Market Monitor February 26th

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Feb 27, 2025

Market Whirlwind: Nvidia exceeds expectations, tensions over Trump tariffs, AppLovin drops and Lucid faces leadership crisis

The Dow Jones fell slightly while the Nasdaq rose. Investor uncertainty was fueled by conflicting messages from President Trump about new import tariffs, including a potential 25% levy on European products and similar measures for goods from Mexico and Canada.

AppLovin's shares (APP) declined after negative reports from short sellers, who claim that the company provides misleading information about its AI advertising platform.

Lucid Motors (LCID) saw its shares plummet following the departure of CEO Peter Rawlinson, which analysts believe will have greater consequences than the market expects, including a stagnation in product development.

Lowe’s (LOW) reported better-than-expected results for the fourth quarter but expects modest growth for the coming year, indicating caution due to rising inflation expectations and tariff uncertainty.

Nvidia (NVDA) once again exceeded expectations with strong revenue and profit growth, driven by enormous demand for their latest Blackwell chips. Revenue increased by 78% to $39.3 billion in the fourth quarter, while earnings per share rose by 71% to 89 cents, both figures exceeding analyst expectations.

Despite a slight decline in gross margin, which was lower than expected, the company remains optimistic about future margins. CEO Jensen Huang emphasized the strong demand for Blackwell chips and the ongoing advancement of AI technologies, including AI agents and physical AI such as robots.

Huang also assured that the dependency on major tech companies for revenue growth would shift to a broader market of regular companies, which will grow faster in AI applications. He further alleviated concerns about competition by highlighting Nvidia's ability to quickly and efficiently deliver and install high-quality AI chips.

Meanwhile, Tesla (TSLA) is experiencing its fifth consecutive loss day. The stock closed at $290.8 and is now more than 19% below its most recent peak on February 19th. The price is less than 5% from the rising SMA(200).

Eli Lilly, (LLY) now the world's most valuable pharmaceutical company due to the success of its obesity drugs, is set to expand in the U.S. with four new manufacturing facilities.

This expansion, representing an investment of at least $27 billion, will create over 3,000 jobs for highly skilled professionals such as engineers and scientists, and approximately 10,000 construction jobs. The locations of these plants will be announced later this year.

Part of this expansion is motivated by the Trump administration's threats of heavy import tariffs on medications, aiming to boost domestic production.

Daily Market Analysis – February 26, 2025 (After Market Close)

Major Index Performance:

SPY (S&P 500 ETF) saw a slight increase, closing up by +0.05% at $594.54, showing a mild positive trend amidst general market fluctuations.

QQQ (Invesco QQQ Trust Series 1), representing the NASDAQ, experienced a small increase of 0.24%, closing at $514.56.

IWM (iShares Russell 2000 ETF), which tracks smaller cap stocks, also had a modest gain, closing up by +0.13% at $215.68, indicating a mixed sentiment in the small-cap sector.

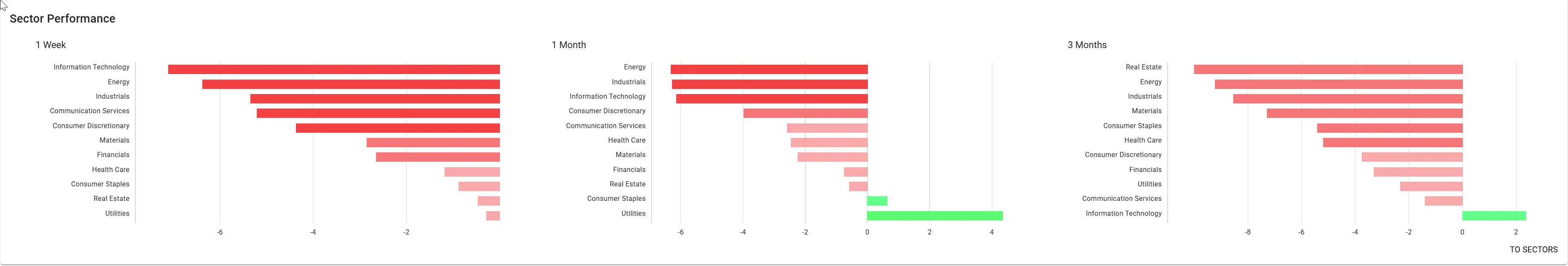

Sector Performance:

Weekly Performance:

- All sectors depicted are in the red, indicating a decline across the board.

