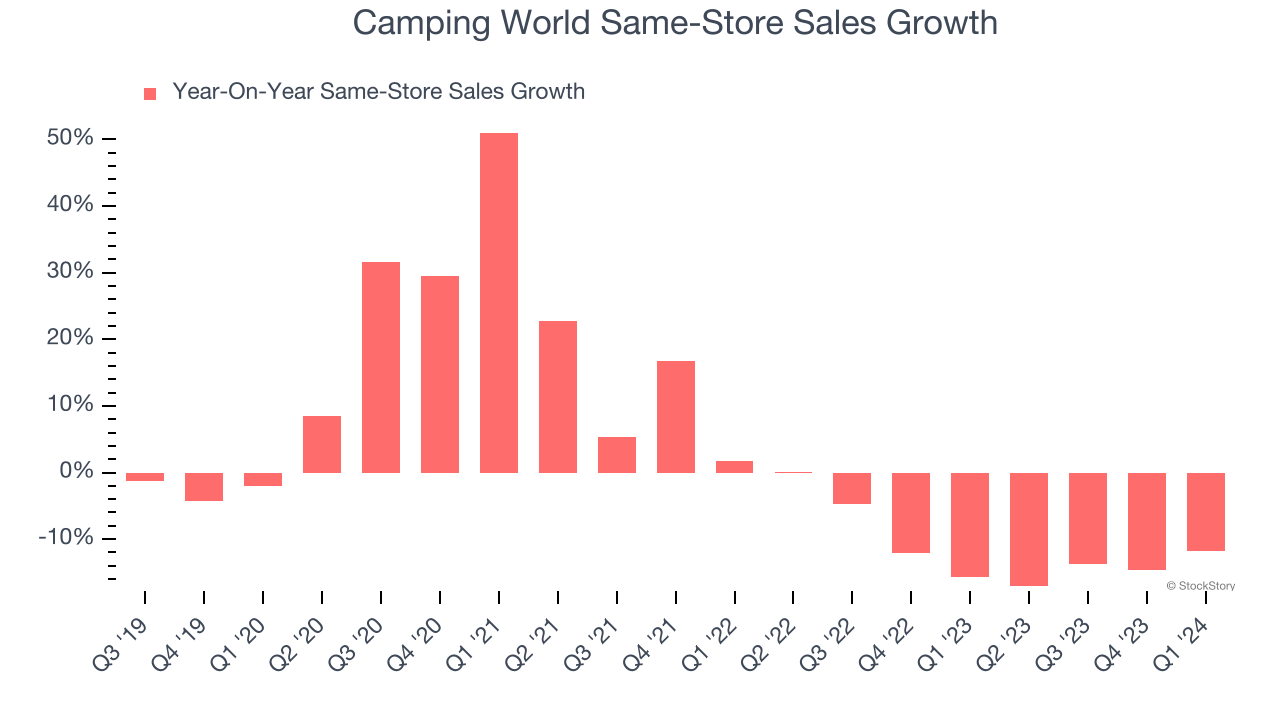

1. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Camping World’s demand has been shrinking over the last two years as its same-store sales have averaged 14.2% annual declines.

Note that Camping World reports its same-store sales intermittently, so some data points are missing in the chart below.

