Interesting Technical Analysis finding for MICROSOFT CORP (NASDAQ:MSFT)

By Mill Chart

Last update: May 9, 2024

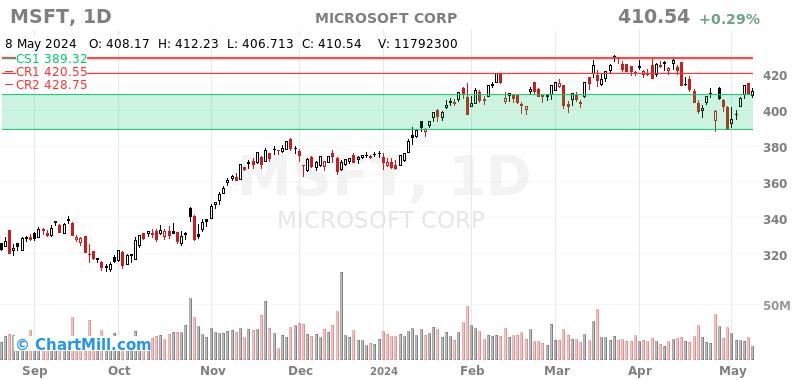

Our stockscreener has identified a possible breakout setup on MICROSOFT CORP (NASDAQ:MSFT). This occurs when the stock consolidates following a significant upward movement. While the breakout outcome cannot be guaranteed, it may be worth monitoring NASDAQ:MSFT for potential opportunities.

In-Depth Technical Analysis of NASDAQ:MSFT

ChartMill employs a sophisticated system to assign a Technical Rating to every stock in its analysis. This rating, which ranges from 0 to 10, is determined by carefully assessing multiple technical indicators and properties.

Overall MSFT gets a technical rating of 7 out of 10. This is due to a consistent overall performance, although we see some doubts in the very recent evolution. In the medium time frame things are still looking good.

- The long term trend is positive and the short term trend is neutral. The long term trend gets the benefit of the doubt for now.

- Looking at the yearly performance, MSFT did better than 75% of all other stocks. On top of that, MSFT also shows a nice and consistent pattern of rising prices.

- MSFT is currently trading in the upper part of its 52 week range. The S&P500 Index however is currently trading near a new high, so MSFT is lagging the market slightly.

- MSFT is part of the Software industry. There are 277 other stocks in this industry, MSFT did better than 67% of them.

- In the last month MSFT has a been trading in the 388.03 - 429.37 range, which is quite wide. It is currently trading in the middle of this range, so some resistance may be found above.

Our latest full technical report of MSFT contains the most current technical analsysis.

How do we evaluate the setup for NASDAQ:MSFT?

In addition to the Technical Rating, ChartMill provides a Setup Rating for each stock. This rating, ranging from 0 to 10, assesses the level of consolidation in the stock based on multiple short-term technical indicators. Currently, NASDAQ:MSFT has a 8 as its setup rating, indicating its current consolidation status.

MSFT has an excellent technical rating and also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is a resistance zone just above the current price starting at 420.55. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 408.72, a Stop Loss order could be placed below this zone.

How to trade NASDAQ:MSFT?

A breakout opportunity may arise when the stock surpasses the current consolidation zone and reaches new highs. Traders often wait for this breakout before considering buying the stock. To manage risk, a stop loss order could be placed below the consolidation zone to limit potential losses.

Of course, there are many ways to trade or not trade NASDAQ:MSFT and this article should in no way be interpreted as trading advice. The article is purely based on an automated technical analysis and just points out the technical observations. Always make your own analysis and trade at your own responsibility.

Every day, new breakout setups can be found on ChartMill in our Breakout screener.

Keep in mind

This article should in no way be interpreted as advice in any way. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.