Brookdale’s (NYSE:BKD) Q4 Earnings Results: Revenue In Line With Expectations

Provided By StockStory

Last update: Feb 18, 2025

Senior living provider Brookdale Senior Living (NYSE:BKD) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 3.5% year on year to $780.9 million. Its GAAP loss of $0.37 per share was 76.2% below analysts’ consensus estimates.

Is now the time to buy Brookdale? Find out by accessing our full research report, it’s free.

Brookdale (BKD) Q4 CY2024 Highlights:

- Revenue: $780.9 million vs analyst estimates of $781.8 million (3.5% year-on-year growth, in line)

- EPS (GAAP): -$0.37 vs analyst expectations of -$0.21 (76.2% miss)

- Adjusted EBITDA: $98.53 million vs analyst estimates of $95.81 million (12.6% margin, 2.8% beat)

- EBITDA guidance for the upcoming financial year 2025 is $437.5 million at the midpoint, above analyst estimates of $428.6 million

- Operating Margin: -0.3%, down from 0.9% in the same quarter last year

- Free Cash Flow was -$5.11 million compared to -$29.21 million in the same quarter last year

- Market Capitalization: $982.1 million

"In 2024, Brookdale made significant progress to achieving its long-term potential. We are proud of the meaningful improvements across many financial, operational, and resident satisfaction metrics. We are grateful for being recognized externally for our workplace culture, leading clinical programming, and being a 'best of' in hundreds of our local markets. Importantly, we delivered positive Adjusted Free Cash Flow in the back half of the year and have positioned the business to generate meaningful Adjusted Free Cash Flow in 2025 through continued focus on profitable occupancy growth and appropriate expense management, completed and pending acquisitions of leased portfolios, and beneficial negotiation of recent lease amendments," said Lucinda ("Cindy") Baier, Brookdale's President and CEO.

Company Overview

Founded in 1978, Brookdale Senior Living (NYSE:BKD) offers independent living, assisted living, Alzheimer's and dementia care, rehabilitation, and skilled nursing care.

Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

Sales Growth

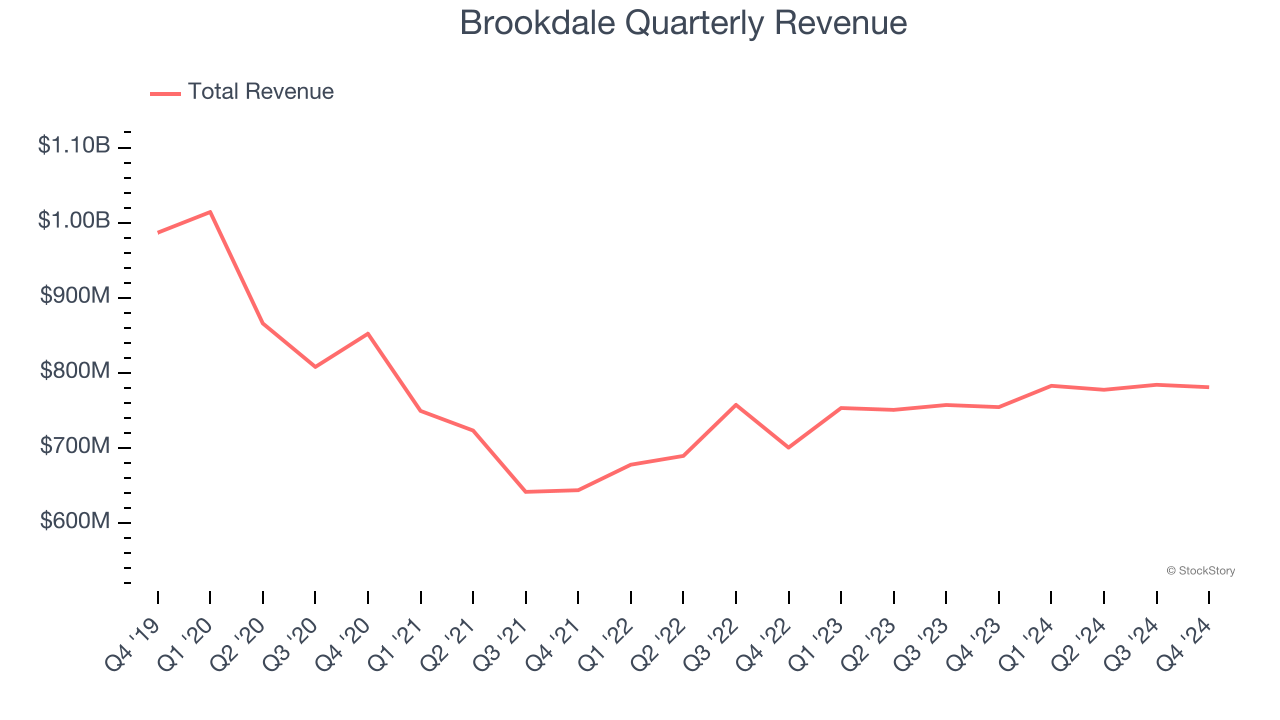

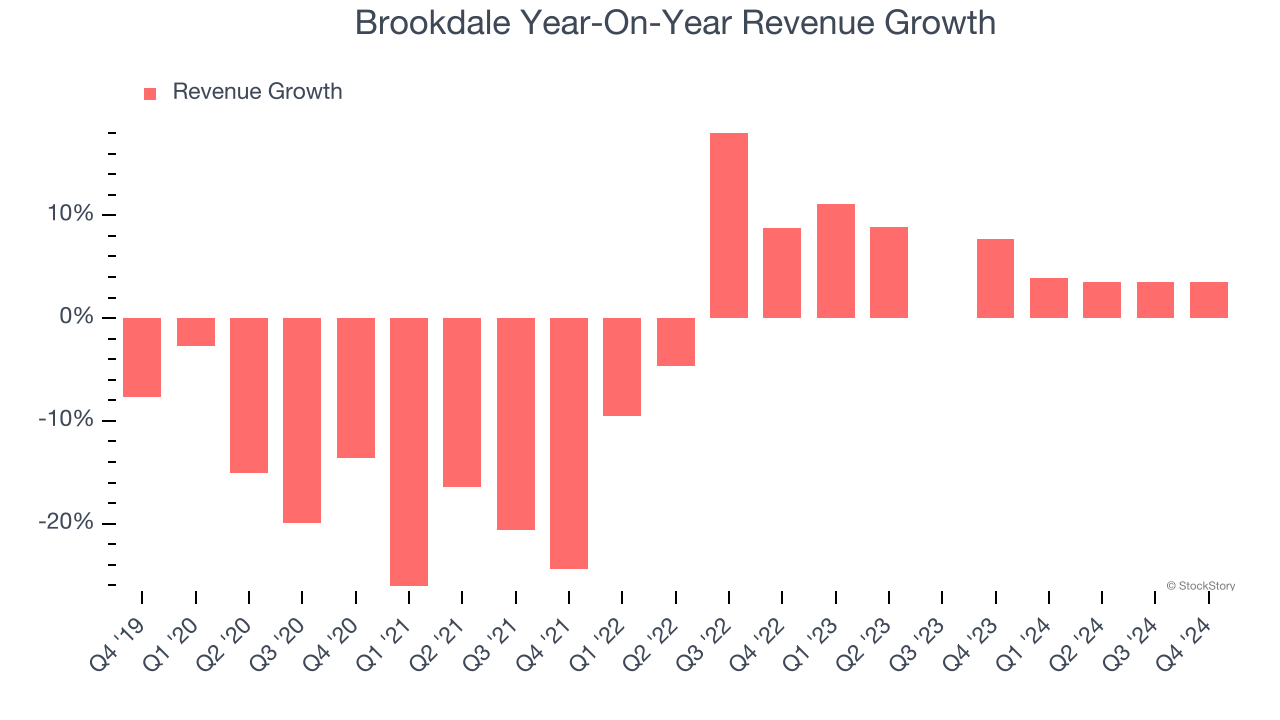

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Brookdale struggled to consistently generate demand over the last five years as its sales dropped at a 5.1% annual rate. This fell short of our benchmarks and is a sign of lacking business quality.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Brookdale’s annualized revenue growth of 5.