Weighted Average Cost of Capital (WACC) Explained

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

The WACC (Weighted Average Cost of Capital) is expressed as a percentage and represents the ratio of the cost incurred by the company in relation to the total capital used to finance the company.

Most companies derive their capital from a combination of both debt and equity capital. To express that cost of capital in a single number, one must proportionally weight the cost of debt and the cost of equity based on the amount of financing obtained through each source of capital.

The Cost of Capital refers to the total capital that includes both equity and debt, consisting of the capital of common and preferred stock (equity) as well as debt (debt). The percentage of each type of capital is then calculated from the total capital in order to obtain the total cost.

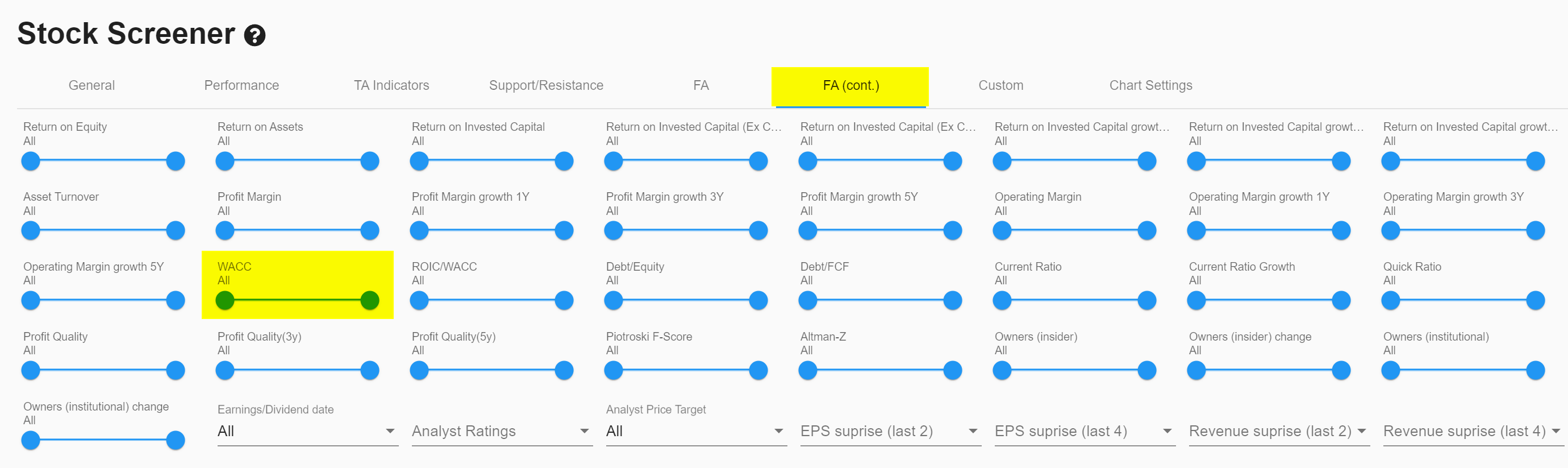

The WACC is available as a fundamental filter in our stock screener. In this article we explain what the term exactly means and how it is calculated.

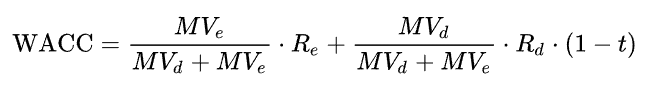

WACC formula

Where:

- MVe= Market Value equity

- MVd= Market Value Debt

- Re= Cost of equity

- Rd= Cost of debt

- t= Tax rate

Example of a WACC calculation

We assume the following situation:

- interest costs on current loans average 5.8%.

- 25% corporate income tax is paid (tax rate)

- Investments are financed with 45% equity and 55% debt

- For the company, we assume a beta of 0.98

- The current 10-year US Treasury yield is 3.68%.

- For the average annual market return, we assume 9%.

Step 1: cost of debt (debt capital) after tax

The cost ratio is known (5.8%). With a tax rate of 25%, we obtain the following result:

Rd = Rd * (1-t)

Rd = 0.058 * (1-0.25)

Rd = 0.058 * 0.75

Rd = 0.043 > 4.3%

Step 2: cost of equity

Things get a little more complicated if one wants to start calculating the cost of equity, where the cost of capital is much less clear. Yet there is indeed a cost of equity.

After all, shareholders expect a certain return on their investment. So that required return is a cost to the company. More so, if the company does not achieve that return, shareholders will sell their shares to look for other and better opportunities.

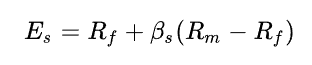

CAPM

Calculating the cost over equity can be done in three different ways:

- CAPM calculation (Capital Assset Pricing Model)

- Dividend Capitalization

- WACE calculation (Weighted Average Cost of Equity)

In the context of WACC, the CAPM method is often used for this purpose, which we will also apply in this example. The following formula is used:

Where:

- Es= expected return on a security

- Rf= risk-free interest rate

- βs= Beta (sensitivity to market risk)

- Rm= average annual market return

Note: Rm-Rf = Equity Risk Premium

With the default data available above, we then obtain:

Es = 0.037 + 0.98 * (0.09 - 0.037)

Es = 0.037 + (0.98 * 0.053)

Es = 0.037 + 0.052

Es = 0.089 > 8.9%

The return expected by shareholders (Es) = the cost of equity (Re).

The risk-free interest rate is the return that can be earned by investing in risk-free securities. A common way to determine this is simply to use the 10-year Treasury bill rate. At the time of writing this article, it is 3.68%.

By subtracting the risk-free rate from the average annual market return, you arrive at the Equity Risk Premium (Rm - Rf). This is the extra return you can earn above the risk-free rate by investing in the equity markets.

The Beta of the security is a measure of the volatility of a stock's return relative to the market as a whole. The beta is available in ChartMill as a Performance filter. The higher the beta the more volatile the stock. In this example, we used a beta of 0.98.

Finally, the average annual market return for stocks worldwide is somewhere between 8 and 12%. In this example we assumed 9%.

Step 3: calculating the actual WACC

Now that we know the cost of debt and equity, we can calculate the final WACC using the formula already discussed above.

WACC = (cost of debt after tax * weighting) + (cost of equity * weighting)

WACC = (0.089 * 0.45) + (0.043 * 0.55)

WACC = 0.04 + 0.024

WACC = 0.064 > 6.4%

So the future annual returns of this business must at least exceed 6.4%, otherwise the activity or investment is simply not profitable.

Why is WACC important?

WACC is a concept not to be underestimated because it is an essential part of the DCF valuation model where it is used as the discount rate. This is the calculation rate used to discount future cash flows. It is a measure of risk and provides insight into enterprise value. After all, money that is yet to be earned in the future is worth less than money that is currently being earned. Much of the reason for this is due to inflation.

Important when interpreting the WACC

The figure depends heavily on the nature of the company's business. Real estate companies, because of their core business, can much more easily negotiate lower financing costs than, say, start-up software companies with a lot more risk involved (and thus a much higher financing cost).

So always compare companies in the same sector and industry to ensure that interpretations and conclusions are made on an objective basis.

For financial companies, by the way, WACC is less appropriate because debt is just part of their business activities.

Another side effect that you, as an investor, should take due account of is the degree of debt that the company carries. After all, the remuneration for debt capital is lower than for equity capital. So the more debt a company takes on, the lower the WACC will be and the higher the valuation. Still, companies that carry far too much debt are to be avoided, even if they have a very attractive WACC...