Unpacking Q4 Earnings: Keysight (NYSE:KEYS) In The Context Of Other Inspection Instruments Stocks

Provided By StockStory

Last update: Mar 4, 2025

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the inspection instruments industry, including Keysight (NYSE:KEYS) and its peers.

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

The 5 inspection instruments stocks we track reported a very strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.1% on average since the latest earnings results.

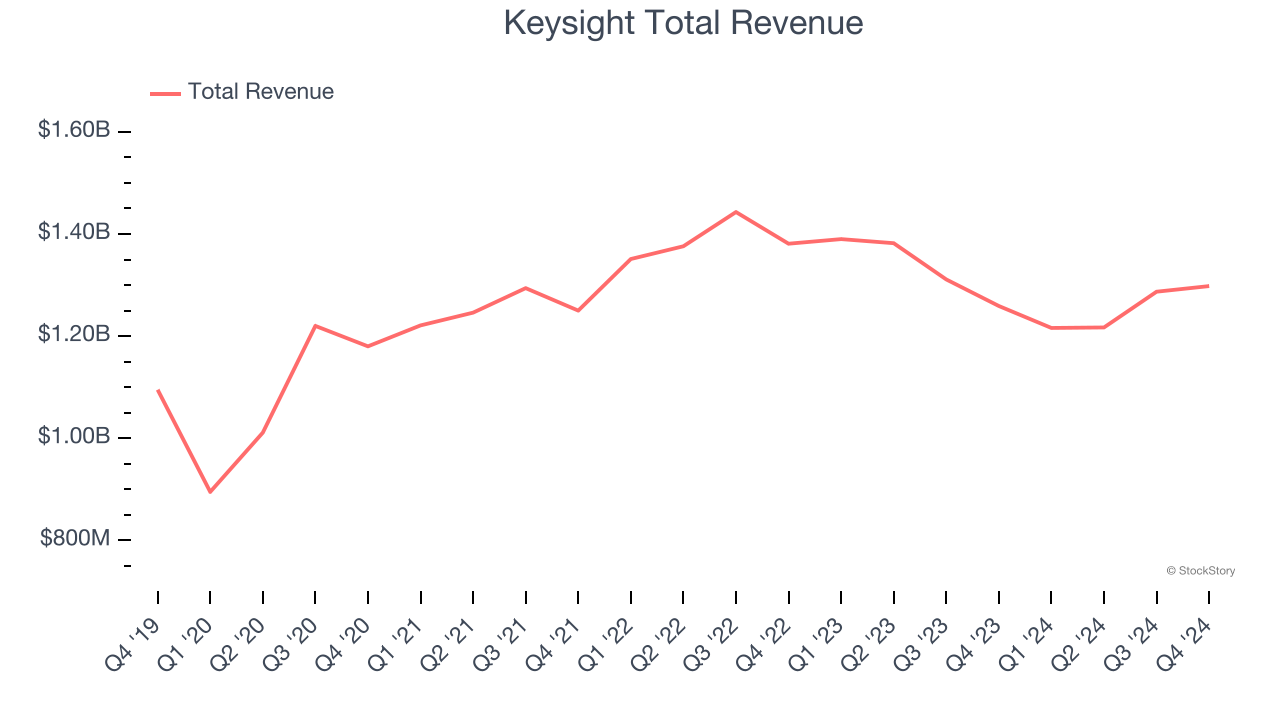

Weakest Q4: Keysight (NYSE:KEYS)

Spun off from Hewlett-Packard in 2014, Keysight (NYSE:KEYS) offers electronic measurement products for use in various sectors.

Keysight reported revenues of $1.30 billion, up 3.1% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates but a miss of analysts’ backlog estimates.

“Keysight delivered strong first quarter results, reflecting year-over-year growth in revenues and orders. The demand environment remains consistent with our view of a gradual recovery in 2025,” said Satish Dhanasekaran, Keysight’s President and CEO.

Keysight delivered the weakest performance against analyst estimates of the whole group. The stock is down 8.8% since reporting and currently trades at $156.99.

Is now the time to buy Keysight? Access our full analysis of the earnings results here, it’s free.