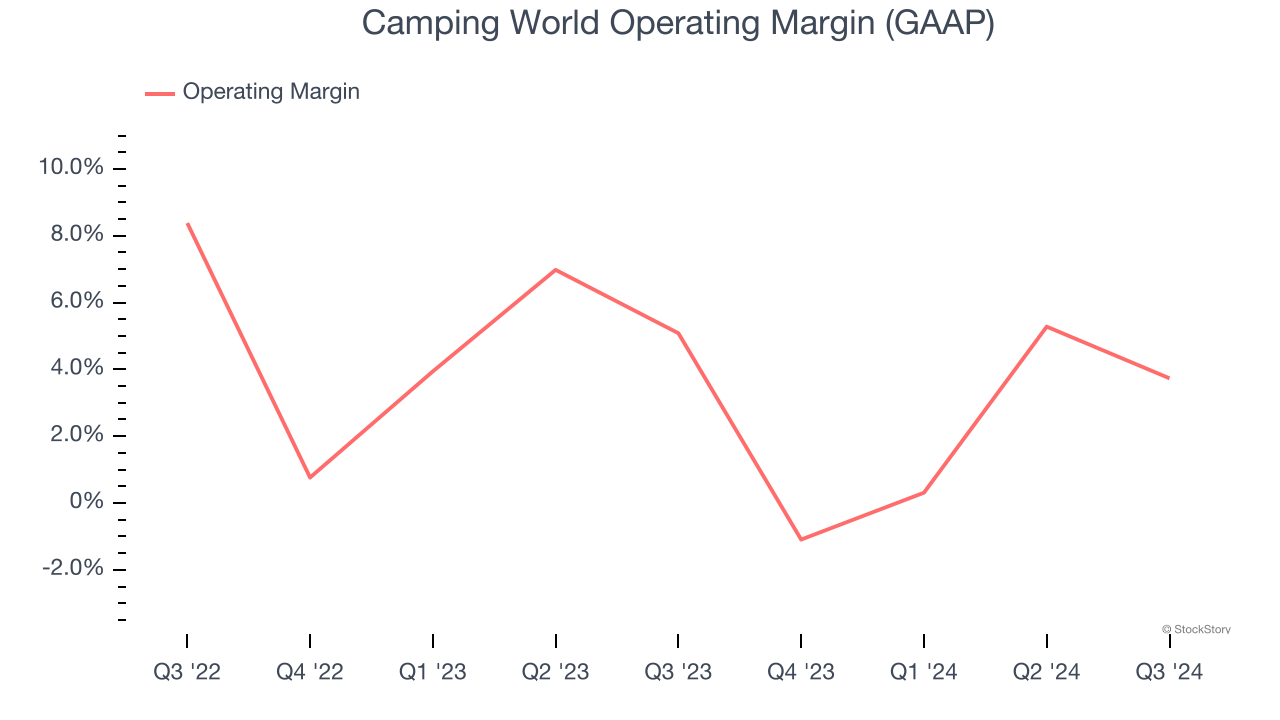

2. Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

Camping World was profitable over the last two years but held back by its large cost base. Its average operating margin of 3.6% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

