The Bearish Engulfing Pattern | Trading Strategy and Screening

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

Bearish Engulfing Trading Strategy: the entry setup

SELL STOP LIMIT (entry) - a few cents below the lowest price of the second candle forming the bearish engulfing pattern.

STOPLOSS (exit at market price) - either just above the highest price of the second candle, or above the highest price of the first candle forming the bearish engulfing pattern.

Tip: Which Order to Use when-Buying Shares?

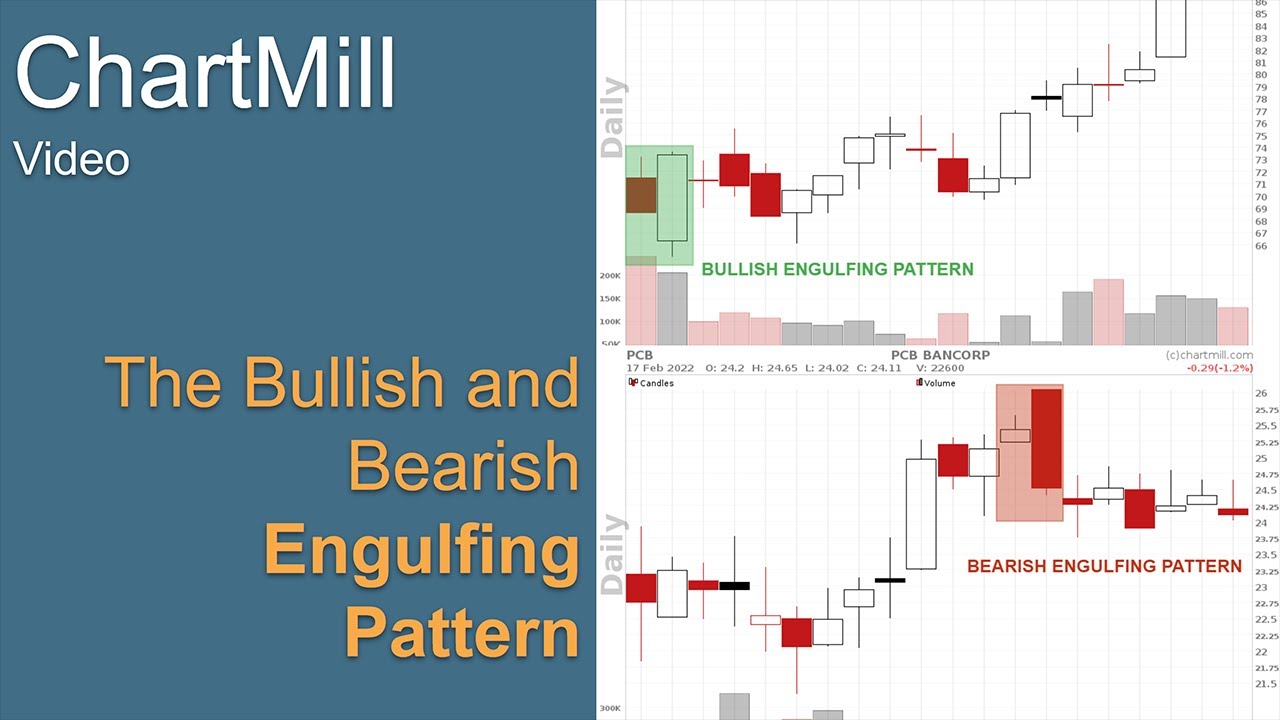

An example setup can be found on the chart below:

A few more points to consider

Not every bullish or bearish engulfing pattern will be successful! Good risk and trade management is at least as important to be successful in the long term. A few things you can consider to increase your success rate:

- Only use the patterns in the direction of the existing long-term trend. For that long-term trend you can use, for example, the popular 200-day average. If the share price is below this average, the general trend is downwards. If the price is above the 200-day average, the trend is upward.

- Within this long-term trend, look for interim trend movements that are opposite to the main trend. Suppose, for example, that share X is in a declining long-term trend and there is a short-term upward trend in the meantime. A bearish engulfing pattern that occurs within this shorter upward trend is more likely to succeed.

- Signals are even more powerful when the pattern occurs at a significant level of support or resistance. A good example is a bullish engulfing pattern that occurs during a re-test of a previous support level. In this way, the pattern is combined with another known technical pattern indicating a possible trend reversal, namely a double bottom.

- Always check in advance whether any important news comes out for the company in the next few days, as this can trigger a strong reaction to the share price (greatly increased volatility). It often happens that such news causes the price to open a whole lot higher or lower the next trading day (gaps). This can cause the opening price to be a lot lower or higher (in case of a short position) than your current stoploss!

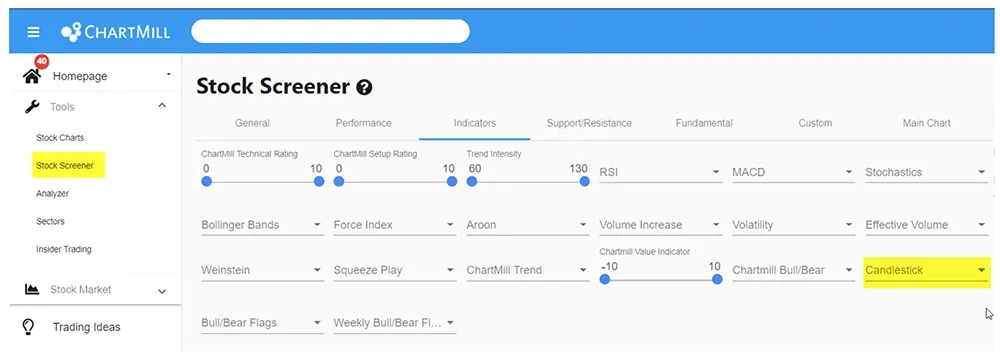

Bearish Engulfing Pattern Stock Screener.

Filtering stocks based on candlestick patterns can be done in the stock screening section under the tab indicators. You'll not only find the engulfing patterns there, but also numerous other popular candlestick patterns.