Gross Profit Margin vs Operating Margin vs Profit Margin

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

Gross Profit Margin vs Operating Margin vs Profit Margin are all financial metrics that help businesses and investors understand the profitability and efficiency of a company's operations.

Let's explore each of these metrics and their uses:

Gross Profit Margin

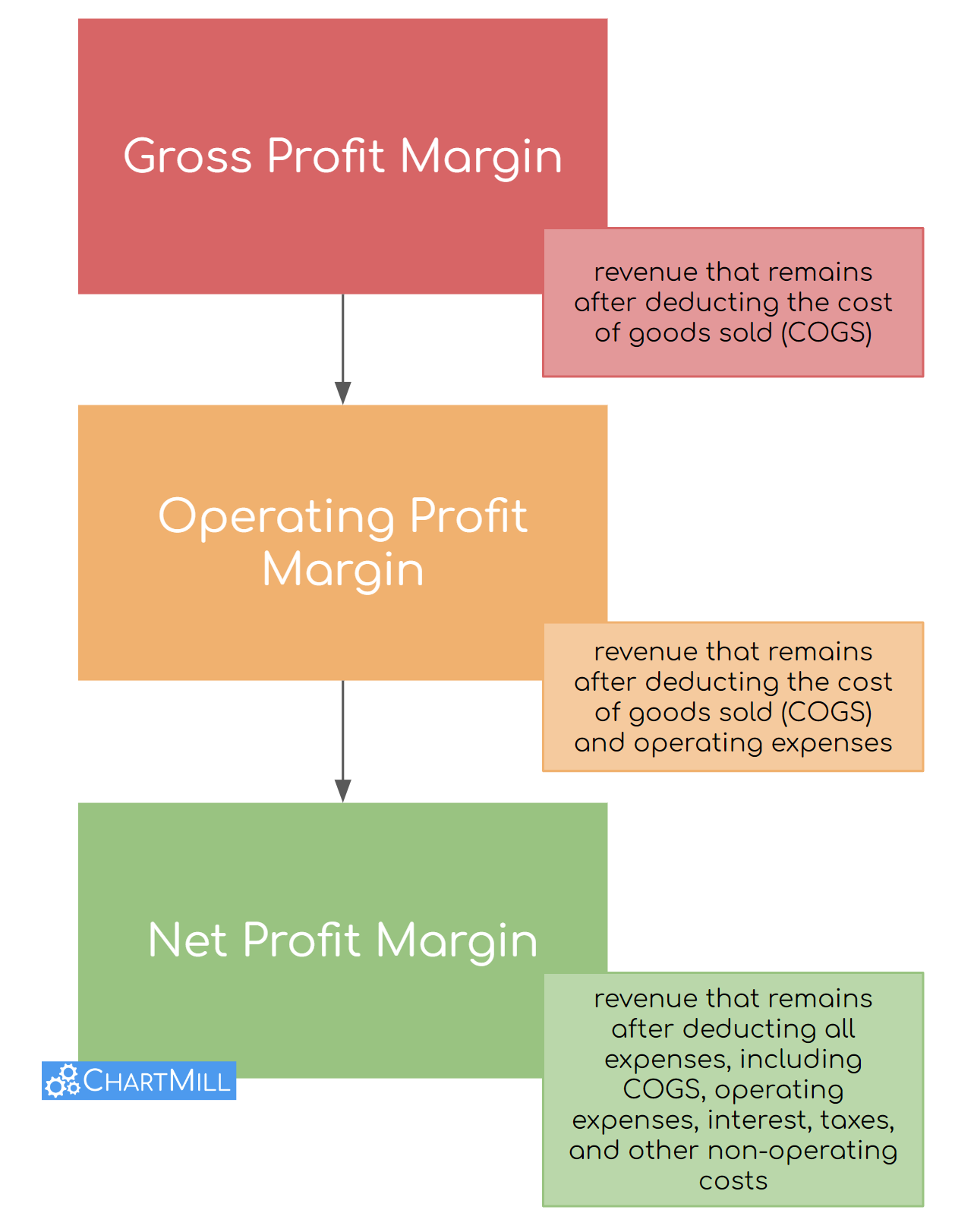

Gross Profit Margin is a financial ratio that indicates the percentage of revenue that remains after deducting the cost of goods sold (COGS). It measures how efficiently a company produces goods and manages its production costs.

Calculation

Gross Profit Margin = (Gross Profit / Revenue) * 100

Use

Gross Profit Margin helps assess a company's ability to cover its direct production costs and still have room to cover other operating expenses. It's particularly useful for comparing the efficiency of production processes between different companies or within the same company over time.

Operating Margin

Operating Margin, also known as Operating Profit Margin, measures the percentage of operating income generated from each dollar of revenue. It considers both operating expenses and COGS but excludes non-operating items like interest and taxes.

Calculation

Operating Margin = (Operating Income / Revenue) * 100

Use

Operating Margin focuses on the core operational efficiency of a company, excluding the impact of non-operating factors like financing and taxes. This metric is particularly valuable for evaluating how effectively a company manages its day-to-day operations to generate profit.

