3 Reasons to Sell AEIS and 1 Stock to Buy Instead

Provided By StockStory

Last update: Apr 21, 2025

What a brutal six months it’s been for Advanced Energy. The stock has dropped 21.5% and now trades at $85.29, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Advanced Energy, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why AEIS doesn't excite us and a stock we'd rather own.

Why Do We Think Advanced Energy Will Underperform?

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ:AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

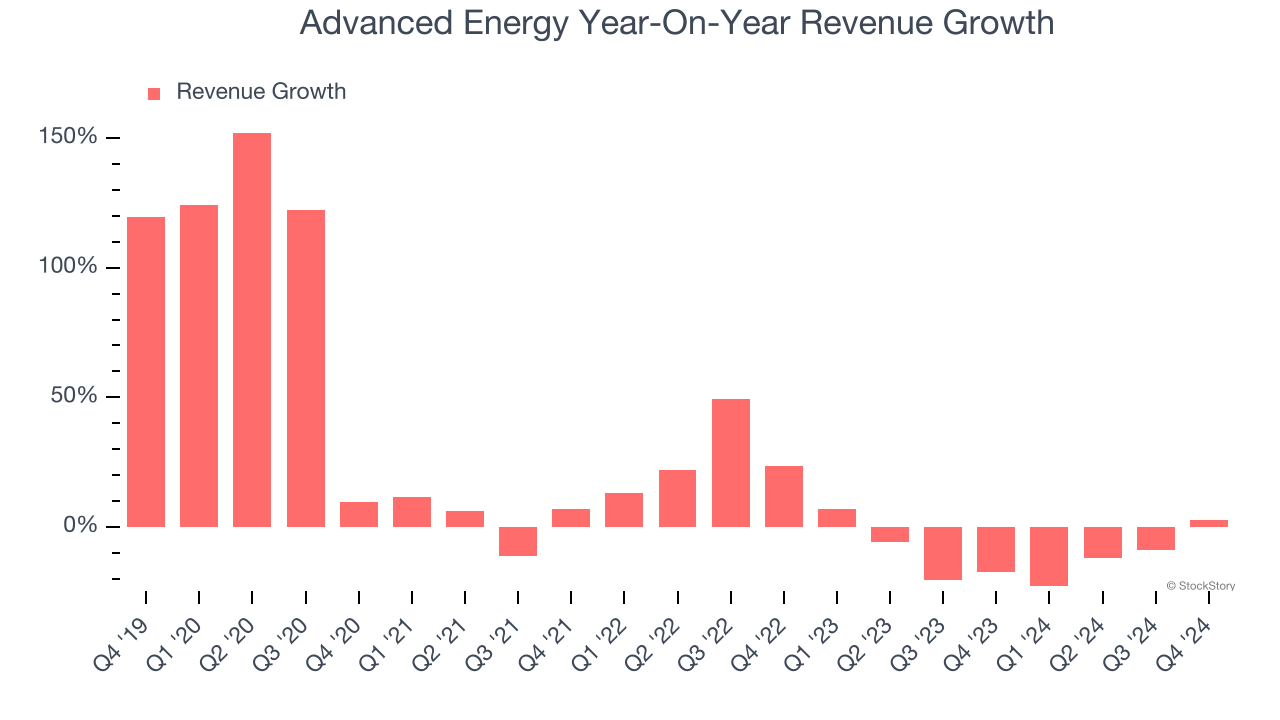

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Advanced Energy’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 10.4% over the last two years. Advanced Energy isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

