BOSTON SCIENTIFIC CORP (NYSE:BSX) showing some interesting technicals. Here's why.

By Mill Chart

Last update: Jan 8, 2025

Our stockscreener has identified a possible breakout setup on BOSTON SCIENTIFIC CORP (NYSE:BSX). This occurs when the stock consolidates following a significant upward movement. While the breakout outcome cannot be guaranteed, it may be worth monitoring NYSE:BSX for potential opportunities.

Insights from Technical Analysis

ChartMill utilizes a proprietary algorithm to assign a Technical Rating to every stock. This rating, ranging from 0 to 10, is computed daily by analyzing a variety of technical indicators and properties.

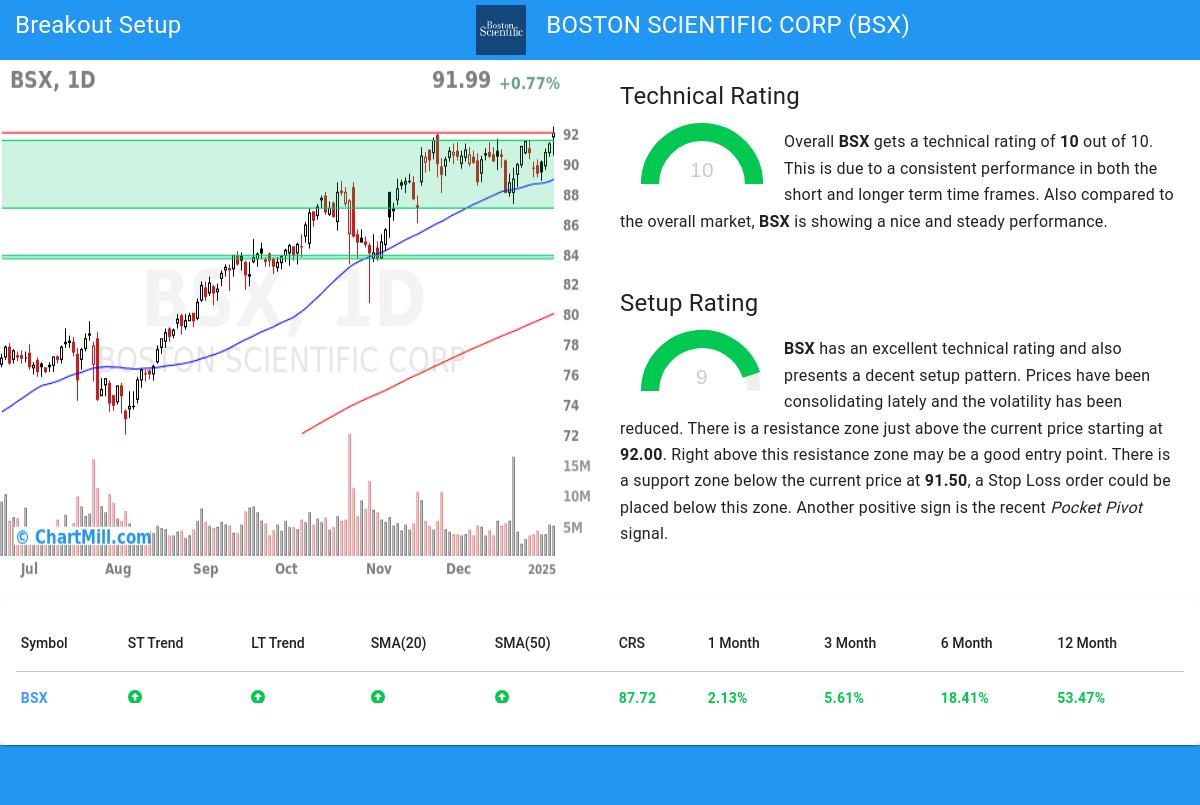

Overall BSX gets a technical rating of 10 out of 10. This is due to a consistent performance in both the short and longer term time frames. Also compared to the overall market, BSX is showing a nice and steady performance.

- The long and short term trends are both positive. This is looking good!

- When comparing the yearly performance of all stocks, we notice that BSX is one of the better performing stocks in the market, outperforming 87% of all stocks. We also observe that the gains produced by BSX over the past year are nicely spread over this period.

- BSX is one of the better performing stocks in the Health Care Equipment & Supplies industry, it outperforms 79% of 187 stocks in the same industry.

- BSX is currently making a new 52 week high. This is a strong signal. The S&P500 Index is trading in the upper part of its 52 week range, but not near new highs, so BSX is leading the market.

- In the last month BSX has a been trading in a tight range between 87.25 and 92.42.

Our latest full technical report of BSX contains the most current technical analsysis.

Why is NYSE:BSX a setup?

Alongside the Technical Rating, ChartMill assigns a Setup Rating to evaluate the consolidation level of a stock. This rating, ranging from 0 to 10, is updated daily and considers various short-term technical indicators. The current setup rating for NYSE:BSX is 9:

BSX has an excellent technical rating and also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is a resistance zone just above the current price starting at 92.00. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 91.50, a Stop Loss order could be placed below this zone. Another positive sign is the recent Pocket Pivot signal.

Trading breakout setups.

A breakout opportunity may arise when the stock surpasses the current consolidation zone and reaches new highs. Traders often wait for this breakout before considering buying the stock. To manage risk, a stop loss order could be placed below the consolidation zone to limit potential losses.

Of course, there are many ways to trade or not trade NYSE:BSX and this article should in no way be interpreted as trading advice. The article is purely based on an automated technical analysis and just points out the technical observations. Always make your own analysis and trade at your own responsibility.

More breakout setups can be found in our Breakout screener.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

92.58

+0.83 (+0.9%)

Find more stocks in the Stock Screener

BSX Latest News and Analysis