Small Cap Investing | How to Pick the Most Promising Small Cap Growth Companies?

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Oct 14, 2024

Investing in small-cap growth stocks can be rewarding, but it also involves a number of risks that should not be underestimated.

In this article we explain what is important when choosing small cap stocks, what the possible pitfalls are and which filters and screens you can use in ChartMill to avoid the risks associated with this type of stocks as much as possible.

What Are Small Cap Stocks?

Small Caps are stocks of companies with a relatively small market capitalization, between $300 million and $2 billion. They are typically companies that are in their growth phase.

That growth phase obviously makes them attractive to investors because the potential returns are considerably higher than investing in the already large established names.

What about the risks?

The prospect of higher profits has the logical consequence that it also comes with more risks.

Lower liquidity

Smaller companies, unlike large established companies, have fewer opportunities to raise financing through bonds or equity offerings, for example. They rely more on their own earnings or third-party investors.

As a result, there are fewer publicly traded shares in circulation than in large caps.

Moreover, smaller stocks get much less exposure to the general public, so they are less known and therefore less traded.

As a result, the spread (the difference between the buying and selling price) is greater. Too big a spread makes it more difficult to sell your shares at the desired price.

To avoid this, it is best to use limit orders for your buying or selling. Please note, always use a market order for stop loss orders!

More information on which orders to use can be found in this article.

Increased volatility

Lower liquidity means that the volatility of a typical small cap stock is (a lot) higher. This volatility refers to the movement of the price.

This makes them more sensitive to market shocks, for example in the event of significant changes in interest rates, commodity prices,....

Those price fluctuations can be violent which affects the stability of your investment in these types of stocks.

Thus, even relatively small buy or sell orders can strongly influence the price, leading to larger price movements, attractive for active traders but less desirable for those who focus on the long term and value stability.

Less robust in difficult economic times

Precisely because these types of stocks have to rely on (exponential) growth and therefore use most of their resources (and any profits) to continue to grow as fast as possible, there is hardly any cushion to bridge economic downturns.

Especially for companies with significant debt, it can quickly be “over and out” if the economy slumps.

Investment horizon

Not really a risk but certainly something to consider. The time required to make the business successful and robust and effectively realize its growth potential may take longer than what you initially envisioned.

Rome wasn't built in 1 day either and patience is one of the necessary traits for those investing in small caps.

Things to consider with small cap stocks

Do your homework! A thorough market research of the small caps on your watchlist is certainly not a luxury.

In addition to the chart and price evolution, be sure to have a look at their financials.

Is there sufficient potential for growth?

Do the sales figures confirm the potential? Is the company already making a profit or at least moving in that direction?

What sector and niche does the company operate in? Who are their competitors and what precisely makes this company have a potential competitive advantage?

Debt ratio

Be very attentive to the debt ratio in small caps, the potential negative effect is usually a lot greater than in large caps.

Smaller companies generally have less financial resources and cash flow available that larger companies.

This ensures that a significant debt load will have a greater impact on the company if the economy experiences hard times. Especially if interest rates rise and financing costs are significantly higher in the short term, this will put additional pressure on profitability and growth potential.

Beware, taking on debt is not always wrong but it should be done with caution.

If the investments are sufficiently profitable, it is a good way to finance growth without diluting shares (if new shares would be issued to raise additional capital).

It is important for investors to carefully analyze the company's debt-to-equity ratio, interest expense and cash flows.

Small-cap companies with manageable debt and strong cash flows can be a good investment opportunity, but companies with too much debt carry additional risks regardless.

Management

How experienced is the management?

There is nothing wrong with a young crew enthusiastically taking the reins, but are they also capable of making tough decisions when necessary?

After all, strong leadership can have a significant impact on the company's success.

Finding the best Small Caps with the ChartMill Stock Screener

Scanning for small caps that have a healthy financial balance while also being sufficiently liquid can be done in several ways in ChartMill.

