Simple vs Exponential Moving Average: Unveiling the Best Choice for Investment and Trading Strategies

~ 3 minutes read - Last update: Apr 19, 2024

In the world of financial analysis, moving averages play a crucial role in identifying price trends. Two commonly used types of moving averages are exponential moving average (EMA) and simple moving average (SMA).

While both serve similar purposes, they differ in their calculation methods and interpretation. This article aims to provide a comprehensive comparison between exponential and simple moving averages, shedding light on their characteristics, strengths, and weaknesses.

Understanding Simple Moving Average (SMA)

The simple moving average is a straightforward method of calculating the average price of a security over a specific period.

It is obtained by summing up the closing prices of the security over a chosen time frame and then dividing the sum by the number of periods considered. The resulting value represents the SMA for that particular period.

Exploring Exponential Moving Average (EMA)

In contrast to the simple moving average, the exponential moving average assigns greater weight to recent data points. This weighting is achieved by applying a smoothing factor to the previous EMA value, resulting in a more responsive indicator.

The EMA reacts faster to price changes, making it a popular choice among short-term traders and active market participants.

Key Differences between EMA and SMA

Calculation Method

SMA calculates the average by equal weighting all price data points within the selected time frame. On the other hand, EMA assigns more weight to recent data, resulting in a more immediate response to price fluctuations.

Sensitivity to Price Changes

Due to the smoothing factor, EMA is more sensitive to recent price movements compared to SMA. This characteristic makes EMA a preferred choice for traders who seek timely signals for quick entries and exits.

Lag Effect

While EMA reacts faster to price changes, it is also more prone to producing false signals during volatile market conditions. SMA, being less sensitive, tends to exhibit a lag effect, smoothing out market noise and potentially providing more reliable signals.

Which one is the best for investing and trading?

When it comes to determining the best-moving average for investing and trading, it ultimately depends on your specific investment goals, trading style, and time horizon. Both exponential moving averages (EMA) and simple moving averages (SMA) have their advantages and applications. Let's explore the considerations for each:

Long-Term Investing

For long-term investors who focus on broader market trends and aim to capture significant price movements over an extended period, the simple moving average (SMA) is often preferred.

The SMA smooths out short-term price fluctuations, providing a clearer view of the overall long-term trends. It is more stable and reliable, making it suitable for identifying long-term investment opportunities.

Short-Term Trading

Short-term traders, such as day traders or swing traders, who seek quick entries and exits in the market, often prefer the exponential moving average (EMA).

The EMA reacts faster to price changes due to its emphasis on recent data points. It provides more timely signals for short-term trading strategies and can be useful in capturing shorter-term price movements.

Combining SMA and EMA In One Trading Strategy

Combining both simple moving averages (SMA) and exponential moving averages (EMA) in one trading strategy is a common practice among traders and investors. This approach allows for the utilization of the unique strengths and characteristics of each moving average.

By using a combination of SMAs and EMAs, traders can create a more comprehensive and robust trading strategy.

Trend Identification

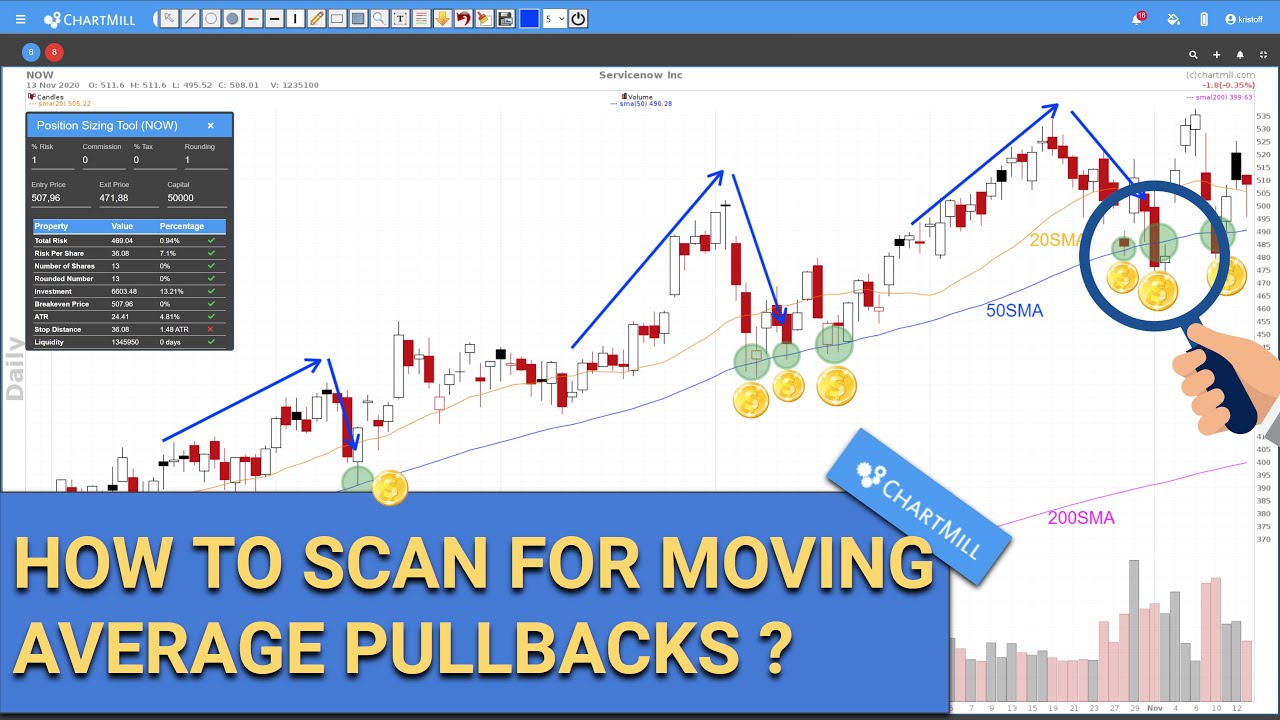

SMAs can be employed to identify the primary trend in the market. For example, a long-term SMA, such as a 200-day SMA, can be used to determine the overall trend direction. Once the trend is identified, EMAs can be used for fine-tuning entries and exits based on shorter-term price movements.

Crossover Signals

Moving average crossovers are a popular trading signal. When a shorter-term EMA crosses above or below a longer-term SMA, it can generate buy or sell signals, respectively. This combination of SMAs and EMAs helps to capture potential trend reversals or confirm the strength of an existing trend.

By combining SMAs and EMAs, traders can harness the strengths of both moving averages to enhance their trading decisions, improve timing, and increase the overall effectiveness of their trading strategy.

Conclusion

-

In conclusion, both exponential moving average (EMA) and simple moving average (SMA) have their distinct advantages and applications in technical analysis.

-

SMA provides a more stable and reliable signal, making it suitable for longer time frames. On the other hand, EMA caters to short-term traders who seek quick and responsive indicators.

-

The choice between the two depends on individual trading styles, time horizons, and risk preferences.

More On Moving Averages...

Exploring The Best Moving Averages For Swing Trading Success

Traders employ various tools and indicators to make decisions regarding entry and exit points. One such tool that plays a crucial role in swing trading is the moving average. Read More...

How to Use Moving Averages to Determine the Trend?

Moving averages can be used in many ways in different types of trading strategies.. Perhaps one of the best known and easiest way is to determine the trend using a specific moving average. Read more...

The Smoothed Moving Average (SMMA)

In this article, we'll explore the SMMA in more detail, including how it differs from other moving averages, how to calculate it, and some common trading strategies that incorporate the SMMA. Read more...