Net Profit Margin

Net Profit Margin represents the percentage of revenue that remains as profit after all expenses, including COGS, operating expenses, interest, taxes, and other non-operating costs, have been deducted.

Calculation

Net Profit Margin = (Net Profit / Revenue) * 100

Use

Net Profit Margin provides a comprehensive view of a company's overall profitability by considering all expenses. It helps investors and analysts understand how efficiently a company manages its costs, taxes, and interest expenses, ultimately translating revenue into bottom-line profit.

Scheme

Is Net Profit Margin Better Than Operating Profit Margin?

When evaluating companies, both Net Profit Margin and Operating Profit Margin are important measures to consider because they offer different insights into a company's financial performance. Choosing between the two depends on the specific aspect of the business you want to focus on:

Use Net Profit Margin if your main concern is to ascertain the overall profitability of the business (after deducting all costs). It gives a clear picture of the extent to which a company is able to generate profits for the shareholder.

Operating Profit Margin is advisable if you want to evaluate the efficiency of the company's day-to-day operations and how well it converts its revenues into operating profits. This metric is especially useful when you want to examine the effectiveness of company management in running its core business.

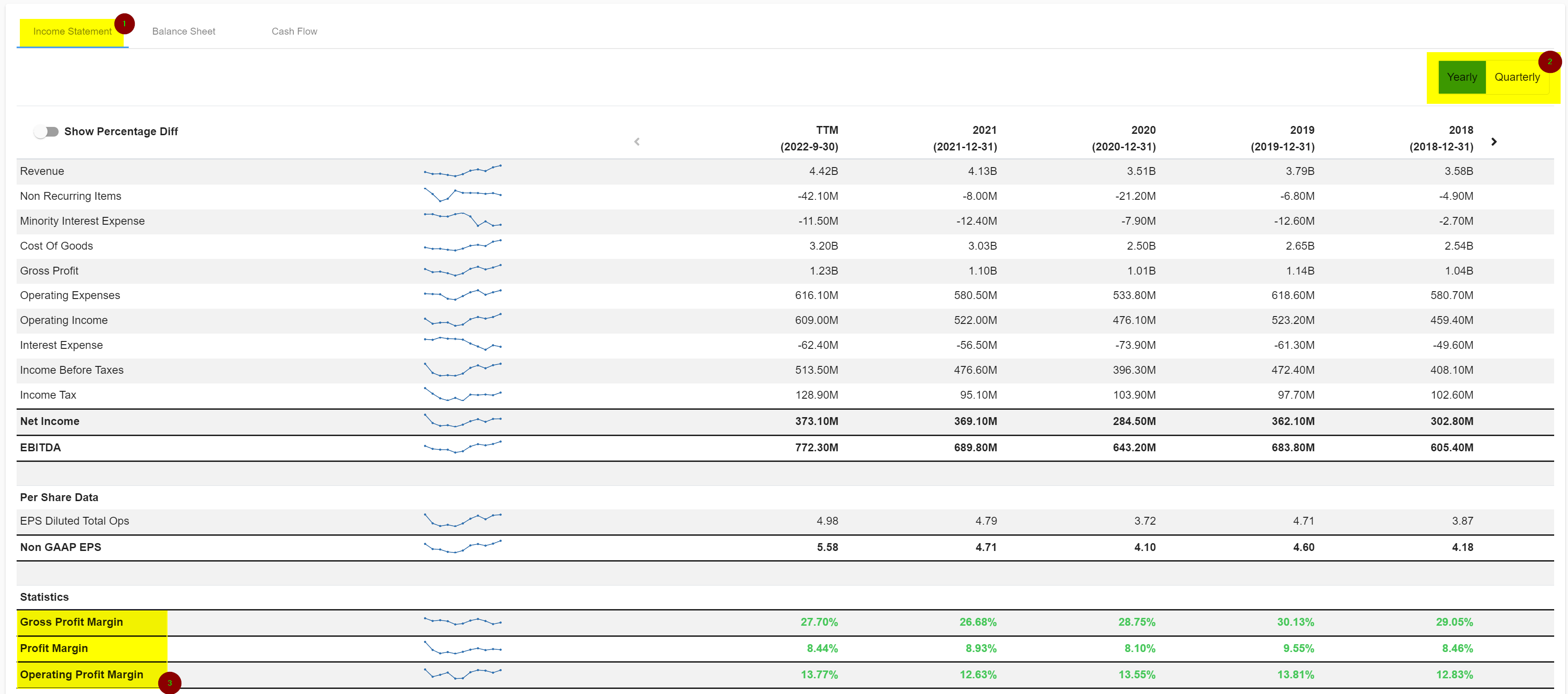

Where To Find These Different Metrics?

Gross, Net and Operating Profit Margin of a company can typically be found on the company's income statement. The income statement is a financial statement that shows a company's revenues, expenses, and profit (or loss) over a period of time, such as a quarter or a year.