Why NASDAQ:CPRX qualifies as a high growth stock.

By Mill Chart

Last update: Dec 3, 2024

CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX) was identified as a Technical Breakout Setup Pattern by our stockscreener. Such a pattern occurs when we see a pause in a strong uptrend: after a strong rise the stock is consolidating a bit and at some point the trend may be continued. Whether this actually happens can not be predicted of course, but it may be a good idea to keep and eye on NASDAQ:CPRX.

Analyzing the Technical Aspects

ChartMill assigns a Technical Rating to every stock. This score ranges from 0 to 10 and is updated daily. The score is determined by evaluating multiple technical indicators and properties.

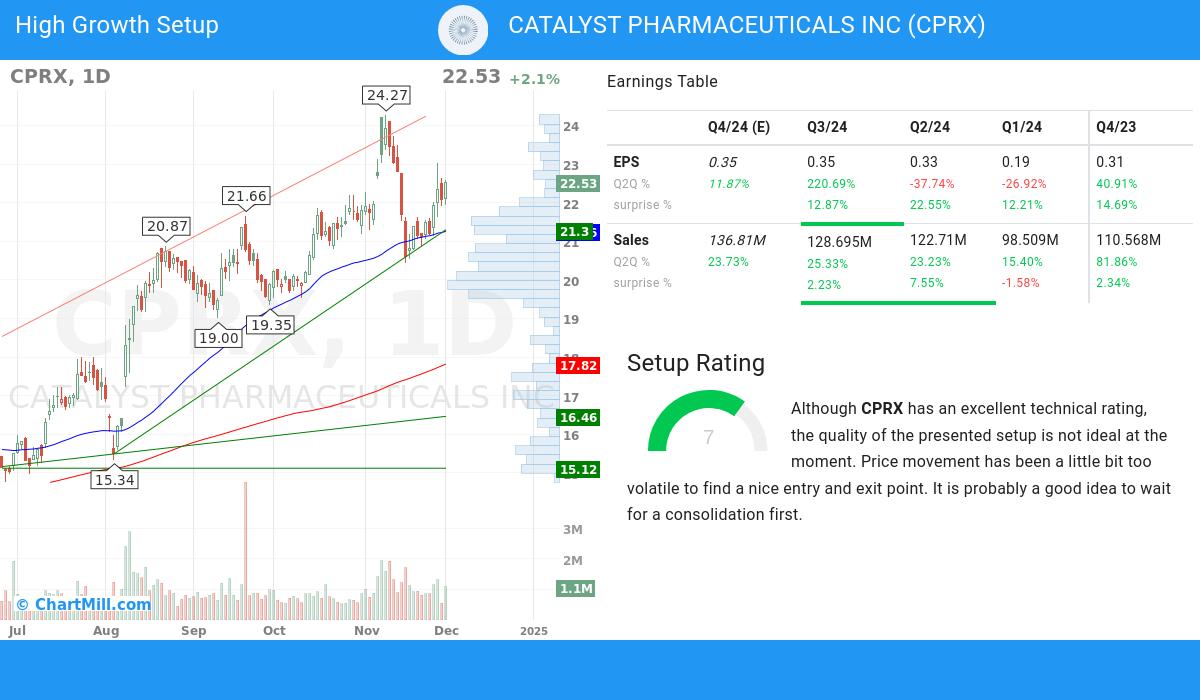

Overall CPRX gets a technical rating of 10 out of 10. Both in the recent history as in the last year, CPRX has proven to be a steady performer, scoring decent points in every aspect analyzed.

- Both the short term and long term trends are positive. This is a very positive sign.

- Looking at the yearly performance, CPRX did better than 86% of all other stocks. We also observe that the gains produced by CPRX over the past year are nicely spread over this period.

- CPRX is one of the better performing stocks in the Biotechnology industry, it outperforms 80% of 570 stocks in the same industry.

- CPRX is currently trading in the upper part of its 52 week range. The S&P500 Index however is currently trading near a new high, so CPRX is lagging the market slightly.

- In the last month CPRX has a been trading in the 20.44 - 24.27 range, which is quite wide. It is currently trading in the middle of this range, so some resistance may be found above.

Our latest full technical report of CPRX contains the most current technical analsysis.

