Mansfield Relative Strength

By Aldwin Keppens - reviewed by Kristoff De Turck

Last update: Apr 26, 2025

This variant of Relative Strength was used in the book “Secrets For Profiting in Bull and Bear Markets’ by Stan Weinstein. Weinstein was using the indicator mainly on weekly charts.

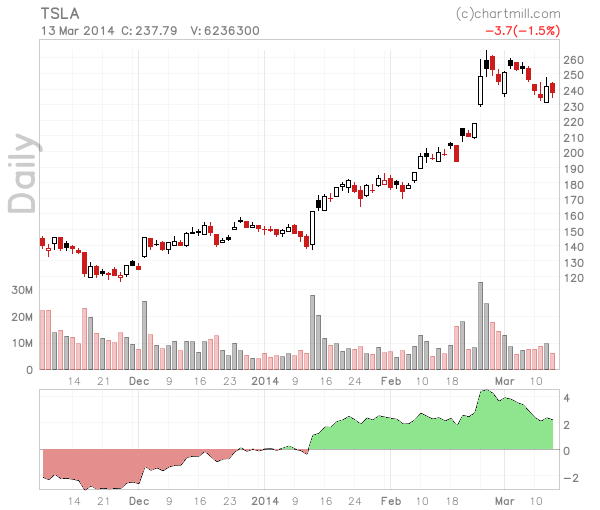

The indicator can be plotted on the stock charts by selecting it from the indicators. An example is shown below:

Calculating Mansfield Relative Strength

The formula of this indicator is a bit more complicated than the regular Dorsey RS, but it is worth the read:

RSM = (( RSD(today) /sma(RSD(today), n)) - 1 ) * 100

Where:

- RSD = Dorsey Relative Strength

- SMA = Simple moving average over n days.

So, the Dorsey Relative Strength value is divided by its own n-day moving average and then one is subtracted. If we look at the daily time frame and use 200 for n, this means:

- We get 0 if the RSD is exactly equal to its 200 day moving average.

- We get a negative number if the RSD is below its 200 day moving average.

- We get a positive number if the RSD is above its 200 day moving average.

Most Technical analysts are familiar with the stock price being above or below a certain Simple Moving Average. With Mansfield RS, the same applies: if the relative strength is above its moving average, positive values are seen, if it is below, we see negative values.

Using Mansfield Relative Strength

As with the regular ( Dorsey ) RS, you can use Mansfield RS to examine if a stock performs better than the market. Only the rising or declining of the indicator matters for this.

Stan Weinstein used the indicator only on weekly charts with 52 as the parameter value for n. He insisted that break outs out of a base had to go together with rising relative strength. The Mansfield RS needs to be rising and close to or above 0.

This indicator has the advantage over the Dorsey RS that the values are below or above the 0 line. This allows us to screen for stocks with a MRS value above 0. When we see that the MRS is far above 0 and has been above 0 for some time, we have found a stock that outperforms the market heavily. We can buy this kind of stock when dips occur.

This screen is a modification of the weekly ChartMill Channel breakout screen, which adds the criteria of a rising Mansfield Relative Strength.

Other Relative Strength Filters Available in ChartMill

ChartMill Relative Strength

At ChartMill we assign a Relative Strength rating number to every stock in our database. The relative strength number of a stock (=CRS) indicates how well the stock has been performing over the last year compared to all other stocks in our database. Read more...

Dorsey Relative Strength

This form or Relative Strength was described and used in the book “Point & Figure Charting” by Thomas Dorsey. Read more...