NASDAQ:CORT: a strong growth stock preparing for the next leg up?.

By Mill Chart

Last update: Oct 14, 2024

Growth investors are on the lookout for stocks displaying robust revenue and EPS growth. In this analysis, we'll assess whether CORCEPT THERAPEUTICS INC (NASDAQ:CORT) aligns with growth investing criteria, especially as it consolidates and signals a possible breakout. As always, investors should conduct their own research, but CORCEPT THERAPEUTICS INC has surfaced on our radar for growth with base formation, warranting further examination.

Exploring NASDAQ:CORT's Growth

Every stock receives a Growth Rating from ChartMill, ranging from 0 to 10. This rating assesses various growth aspects, including historical and projected EPS and revenue growth. NASDAQ:CORT boasts a 8 out of 10:

- The Earnings Per Share has grown by an impressive 36.14% over the past year.

- CORT shows a strong growth in Revenue. In the last year, the Revenue has grown by 33.02%.

- The Revenue has been growing by 13.94% on average over the past years. This is quite good.

- CORT is expected to show a strong growth in Earnings Per Share. In the coming years, the EPS will grow by 26.44% yearly.

- The Revenue is expected to grow by 16.69% on average over the next years. This is quite good.

- When comparing the EPS growth rate of the last years to the growth rate of the upcoming years, we see that the growth is accelerating.

What does the Health looks like for NASDAQ:CORT

ChartMill utilizes a Health Rating to assess stocks, scoring them on a scale of 0 to 10. This rating takes into account a variety of liquidity and solvency ratios, both in absolute terms and in comparison to industry peers. NASDAQ:CORT has earned a 9 out of 10:

- An Altman-Z score of 27.15 indicates that CORT is not in any danger for bankruptcy at the moment.

- CORT's Altman-Z score of 27.15 is amongst the best of the industry. CORT outperforms 90.72% of its industry peers.

- CORT has no outstanding debt. Therefor its Debt/Equity and Debt/FCF ratios are 0 and belong to the best of the industry.

- A Current Ratio of 5.57 indicates that CORT has no problem at all paying its short term obligations.

- The Current ratio of CORT (5.57) is better than 66.49% of its industry peers.

- CORT has a Quick Ratio of 5.48. This indicates that CORT is financially healthy and has no problem in meeting its short term obligations.

- CORT's Quick ratio of 5.48 is fine compared to the rest of the industry. CORT outperforms 66.49% of its industry peers.

Assessing Profitability for NASDAQ:CORT

ChartMill's Profitability Rating offers a unique perspective on stock analysis, providing scores from 0 to 10. These ratings consider a wide range of profitability metrics and margins, both in comparison to industry peers and on their own merits. For NASDAQ:CORT, the assigned 7 is a significant indicator of profitability:

- CORT has a Return On Assets of 17.63%. This is amongst the best in the industry. CORT outperforms 96.91% of its industry peers.

- The Return On Equity of CORT (21.13%) is better than 92.27% of its industry peers.

- The Return On Invested Capital of CORT (17.98%) is better than 94.33% of its industry peers.

- Looking at the Profit Margin, with a value of 22.12%, CORT belongs to the top of the industry, outperforming 93.81% of the companies in the same industry.

- CORT has a Operating Margin of 22.46%. This is amongst the best in the industry. CORT outperforms 89.18% of its industry peers.

- CORT has a Gross Margin of 98.50%. This is amongst the best in the industry. CORT outperforms 97.94% of its industry peers.

Why is NASDAQ:CORT a setup?

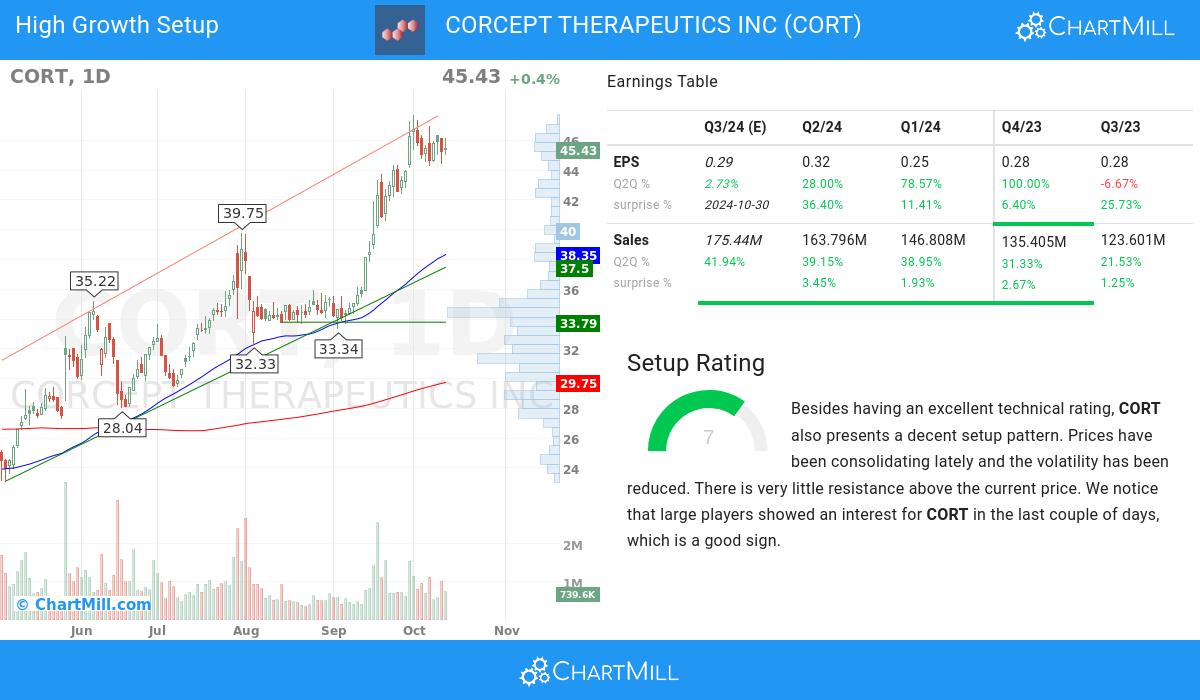

In addition to the Technical Rating, ChartMill provides a Setup Rating for each stock. This rating, ranging from 0 to 10, assesses the extent of consolidation in the stock based on multiple short-term technical indicators. Currently, NASDAQ:CORT has a 7 as its setup rating:

Besides having an excellent technical rating, CORT also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is very little resistance above the current price. We notice that large players showed an interest for CORT in the last couple of days, which is a good sign.

More Strong Growth stocks can be found in our Strong Growth screener.

Our latest full fundamental report of CORT contains the most current fundamental analsysis.

Check the latest full technical report of CORT for a complete technical analysis.

Disclaimer

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.