Looking at the Setup

ChartMill also assign a Setup Rating to every stock. With this score it is determined to what extend the stock has been trading in a range in the recent days and weeks. This score also ranges from 0 to 10 and is updated daily. The setup score evaluates various short term technical indicators. NASDAQ:CPRX scores a 7 out of 10:

CPRX has an excellent technical rating, but the quality of the setup is only medium at the moment. Price movement has been a little bit too volatile to find a nice entry and exit point. It is probably a good idea to wait for a consolidation first.

Some of the high growth metrics of NASDAQ:CPRX highlighted

- In the most recent financial report, CATALYST PHARMACEUTICALS INC reported a 221.0% increase in quarterly earnings compared to the previous quarter. This notable growth indicates positive momentum in the company's financials, suggesting an upward trend

- CATALYST PHARMACEUTICALS INC has demonstrated strong q2q revenue growth of 25.33%, suggesting a favorable trend in the company's financials and indicating the potential for continued expansion.

- The EPS of CATALYST PHARMACEUTICALS INC has shown consistent growth over a 3-year period, indicating the company's ability to generate increasing earnings over time.

- CATALYST PHARMACEUTICALS INC has demonstrated strong 1-year revenue growth of 85.9%, reflecting revenue momentum and its ability to generate consistent top-line expansion. This growth underscores the company's strong market position and its potential for future success.

- The quarterly earnings of CATALYST PHARMACEUTICALS INC have shown a 221.0% increase compared to the previous quarter, as revealed in the recent financial report. This growth signifies positive momentum in the company's financials, pointing towards a promising upward trend

- accelerating EPS growth for CATALYST PHARMACEUTICALS INC: the current Q2Q growth of 221.0% exceeds the previous year Q2Q growth of -245.0%.

- CATALYST PHARMACEUTICALS INC has shown positive growth in its free cash flow (FCF) over the past year, indicating improved cash generation and financial strength. This growth highlights the company's ability to effectively manage its cash flows and generate surplus funds.

- With a solid Return on Equity (ROE) of 11.19%, CATALYST PHARMACEUTICALS INC exemplifies its ability to generate favorable returns on shareholder investments. This metric demonstrates the company's commitment to maximizing shareholder value.

- CATALYST PHARMACEUTICALS INC maintains a healthy Debt-to-Equity ratio of 0.0. This indicates the company's conservative capital structure and signifies its ability to effectively manage debt obligations while maintaining a strong equity position.

- CATALYST PHARMACEUTICALS INC has a strong history of beating EPS estimates in the last 4 quarters, signaling its ability to consistently exceed market expectations. This indicates the company's strong financial performance and its potential for creating shareholder value.

- CATALYST PHARMACEUTICALS INC has achieved an impressive Relative Strength (RS) rating of 86.24, showcasing its ability to outperform the broader market. This strong performance positions CATALYST PHARMACEUTICALS INC as an attractive stock for potential price appreciation.

More ideas for high growth momentum breakouts can be found on ChartMill in our High Growth Momentum Breakout screen.

Disclaimer

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

23.45

+0.26 (+1.12%)

Find more stocks in the Stock Screener

CPRX Latest News and Analysis

2 days ago - ChartmillInvestors should take note of CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX), a growth stock that remains attractively priced.

2 days ago - ChartmillInvestors should take note of CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX), a growth stock that remains attractively priced.CATALYST PHARMACEUTICALS INC was identified as an affordable growth stock. NASDAQ:CPRX is showing great growth, but also scores well on profitability. At the same time it seems to be priced reasonably.

5 days ago - ChartmillWhy CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX) qualifies as a high growth stock.

5 days ago - ChartmillWhy CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX) qualifies as a high growth stock.A fundamental analysis of (NASDAQ:CPRX): Delving into CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX)'s Growth Prospects.

8 days ago - ChartmillIs CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX) a Fit for high Growth Investing Strategies?

8 days ago - ChartmillIs CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX) a Fit for high Growth Investing Strategies?A fundamental and technical analysis of (NASDAQ:CPRX): Why the high growth investor may take a look at CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX).

10 days ago - ChartmillCATALYST PHARMACEUTICALS INC (NASDAQ:CPRX) is a candidate for growth investors. Here's why.

10 days ago - ChartmillCATALYST PHARMACEUTICALS INC (NASDAQ:CPRX) is a candidate for growth investors. Here's why.A fundamental analysis of (NASDAQ:CPRX): CATALYST PHARMACEUTICALS INC (NASDAQ:CPRX) is a candidate for growth investors. Here's why.