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can better understand the company’s revenue dynamics by analyzing its most important segment, . Over the last two years, Brookdale’s revenue averaged 7.3% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Brookdale grew its revenue by 3.5% year on year, and its $780.9 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

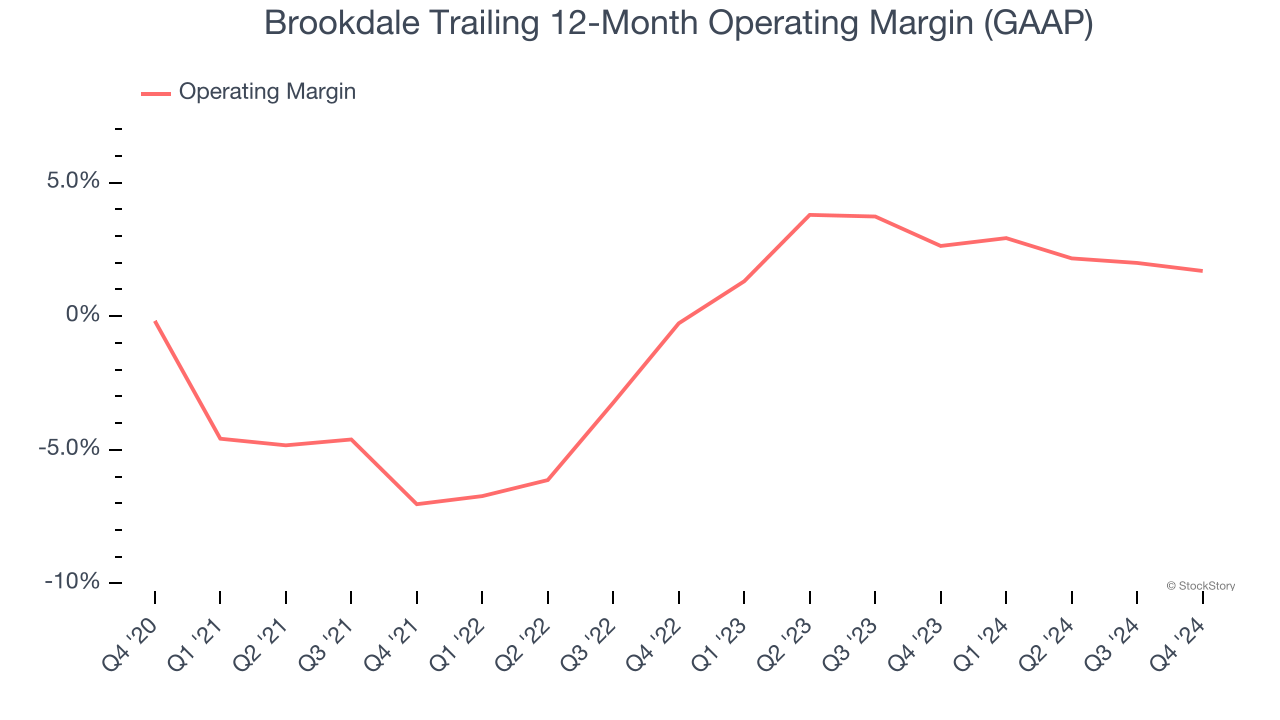

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Brookdale was roughly breakeven when averaging the last five years of quarterly operating profits, lousy for a healthcare business.

