Why NYSE:CAH provides a good dividend, while having solid fundamentals.

By Mill Chart

Last update: Sep 23, 2024

CARDINAL HEALTH INC (NYSE:CAH) has caught the attention of dividend investors as a stock worth considering. NYSE:CAH excels in profitability, solvency, and liquidity, all while providing a decent dividend. Let's delve into the details.

What does the Dividend looks like for NYSE:CAH

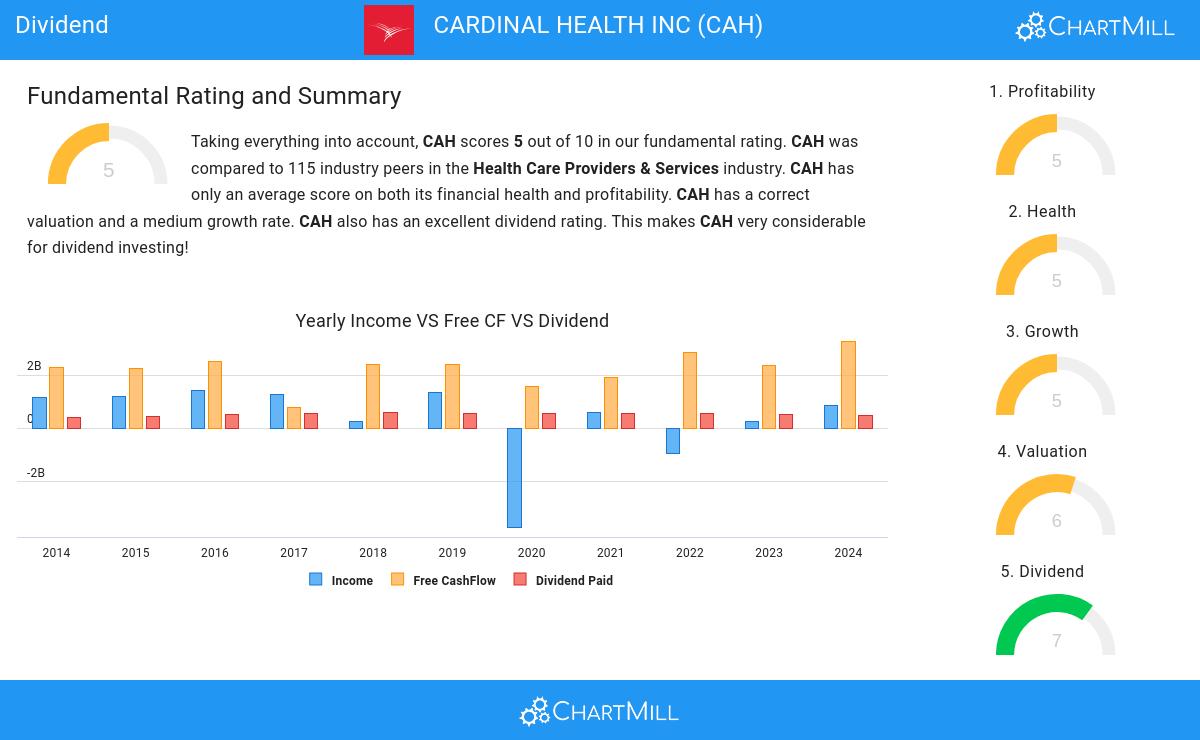

To gauge a stock's dividend quality, ChartMill utilizes a Dividend Rating ranging from 0 to 10. This comprehensive assessment considers various dividend aspects, including yield, history, growth, and sustainability. NYSE:CAH has achieved a 7 out of 10:

- CAH's Dividend Yield is rather good when compared to the industry average which is at 2.58. CAH pays more dividend than 90.35% of the companies in the same industry.

- CAH has paid a dividend for at least 10 years, which is a reliable track record.

- CAH has not decreased their dividend for at least 10 years, which is a reliable track record.

- CAH's earnings are growing more than its dividend. This makes the dividend growth sustainable.

How We Gauge Health for NYSE:CAH

ChartMill employs its own Health Rating for stock assessment. This rating, ranging from 0 to 10, is calculated by examining various liquidity and solvency ratios. In the case of NYSE:CAH, the assigned 5 reflects its health status:

- An Altman-Z score of 5.49 indicates that CAH is not in any danger for bankruptcy at the moment.

- With an excellent Altman-Z score value of 5.49, CAH belongs to the best of the industry, outperforming 88.60% of the companies in the same industry.

- The Debt to FCF ratio of CAH is 1.57, which is an excellent value as it means it would take CAH, only 1.57 years of fcf income to pay off all of its debts.

- CAH has a Debt to FCF ratio of 1.57. This is amongst the best in the industry. CAH outperforms 87.72% of its industry peers.

Looking at the Profitability

ChartMill employs its own Profitability Rating system for stock evaluation. This score, ranging from 0 to 10, is derived from an analysis of diverse profitability metrics and margins. In the case of NYSE:CAH, the assigned 5 is noteworthy for profitability:

- With a decent Return On Assets value of 1.89%, CAH is doing good in the industry, outperforming 65.79% of the companies in the same industry.

- CAH has a Return On Invested Capital of 17.91%. This is amongst the best in the industry. CAH outperforms 95.61% of its industry peers.

- The Average Return On Invested Capital over the past 3 years for CAH is significantly above the industry average of 7.77%.

- The 3 year average ROIC (14.10%) for CAH is below the current ROIC(17.91%), indicating increased profibility in the last year.

Every day, new Best Dividend stocks can be found on ChartMill in our Best Dividend screener.

Check the latest full fundamental report of CAH for a complete fundamental analysis.

Disclaimer

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.