- Information Technology, Energy, and Industrials faced significant drops, as shown by the longer red bars, signaling a tougher week for these sectors.

- Utilities experienced the smallest decline among all, as its red bar is the shortest, indicating relatively lesser losses.

Monthly Performance:

- Consumer Staples and Utilities are the only sectors showing gains, as indicated by the green bars, pointing to some resilience or positive developments in these areas over the past month.

- All other sectors still experienced declines.

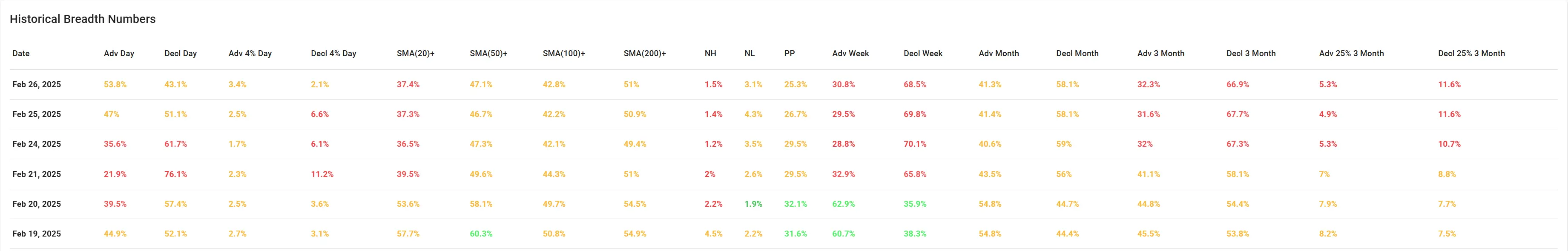

Historical Breadth Numbers:

Historical Breadth Numbers suggest that the market's advance-decline line varied, with a generally balanced mix of advancing and declining issues over the past week.

This market snapshot reveals a challenging market environment where all sectors experienced declines over the past week, with Information Technology, Energy, and Industrials facing the most significant downturns.

Over the past month, Consumer Staples and Utilities have shown some resilience, being the only sectors to register gains.

This suggests a selective stability within these sectors amidst overall market weakness.

The modest improvements in major indices like SPY and IWM indicate a mixed sentiment, leaning towards cautious optimism despite prevailing sector-specific challenges.

331

-46.06 (-12.22%)

915.01

+13.21 (+1.46%)

247.07

+4.68 (+1.93%)

131.28

+4.65 (+3.67%)

290.8

-12 (-3.96%)

2.255

-0.35 (-13.6%)

Find more stocks in the Stock Screener

APP Latest News and Analysis

2 hours ago - ChartmillMarket Monitor February 26th

2 hours ago - ChartmillMarket Monitor February 26thMarket Whirlwind: Nvidia (NVDA) exceeds expectations, tensions over Trump tariffs, AppLovin drops and Lucid faces leadership crisis

18 hours ago - ChartmillTraders are paying attention to the gapping stocks in Wednesday's session.

18 hours ago - ChartmillTraders are paying attention to the gapping stocks in Wednesday's session.In today's session, there are notable price gaps in the US markets on Wednesday. Take a closer look at the stocks that are gap up and gap down.

14 days ago - ChartmillThursday's session: gap up and gap down stocks

14 days ago - ChartmillThursday's session: gap up and gap down stocksIn today's session, there are notable price gaps in the US markets on Thursday. Take a closer look at the stocks that are gap up and gap down.

14 days ago - ChartmillThursday's pre-market session: top gainers and losers

14 days ago - ChartmillThursday's pre-market session: top gainers and losersWondering what's happening in Thursday's pre-market session? Find an overview in this article.

14 days ago - ChartmillWondering what's happening in today's after-hours session?

14 days ago - ChartmillWondering what's happening in today's after-hours session?After the conclusion of the US market's regular session on Wednesday, let's examine the after-hours session and unveil the notable performers among the top gainers and losers.