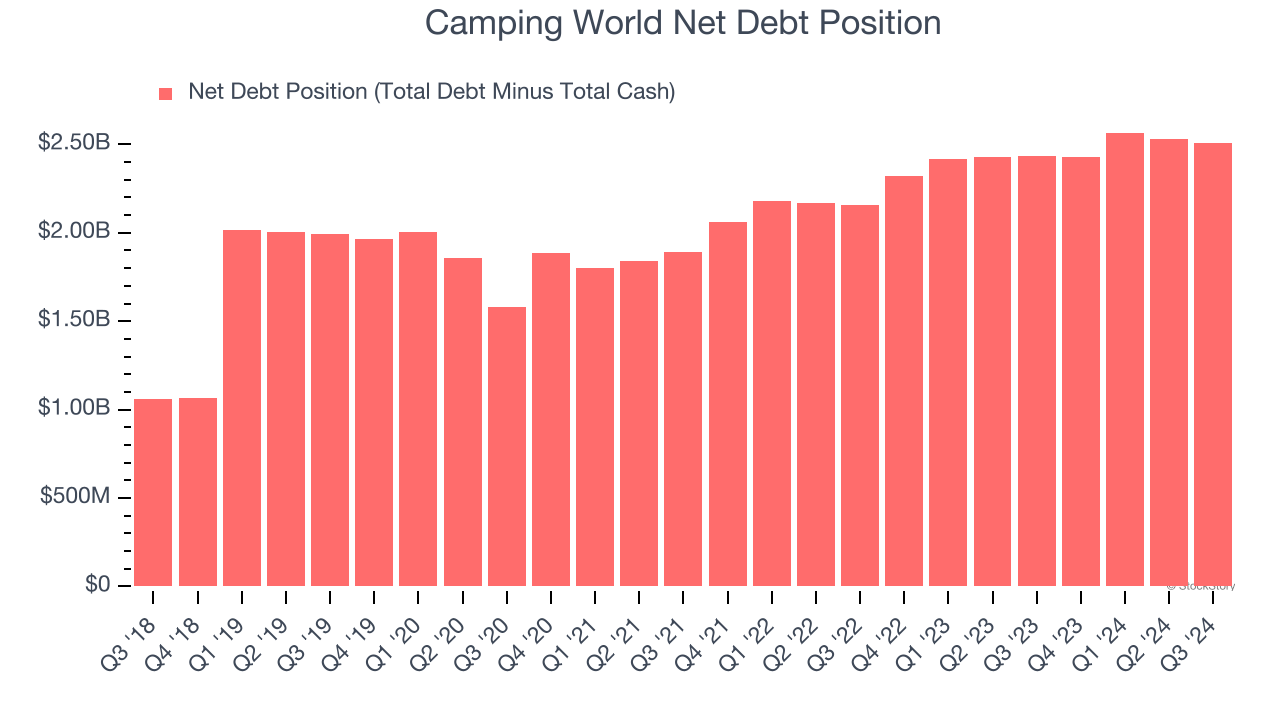

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Camping World’s $2.53 billion of debt exceeds the $28.38 million of cash on its balance sheet. Furthermore, its 9× net-debt-to-EBITDA ratio (based on its EBITDA of $272.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Camping World could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Camping World can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Camping World’s business quality ultimately falls short of our standards. That said, the stock currently trades at 22× forward price-to-earnings (or $22.59 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Camping World

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

72.06

-3.67 (-4.85%)

20.34

-0.97 (-4.55%)

Find more stocks in the Stock Screener

TTD Latest News and Analysis

10 days ago - ChartmillKeep an eye on the top gainers and losers in Thursday's session.

10 days ago - ChartmillKeep an eye on the top gainers and losers in Thursday's session.Keep an eye on the top gainers and losers in Thursday's session, as they reflect the most notable price movements.

10 days ago - ChartmillWhich stocks are moving on Thursday?

10 days ago - ChartmillWhich stocks are moving on Thursday?Stay up-to-date with the latest market trends in the middle of the day on Thursday. Explore the top gainers and losers during today's session in our detailed report.

10 days ago - ChartmillThursday's session: gap up and gap down stocks

10 days ago - ChartmillThursday's session: gap up and gap down stocksIn today's session, there are notable price gaps in the US markets on Thursday. Take a closer look at the stocks that are gap up and gap down.

10 days ago - ChartmillThursday's pre-market session: top gainers and losers

10 days ago - ChartmillThursday's pre-market session: top gainers and losersWondering what's happening in Thursday's pre-market session? Find an overview in this article.

10 days ago - ChartmillWhy NASDAQ:TTD Is a Promising High-Growth Stock in the Midst of Consolidation.

10 days ago - ChartmillWhy NASDAQ:TTD Is a Promising High-Growth Stock in the Midst of Consolidation.Based on a technical and fundamental analysis of NASDAQ:TTD we are exploring the Growth Potential of TRADE DESK INC/THE -CLASS A (NASDAQ:TTD) as It Nears a Breakout.

11 days ago - ChartmillWondering what's happening in today's after-hours session?

11 days ago - ChartmillWondering what's happening in today's after-hours session?After the conclusion of the US market's regular session on Wednesday, let's examine the after-hours session and unveil the notable performers among the top gainers and losers.