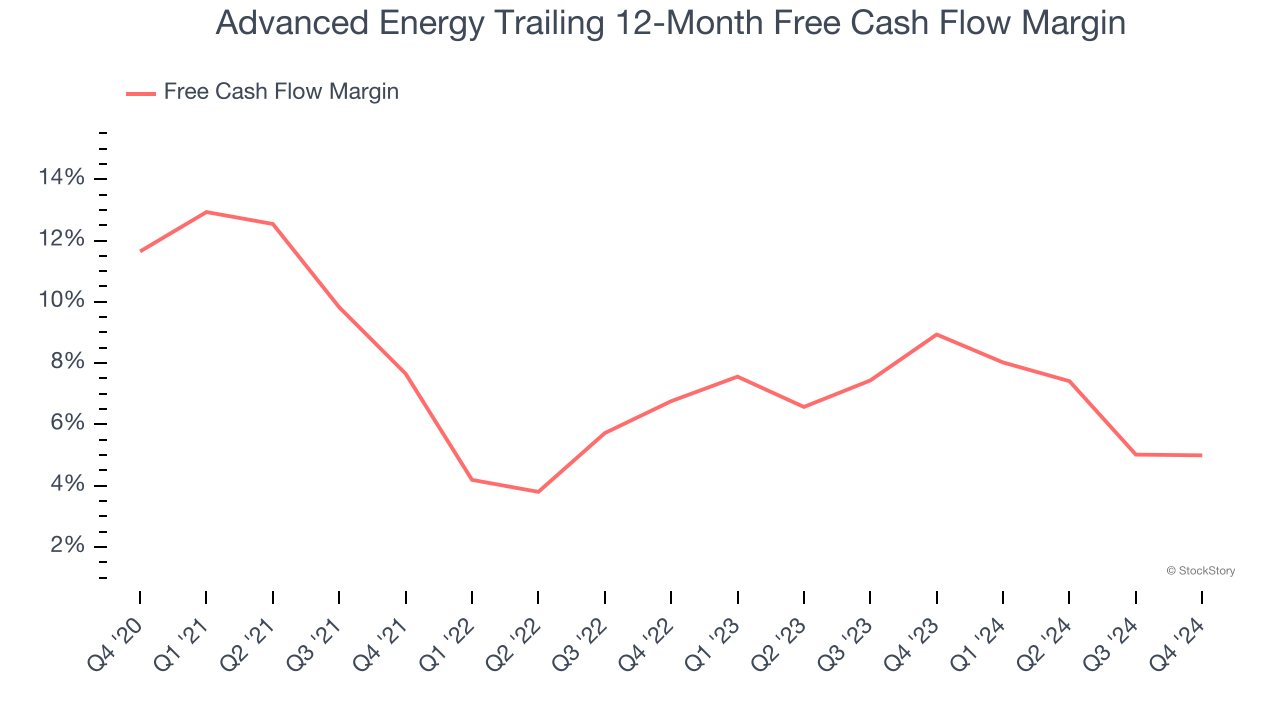

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Advanced Energy’s margin dropped by 6.7 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle. Advanced Energy’s free cash flow margin for the trailing 12 months was 5%.

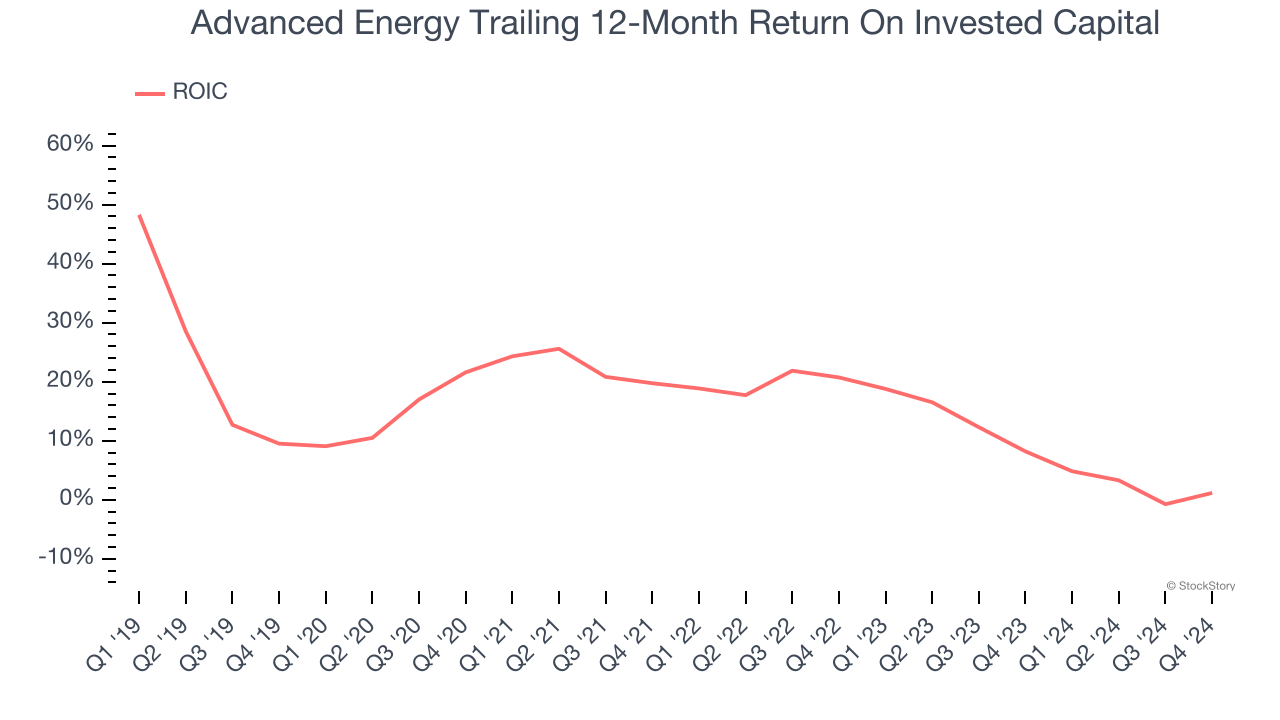

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Advanced Energy’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Advanced Energy falls short of our quality standards. After the recent drawdown, the stock trades at 17.5× forward price-to-earnings (or $85.29 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Advanced Energy

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

484.66

-16.82 (-3.35%)

86.04

-0.75 (-0.86%)

Find more stocks in the Stock Screener

META Latest News and Analysis

7 days ago - ChartmillMarket Monitor April 15 Before Market Open ( Dell, Palantir UP, Meta DOWN)

7 days ago - ChartmillMarket Monitor April 15 Before Market Open ( Dell, Palantir UP, Meta DOWN)Wall Street Starts Easter Week Strong as Tariff Concerns Ease

7 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.

7 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.Let's have a look at the top S&P500 gainers and losers one hour before the close of the markets of today's session.

7 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.

7 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.Stay informed about the performance of the S&P500 index in the middle of the day on Monday. Uncover the top gainers and losers in today's session for valuable insights.

14 days ago - ChartmillWhy Peter Lynch may take an interest in META PLATFORMS INC-CLASS A (NASDAQ:META)

14 days ago - ChartmillWhy Peter Lynch may take an interest in META PLATFORMS INC-CLASS A (NASDAQ:META)Peter Lynch’s investment philosophy combines fundamental analysis with a deep understanding of business models. Let’s analyze if META PLATFORMS INC-CLASS A (NASDAQ:META) meets his criteria for a solid investment.