What Is a Mean Reversion Strategy? Understanding the Basics of Mean Reversion in Trading

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

Mean reversion is a trading strategy based on the principle that prices and markets tend to move back toward their average or mean over time. This strategy assumes that extreme price movements, whether upward or downward, are temporary and that prices will eventually revert to their average levels.

In this article, we will explore the concept of mean reversion in trading and delve into the basics of a mean reversion strategy.

Understanding Mean Reversion

Mean reversion is rooted in the idea that prices oscillate around their long-term average. In other words, when prices deviate significantly from their average, there is a higher probability of a price correction in the opposite direction to bring them back to the mean.

This concept is based on the assumption that markets are driven by emotions, and these emotions often lead to overreactions or exaggerated movements.

Mean reversion can be observed in various financial markets, including stocks, currencies, commodities, and indices. It is a widely studied phenomenon and has been the basis for many successful trading strategies.

'Regression to the Mean' is primarily a statistical phenomenon that became known through the work of the British statistician Francis Galton, a half-cousin of the thirteen years older Charles Darwin.

The Basics of a Mean Reversion Strategy

A mean reversion strategy involves identifying when a price has deviated significantly from its mean and taking a position in anticipation of a reversion back to the mean. Traders using this strategy typically employ various technical indicators, statistical tools, and chart patterns to identify potential mean reversion opportunities.

Here are some key elements of a mean reversion strategy:

Identifying Overextended Moves

Traders look for price movements that have deviated significantly from the mean (red and green circles on the chart), indicating potential overextension.

This can be done by using indicators like Bollinger Bands, which provide a measure of volatility and highlight price levels outside of the normal range.

Confirmation Signals

Traders seek confirmation signals to validate a potential mean reversion trade.

This can include oversold or overbought readings on oscillators like the Relative Strength Index (RSI) or the Stochastic Oscillator, indicating a potential reversal.

Entry and Exit Points

Traders determine entry and exit points based on their analysis of the mean reversion potential. They may enter a trade when the price reaches an extreme level and start to show signs of a reversal.

Exit points are typically set at a predetermined target or when the price starts moving back toward the mean.

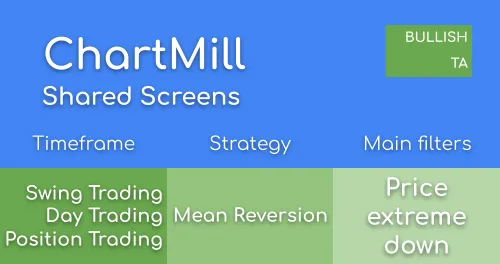

This strategy is especially interesting for day and swing traders. It comes down to finding the stocks that deviate the most from their average price, especially when those extreme deviations coincide with significant support or resistance zones.

In this way, some interesting low risk entries can be found.

Risk Management

As with any trading strategy, risk management is crucial in mean reversion trading. Traders set stop-loss orders to limit potential losses if the trade goes against them. Position sizing and proper risk-reward ratios are also important considerations.

Monitoring Fundamental Factors

While mean reversion strategies primarily focus on technical analysis, it is essential to monitor relevant fundamental factors that could impact the price. These factors may include economic news, earnings reports, or market sentiment.

Advantages and Risks of Mean Reversion Strategies

Mean reversion strategies offer several potential advantages for traders:

Profit Potential

Mean reversion traders aim to capitalize on the price correction back towards the mean, potentially generating profits.

Clear Entry and Exit Signals

Mean reversion strategies provide clear entry and exit signals based on technical indicators, making it easier for traders to execute trades.

Risk Management Opportunities

Setting stop-loss orders and managing risk effectively, allows traders to limit potential losses.

However, it's important to note that this type of strategy also carries certain risks:

Trend Continuation

Prices may not always revert to the mean and can continue trending in the same direction, leading to potential losses.

Extended Deviations

Prices can remain overextended for far longer periods than expected, resulting in missed opportunities or further losses.

False Reversals

Sometimes, what appears to be a mean reversion opportunity may turn out to be a false reversal, leading to losses if trades are taken prematurely.

In Conclusion

Mean reversion strategies are a popular approach in trading, based on the idea that prices tend to move back toward their average over time. By identifying overextended price movements and anticipating a reversion to the mean, traders can potentially profit from price corrections.

This type of strategy is completely the opposite of a trend strategy, precisely because it goes against the prevailing trend and speculates on a counter-move in the existing trend. These are often used in swing trading.

However, remember that once the price extreme is restored the existing trend may still be intact. Thus, the time frame in which you operate with such a strategy is much shorter and the style of trading is quite a bit more aggressive.

Keep in mind that it's essential to combine mean reversion strategies with proper risk management and analysis of relevant fundamental factors. As with any trading strategy, it is advisable to thoroughly test these techniques before applying them to live trading.

More 'Mean Reversion' Articles

The Red Dog Reversal: A Mean Reversion Strategy for Day and Swing Trading

This strategy looks for stocks that show a price extreme. Read more...

RSI2 Mean Reversion Strategy

Another mean reversion strategy. Read more...

Mean Reversion Stock Screener

In this article we will give some general screening ideas. Read more...