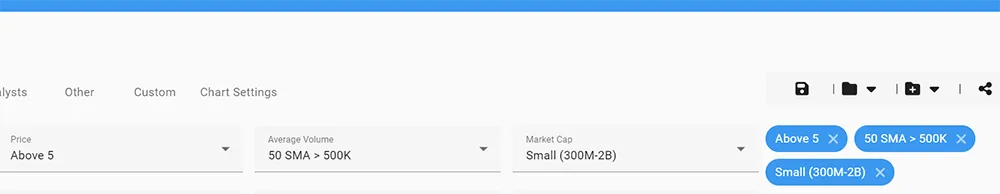

As always, let's start with some basic general filters. These ensure that we exclude all stocks that have too low a price or insufficient trading volume.

Make sure you have the stock screener page selected and go to the “General” tab. There you will select the following options for the 'Price', 'Volume' and 'Market Cap' sections:

Price > Above 5

This excludes all stocks that quote lower than $5 or euro.

Volume > 50SMA > 500.000

This ensures that we only hold stocks whose average daily trading volume over the past 50 trading days exceeds 500,000 units traded.

Market Cap > Small (300M - 2B)

By doing so, we specify that we only want to select stocks that belong to the small caps segment.

These simple basic filters have ensured that of the more than 3600 global small caps present in our database, only 526 remain. But you can be sure that with this selection they are all easily tradable!

Adding fundamental filters

The next step is to hold purely small caps with a reasonably financially sound balance sheet and sufficient growth potential.

The quickest and easiest way is to use our ChartMill Ratings. This is especially useful for those who are not (yet) really familiar with the many individual fundamental ratios also available in ChartMill.

To do this, open the Health tab in the stock screener. Use the ChartMill Health Rating in the upper left corner and set it to 6/10.

The number of stocks in the selection is immediately recalculated and, as you notice, a lot of small caps are again dropped.

Finally, we also want to set a parameter that guarantees us that the company is growing enough, as this is the best indication that the company can continue to grow in the future.

Select the 'Growth' tab and also set this slider to 6/10.

This will give us a final list of 42 stocks worldwide.

A few other options

Only interested in US stocks? Click on the 'Exchange' section in the General tab and select 'US only'. In our example, the selection now consists of 37 stocks (at the time this article was written).

This is the direct link to the small cap screen with the above settings.

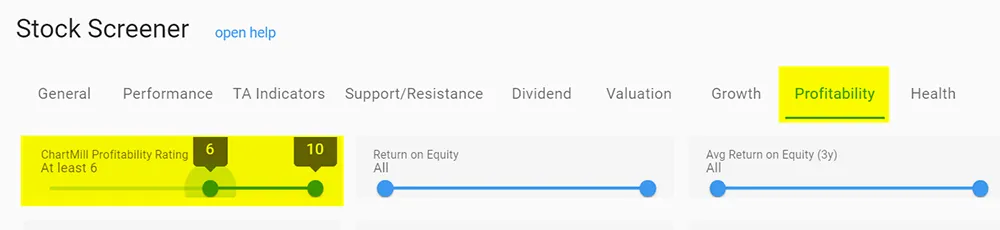

In this example we used the ChartMill ratings 'Health' and 'Growth' but you can of course use the individual filter options in the stock screener.

If you want the selected companies to score well on profitability, add - just as for 'health' and 'growth' - a specific profitability rating of at least 6/10.

Keep in mind that the number of remaining candidates will again drop significantly.

Click this link to see the results of this filter in the screener.

In fact, you might as well combine both options. You could set the rating for both Health and Growth with a minimum score of 5/10 and then set your own emphasis with an additional individual filter.

For example, if you consider quarterly sales growth important, you could add the following two individual filters in the growth tab:

Sales growth Q2Q > at least 30%. This filter defines that the quarterly sales growth in the last quarter was at least 30%.

EPS/Revenue Acceleration > Sales Acceleration last quarter This ensures that sales growth in the most recent quarter has increased compared to the previous quarter.

A link to the results of this particular screen can be found here.

In summary

Small-cap stocks offer excellent opportunities for investors seeking growth, but they also come with significant risks such as higher volatility and lower liquidity.

It is also crucial to do good research and look critically at a company's financial health, growth potential, and debt ratio.

With the ChartMill Stock Screener, you can significantly mitigate these risks by targeting smallcaps with strong fundamental characteristics.

Use filters such as the “Health” and “Growth” ratings to find financially sound and growing companies, and refine your selection with specific filters such as revenue growth or cash flows.

This way, you can invest in smallcaps with confidence and take full advantage of their potential, without losing sight of the risks.