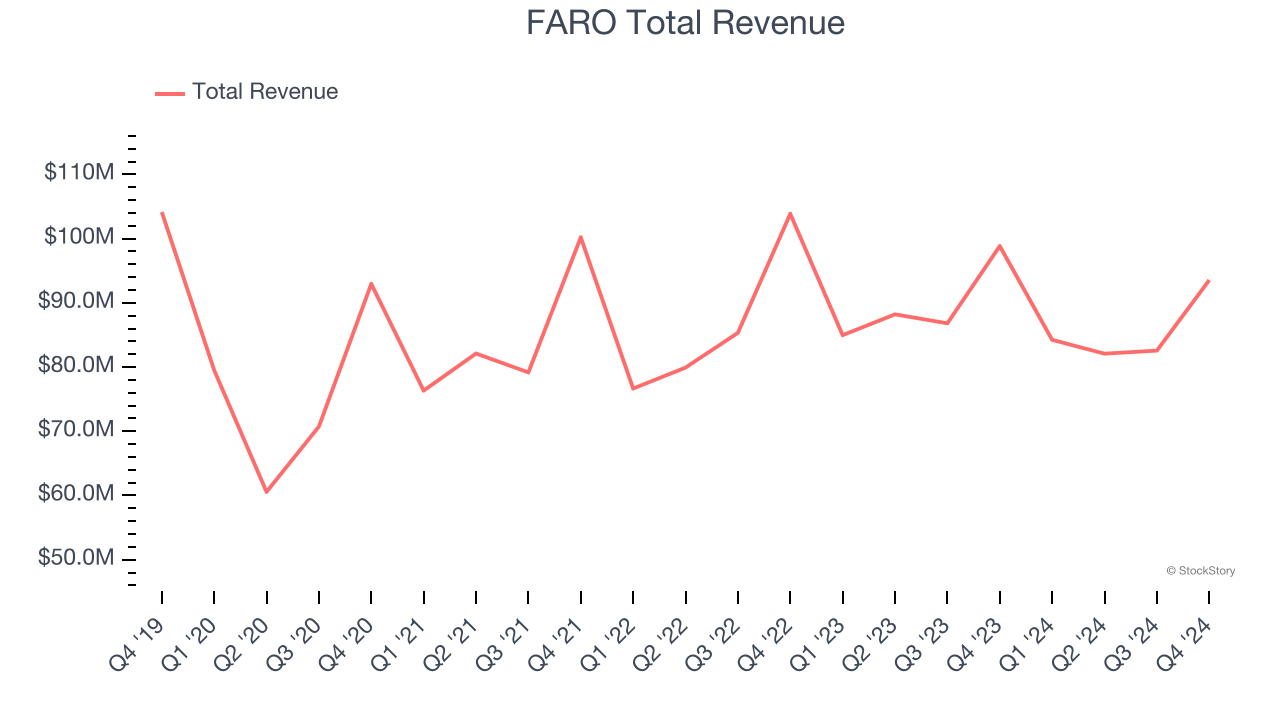

Best Q4: FARO (NASDAQ:FARO)

Launched by two PhD students in a garage, FARO (NASDAQ:FARO) provides 3D measurement and imaging systems for the manufacturing, construction, engineering, and public safety industries.

FARO reported revenues of $93.54 million, down 5.4% year on year, outperforming analysts’ expectations by 2.3%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 11.2% since reporting. It currently trades at $30.12.

Is now the time to buy FARO? Access our full analysis of the earnings results here, it’s free.

Badger Meter (NYSE:BMI)

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE:BMI) provides water control and measure equipment to various industries.

Badger Meter reported revenues of $205.2 million, up 12.5% year on year, exceeding analysts’ expectations by 2.3%. It was a satisfactory quarter as it also posted a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $209.70.

Read our full analysis of Badger Meter’s results here.

Teledyne (NYSE:TDY)

Playing a role in mapping the ocean floor as we know it today, Teledyne (NYSE:TDY) offers digital imaging and instrumentation products for various industries.

Teledyne reported revenues of $1.50 billion, up 5.4% year on year. This result surpassed analysts’ expectations by 3.6%. Overall, it was an exceptional quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Teledyne pulled off the biggest analyst estimates beat among its peers. The stock is up 6.8% since reporting and currently trades at $512.96.

Read our full, actionable report on Teledyne here, it’s free.

Itron (NASDAQ:ITRI)

Founded by a small group of engineers who wanted to build a more efficient way to read utility meters, Itron (NASDAQ:ITRI) offers energy and water management products for the utility industry, municipalities, and industrial customers.

Itron reported revenues of $612.9 million, up 6.2% year on year. This number topped analysts’ expectations by 1.7%. It was an exceptional quarter as it also put up EPS guidance for next quarter exceeding analysts’ expectations.

The stock is up 16% since reporting and currently trades at $107.49.

Read our full, actionable report on Itron here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

155.89

+1.37 (+0.89%)

482.94

-8.33 (-1.7%)

29.28

-0.47 (-1.58%)

212.07

+2.94 (+1.41%)

105.82

-0.37 (-0.35%)

Find more stocks in the Stock Screener

KEYS Latest News and Analysis

11 days ago - ChartmillTop S&P500 movers in Wednesday's session

11 days ago - ChartmillTop S&P500 movers in Wednesday's sessionLet's delve into the developments on the US markets one hour before the close of the markets on Wednesday. Below, you'll find the top gainers and losers within the S&P500 index during today's session.

11 days ago - ChartmillWhich S&P500 stocks have an unusual volume on Wednesday?

11 days ago - ChartmillWhich S&P500 stocks have an unusual volume on Wednesday?Curious about which S&P500 stocks are generating unusual volume on Wednesday? Find out below.

11 days ago - ChartmillExploring the top movers within the S&P500 index during today's session.

11 days ago - ChartmillExploring the top movers within the S&P500 index during today's session.Stay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Wednesday.

11 days ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocks

11 days ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocksWondering what's happening in today's session regarding gap up and gap down stocks? Explore the S&P500 index on Wednesday to uncover the stocks that are gapping in the S&P500 index.