Double Top

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

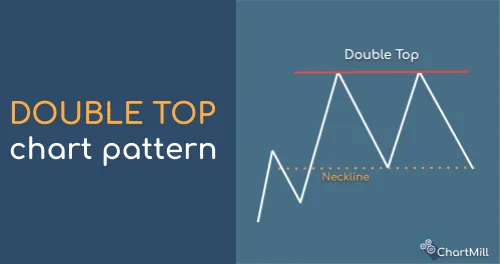

Double Top Basic Pattern

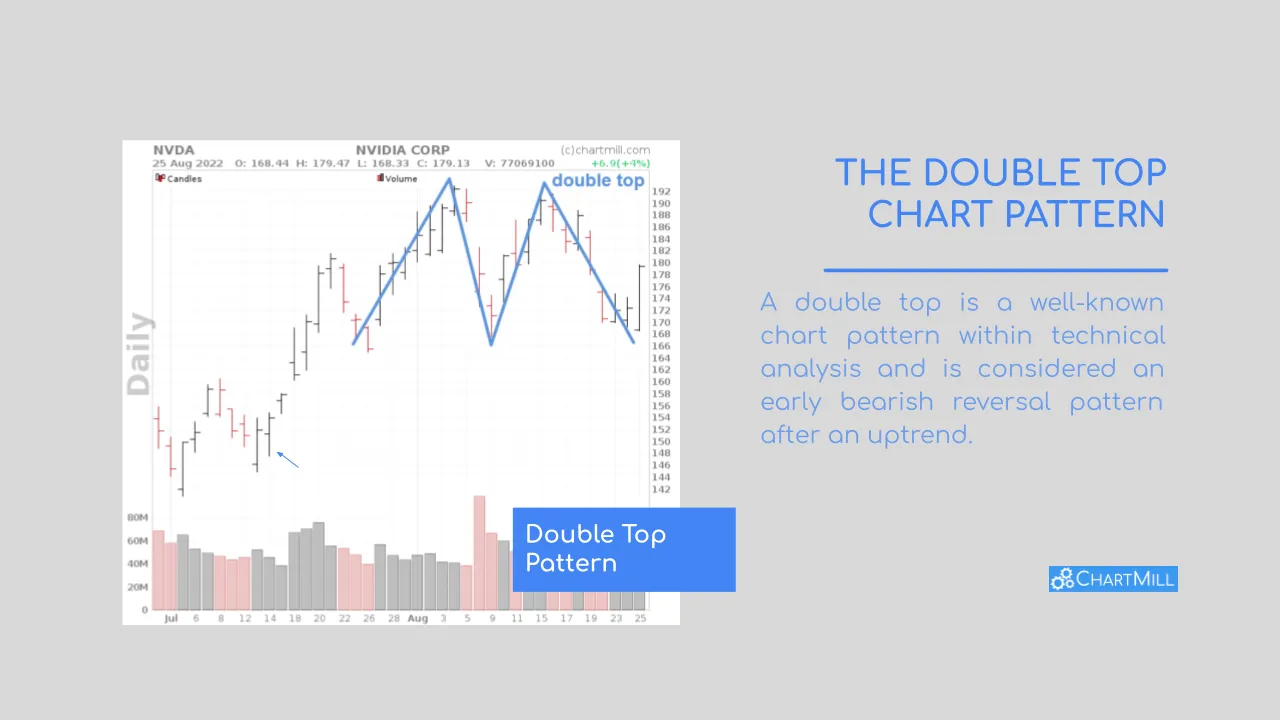

A double top is a bearish reversal pattern and is thus the counterpart of the double bottom pattern. The pattern is a first tentative indication that the current bullish trend is coming to an end and the chances of a bearish trend change are present.

The pattern is formed by two tops at the same price level with a small price rebound in between. This creates the so-called M pattern specific to a double top. To speak of a true M-pattern it is crucial that a clear but short-lived price dip is visible between the two tops.

A normal uptrend is characterized by a succession of higher tops and bottoms and that is where this M pattern provides an initial signal. Instead of a subsequent higher top, there is a top which is at the same price level as the previous top. Buyers fail to drive the price higher. The upward momentum is weakening. Yet this does not necessarily mean that the prevailing trend will simply turn. In many cases, the double top will indeed create some price pressure, but it is more likely that a sideways price range will form.

So the pattern should not be used as a short signal in a still existing uptrend, it should rather be interpreted as a warning to increase the stoploss of open long positions and thus protect a larger portion of profits should the price drop further.

Double Top Breakdown

However, a downward breakout from a sideways trading range of which the double top is a component can be held back as a possible short setup. These setups occur as soon as the price closes below the lowest price between the two tops.

Double Top Stoploss and Price Target.

When the price breaks down, by default the stoploss is provided above the M pattern. The first price target is equal to the total height of the M pattern.

Double Tops in the ChartMill stockscreener

Double tops are available as a filter in the stock screener. These are available on the stock screener page under the 'TA Indicators' tab. Then choose 'Chart Patterns'. Two different filters are available: double tops or double tops near highs.

The screening filters are suitable for quickly obtaining an initial broad selection of stocks whose price forms a top at about the same level as a previous top. However, manual filtering remains necessary to retain the setups that best meet the criteria.