On the plus side, Brookdale’s operating margin rose by 1.9 percentage points over the last five years. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

Brookdale’s operating margin was negative 0.3% this quarter. The company's consistent lack of profits raise a flag.

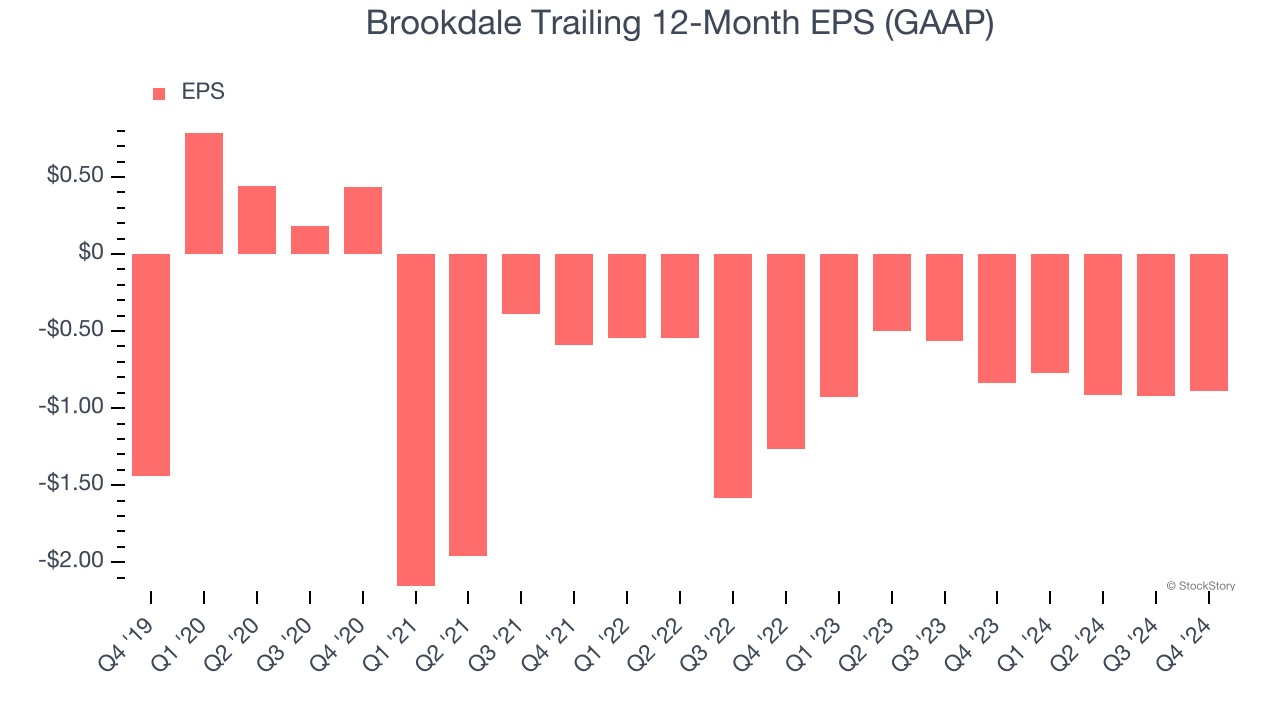

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Brookdale’s full-year earnings are still negative, it reduced its losses and improved its EPS by 9.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Brookdale reported EPS at negative $0.37, up from negative $0.40 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Brookdale to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.89 will advance to negative $0.67.

Key Takeaways from Brookdale’s Q4 Results

It was encouraging to see Brookdale’s full-year EBITDA guidance beat analysts’ expectations. We were also glad this quarter's EBITDA beat. On the other hand, its revenue was in line and its EPS missed significantly due to non-recurring restructuring and asset impairment expenses. Overall, this was a mixed quarter. The stock remained flat at $5.28 immediately following the results.

The latest quarter from Brookdale’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.