Why NYSE:CVX is a Top Pick for Dividend Investors.

By Mill Chart

Last update: Sep 4, 2024

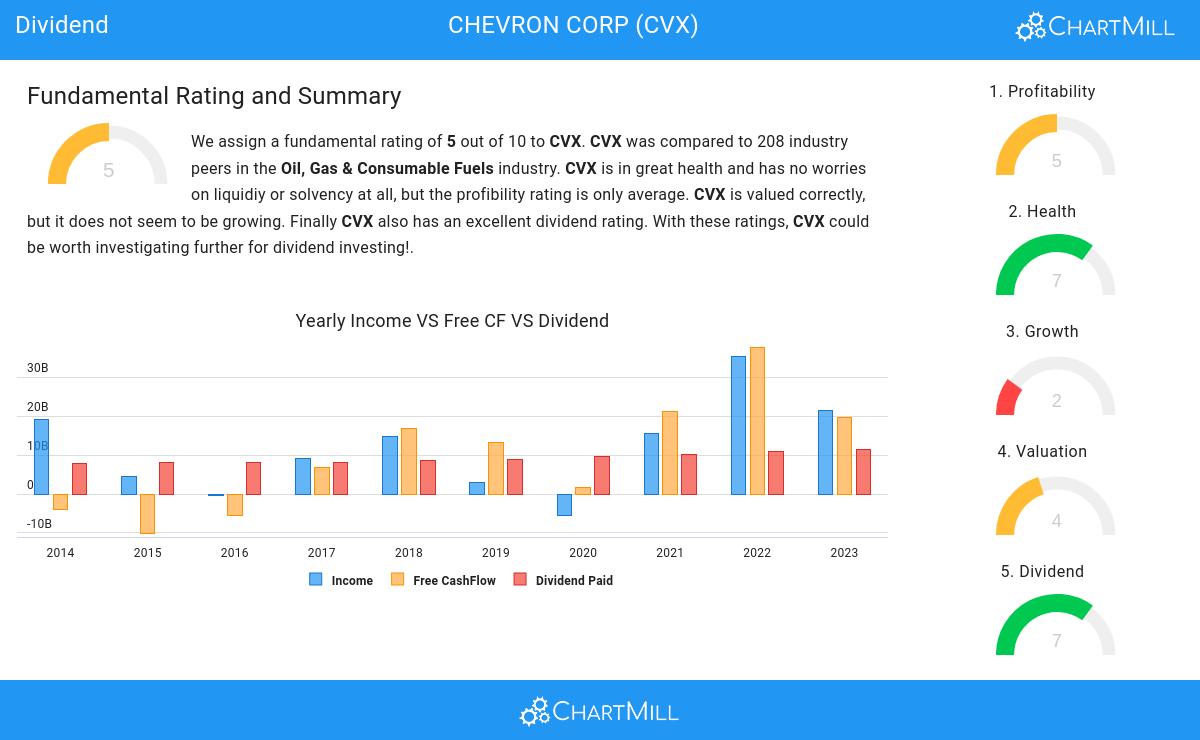

Take a closer look at CHEVRON CORP (NYSE:CVX), a stock of interest to dividend investors uncovered by our stock screener. NYSE:CVX excels in fundamentals and provides a decent dividend, all while maintaining a reasonable valuation. Let's break it down further.

Unpacking NYSE:CVX's Dividend Rating

ChartMill assigns a proprietary Dividend Rating to each stock. The score is computed by evaluating various valuation aspects, like the yield, the history, the dividend growth and sustainability. NYSE:CVX was assigned a score of 7 for dividend:

- With a Yearly Dividend Yield of 4.42%, CVX is a good candidate for dividend investing.

- CVX's Dividend Yield is a higher than the industry average which is at 6.03.

- CVX's Dividend Yield is rather good when compared to the S&P500 average which is at 2.24.

- The dividend of CVX is nicely growing with an annual growth rate of 6.07%!

- CVX has been paying a dividend for at least 10 years, so it has a reliable track record.

- CVX has not decreased their dividend for at least 10 years, which is a reliable track record.

Analyzing Health Metrics

ChartMill utilizes a Health Rating to assess stocks, scoring them on a scale of 0 to 10. This rating takes into account a variety of liquidity and solvency ratios, both in absolute terms and in comparison to industry peers. NYSE:CVX has earned a 7 out of 10:

- CVX has an Altman-Z score of 3.74. This indicates that CVX is financially healthy and has little risk of bankruptcy at the moment.

- CVX has a better Altman-Z score (3.74) than 83.65% of its industry peers.

- The Debt to FCF ratio of CVX is 1.28, which is an excellent value as it means it would take CVX, only 1.28 years of fcf income to pay off all of its debts.

- CVX's Debt to FCF ratio of 1.28 is amongst the best of the industry. CVX outperforms 84.13% of its industry peers.

- CVX has a Debt/Equity ratio of 0.13. This is a healthy value indicating a solid balance between debt and equity.

- CVX has a better Debt to Equity ratio (0.13) than 75.00% of its industry peers.

A Closer Look at Profitability for NYSE:CVX

ChartMill assigns a Profitability Rating to every stock. This score ranges from 0 to 10 and evaluates the different profitability ratios and margins, both absolutely, but also relative to the industry peers. NYSE:CVX scores a 5 out of 10:

- The Return On Assets of CVX (7.18%) is better than 61.54% of its industry peers.

- CVX's Profit Margin has improved in the last couple of years.

- In the last couple of years the Operating Margin of CVX has grown nicely.

Our Best Dividend screener lists more Best Dividend stocks and is updated daily.

For an up to date full fundamental analysis you can check the fundamental report of CVX

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

150.5

-0.01 (-0.01%)

Find more stocks in the Stock Screener

CVX Latest News and Analysis