Screening for Short Trade Setups

By Aldwin Keppens - reviewed by Kristoff De Turck

Last update: Apr 19, 2024

Many articles on chartmill focus on selecting long setups, but chartmill can also be used for find short setups of course. We'll try to give some ideas in this article.

Using the Trading ideas

Our trading ideas page contains a lot of short screens. To view only the short screens, select ' short only' in the first filter box. Applying this filter will only show you the screens intended to find short setups. We'll discuss some of these screens in this article.

Stocks nearing Support line

This screen looks for a strong support line (horizontal or trend line) to which the stock is nearing from above. The idea is that the stock can be shorted when the support line is broken. Run the stocks nearing support line screen from its documentation page

Example results

Bear Flags

Bear flags are formed when the stock enters a consolidation zone after a strong decline. The idea is that the decline can continue when the consolidation zone is broken. Run the bear flags screen from its documentation page

Example results

Short squeeze play setups

This screen finds stocks that are consolidating after a strong decline. So this is similar to the bear flags screen, only the squeeze play pattern typically takes a bit longer to form than a bear flag pattern. The idea is again that the decline can continue once the consolidation is broken. Run the Short squeeze play setups screen from its documentation page

Example results

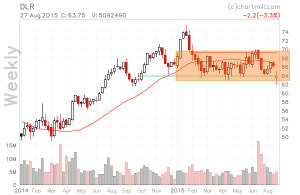

Weekly Chartmill Channel breakdown

This screen looks for stocks that are nearing their lower channel boundaries from above on the weekly chart. The channel is typically a strong support area that has been tested several times in the past. When this support breaks, a further decline is possible. Run the Weekly Chartmill Channel breakdown screen from its documentation page.

Example results

Short Trades using ChartMill Technical and Setup Rating

Although the ChartMill Technical Rating and Setup Quality Rating were developed to find good long setups, they can also be used to find short setups. We also want a high setup qualilty on our short trades, but instead of looking for an upward breakout, we will look for a downward breakdown. Additionally we filter for stocks with a low technical rating. This screen will give us results which are consolidating during an overall decline.

Mean Reversion Short Ideas

Another interesting source for inspiration on short trading can be found in the article on mean reversion screens.